Retrofit for net zero focuses on upgrading buildings to achieve zero carbon emissions through comprehensive energy efficiency measures and renewable energy integration. Energy performance contracting (EPC) involves a third party guaranteeing energy savings by implementing targeted improvements, with costs offset by the verified savings. Discover how these strategies transform real estate sustainability and operational efficiency.

Why it is important

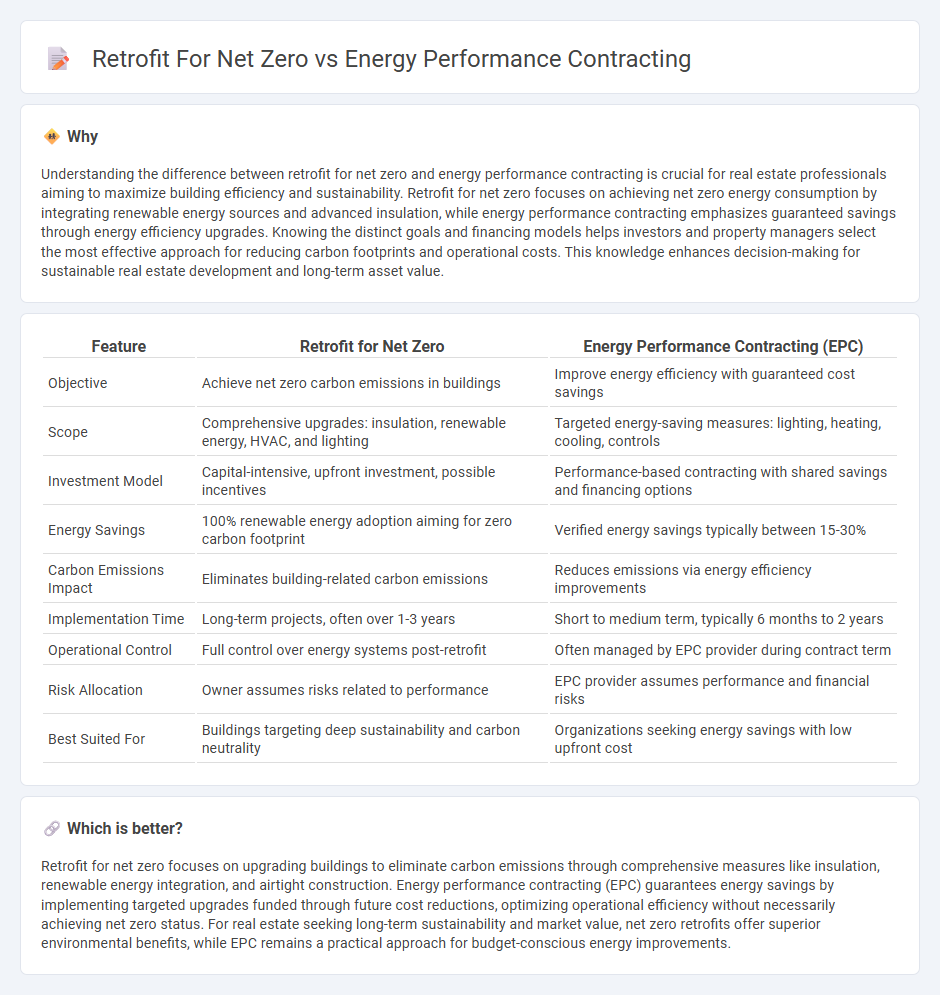

Understanding the difference between retrofit for net zero and energy performance contracting is crucial for real estate professionals aiming to maximize building efficiency and sustainability. Retrofit for net zero focuses on achieving net zero energy consumption by integrating renewable energy sources and advanced insulation, while energy performance contracting emphasizes guaranteed savings through energy efficiency upgrades. Knowing the distinct goals and financing models helps investors and property managers select the most effective approach for reducing carbon footprints and operational costs. This knowledge enhances decision-making for sustainable real estate development and long-term asset value.

