iBuyer platforms use algorithms and data analytics to provide homeowners with quick, competitive cash offers, streamlining transactions and minimizing market uncertainties. Home flippers invest in properties needing renovation, aiming to increase value through remodeling before reselling for profit. Explore how these distinct real estate strategies can optimize your property investment decisions.

Why it is important

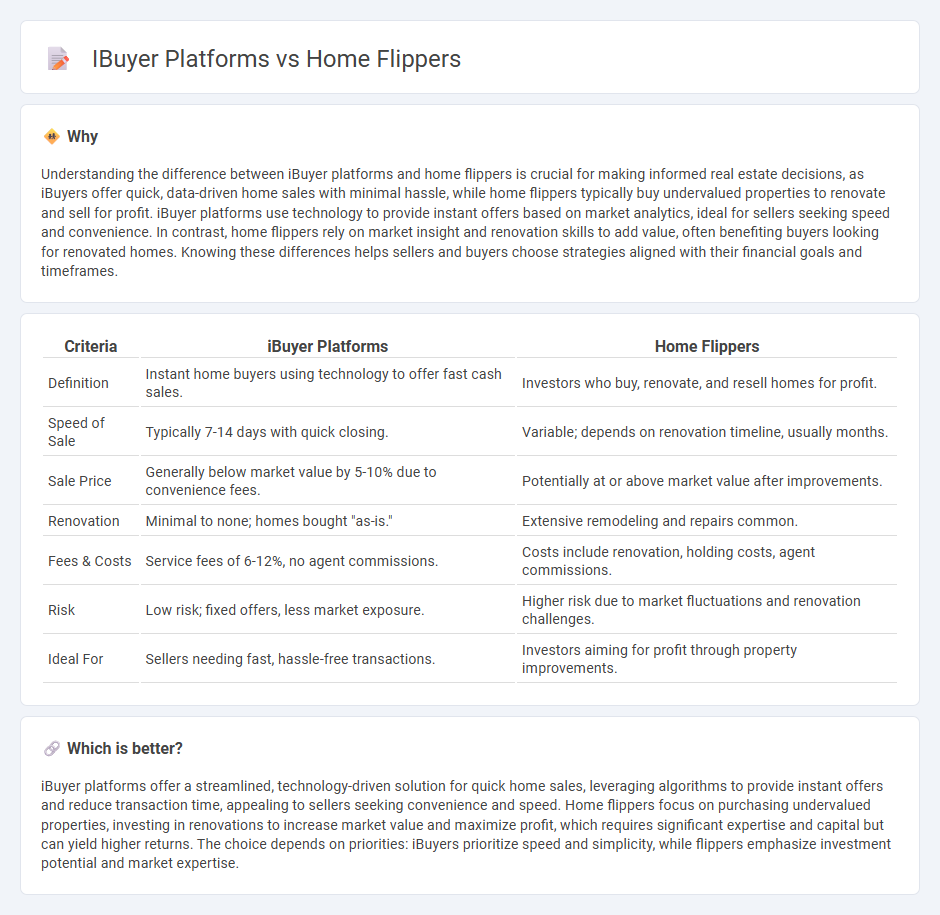

Understanding the difference between iBuyer platforms and home flippers is crucial for making informed real estate decisions, as iBuyers offer quick, data-driven home sales with minimal hassle, while home flippers typically buy undervalued properties to renovate and sell for profit. iBuyer platforms use technology to provide instant offers based on market analytics, ideal for sellers seeking speed and convenience. In contrast, home flippers rely on market insight and renovation skills to add value, often benefiting buyers looking for renovated homes. Knowing these differences helps sellers and buyers choose strategies aligned with their financial goals and timeframes.

Comparison Table

| Criteria | iBuyer Platforms | Home Flippers |

|---|---|---|

| Definition | Instant home buyers using technology to offer fast cash sales. | Investors who buy, renovate, and resell homes for profit. |

| Speed of Sale | Typically 7-14 days with quick closing. | Variable; depends on renovation timeline, usually months. |

| Sale Price | Generally below market value by 5-10% due to convenience fees. | Potentially at or above market value after improvements. |

| Renovation | Minimal to none; homes bought "as-is." | Extensive remodeling and repairs common. |

| Fees & Costs | Service fees of 6-12%, no agent commissions. | Costs include renovation, holding costs, agent commissions. |

| Risk | Low risk; fixed offers, less market exposure. | Higher risk due to market fluctuations and renovation challenges. |

| Ideal For | Sellers needing fast, hassle-free transactions. | Investors aiming for profit through property improvements. |

Which is better?

iBuyer platforms offer a streamlined, technology-driven solution for quick home sales, leveraging algorithms to provide instant offers and reduce transaction time, appealing to sellers seeking convenience and speed. Home flippers focus on purchasing undervalued properties, investing in renovations to increase market value and maximize profit, which requires significant expertise and capital but can yield higher returns. The choice depends on priorities: iBuyers prioritize speed and simplicity, while flippers emphasize investment potential and market expertise.

Connection

iBuyer platforms and home flippers are interconnected through their shared focus on fast, cash-based property transactions aimed at capitalizing on market opportunities. iBuyers use algorithms and data analytics to quickly purchase homes, which home flippers often acquire to renovate and resell at a profit. This dynamic accelerates real estate turnover and influences pricing trends within competitive housing markets.

Key Terms

After Repair Value (ARV)

Home flippers prioritize accurately estimating the After Repair Value (ARV) to gauge potential profits by renovating properties and selling them at a higher price, relying on detailed market analysis and comparable sales data. iBuyer platforms use automated algorithms and real-time market data to provide instant offers based on ARV projections, streamlining transactions but sometimes overlooking unique property features. Discover how understanding ARV nuances can enhance investment strategies in both home flipping and iBuyer markets.

Instant Offer

Home flippers benefit from instant offer platforms by receiving quick property valuations, enabling faster transaction turnaround compared to traditional sales. iBuyer platforms utilize advanced algorithms and market data to present competitive, hassle-free offers without requiring extensive home repairs or staging. Explore how instant offer technology transforms property reselling by learning more about its impact on real estate investment.

Holding Costs

Home flippers often face significant holding costs including mortgage payments, property taxes, insurance, utilities, and maintenance expenses during renovation periods, which can impact profitability. iBuyer platforms mitigate holding costs by leveraging technology to offer near-instant purchases and quick resales, reducing time spent owning the property and associated expenses. Explore how minimizing holding costs through iBuyer platforms can enhance real estate investment outcomes.

Source and External Links

How to Find House Flippers Near Me (& More Cash Offer ... - House flippers are real estate investors who buy properties in need of significant repairs, renovate them, and then resell for profit, often purchasing homes directly for cash from sellers unable or unwilling to make repairs themselves.

Flipping Houses: A How-To Guide For Beginners - Flipping houses involves buying a property, holding it for a short period while making improvements, and then selling it at a higher price, with potential for substantial profits but also significant risks depending on market conditions and renovation costs.

What is the 70% rule in house flipping? - The 70% rule is a guideline suggesting investors should pay no more than 70% of a property's after-repair value minus repair costs, helping flippers estimate the maximum purchase price to maintain profitability, though it relies on accurate estimates and has limitations.

dowidth.com

dowidth.com