Comparison Table

| Feature | Retrofit for Net Zero | Energy Performance Contracting (EPC) |

|---|---|---|

| Objective | Achieve net zero carbon emissions in buildings | Improve energy efficiency with guaranteed cost savings |

| Scope | Comprehensive upgrades: insulation, renewable energy, HVAC, and lighting | Targeted energy-saving measures: lighting, heating, cooling, controls |

| Investment Model | Capital-intensive, upfront investment, possible incentives | Performance-based contracting with shared savings and financing options |

| Energy Savings | 100% renewable energy adoption aiming for zero carbon footprint | Verified energy savings typically between 15-30% |

| Carbon Emissions Impact | Eliminates building-related carbon emissions | Reduces emissions via energy efficiency improvements |

| Implementation Time | Long-term projects, often over 1-3 years | Short to medium term, typically 6 months to 2 years |

| Operational Control | Full control over energy systems post-retrofit | Often managed by EPC provider during contract term |

| Risk Allocation | Owner assumes risks related to performance | EPC provider assumes performance and financial risks |

| Best Suited For | Buildings targeting deep sustainability and carbon neutrality | Organizations seeking energy savings with low upfront cost |

Which is better?

Retrofit for net zero focuses on upgrading buildings to eliminate carbon emissions through comprehensive measures like insulation, renewable energy integration, and airtight construction. Energy performance contracting (EPC) guarantees energy savings by implementing targeted upgrades funded through future cost reductions, optimizing operational efficiency without necessarily achieving net zero status. For real estate seeking long-term sustainability and market value, net zero retrofits offer superior environmental benefits, while EPC remains a practical approach for budget-conscious energy improvements.

Connection

Retrofitting real estate for net zero involves upgrading buildings with energy-efficient technologies and renewable energy systems to drastically reduce carbon emissions. Energy performance contracting (EPC) provides a financial framework where contractors guarantee energy savings through these retrofits, making net zero goals financially viable. Together, retrofits and EPC enable property owners to achieve sustainability targets while optimizing operational costs and energy performance.

Key Terms

Energy Savings Guarantee

Energy Performance Contracting (EPC) offers a financial guarantee on energy savings, ensuring measurable reductions aligned with net zero goals, while retrofits typically involve upfront investments without guaranteed outcomes. EPC projects incorporate comprehensive energy audits, tailored upgrades, and performance monitoring to secure guaranteed savings, contrasting with retrofit approaches that may not provide formal energy savings guarantees. Explore how EPC guarantees can de-risk your net zero initiatives and optimize long-term energy efficiency.

Building Envelope Upgrades

Energy performance contracting leverages guaranteed energy savings through third-party financing, enabling comprehensive building envelope upgrades such as high-performance insulation, advanced glazing, and airtight sealing to achieve net zero targets. Retrofit approaches directly modify the building envelope by installing energy-efficient materials or systems to reduce thermal losses and improve overall sustainability metrics. Explore detailed strategies and case studies to optimize your building envelope for net zero performance.

Measurement and Verification

Energy Performance Contracting (EPC) leverages rigorous Measurement and Verification (M&V) protocols to guarantee energy savings, often following industry standards like IPMVP, ensuring transparent tracking and accountability for net zero goals. Retrofits for net zero emphasize customized M&V strategies to assess actual energy reductions from upgraded systems and materials, often integrating real-time data analytics to optimize performance post-implementation. Explore detailed methodologies and case studies to enhance your understanding of effective M&V in energy efficiency projects.

Source and External Links

Energy Performance Contracting - Johnson Controls - Energy Performance Contracting is a financing model that guarantees energy savings through facility upgrades without upfront capital investment, with the contractor covering any shortfall in savings.

Energy Savings Performance Contracting | ESG - An Energy Savings Performance Contract (ESPC) involves an energy services company designing, financing, and installing energy-saving improvements that are paid for over time through the energy savings achieved, with guaranteed savings and no upfront costs.

Performance Contracting and Energy Service Agreements - EPA - Performance contracting typically features guaranteed energy savings by an ESCO that installs and maintains equipment, with payments tied to verified savings over contract terms usually between 10 and 20 years, widely used in public and institutional sectors.

dowidth.com

dowidth.com