Proptech revolutionizes real estate by integrating digital technologies such as AI, big data, and IoT to enhance property management, sales, and rentals, boosting efficiency and transparency. Insurtech transforms property insurance through automated claims processing, risk assessment, and personalized policies powered by machine learning and blockchain. Discover how these technological innovations redefine real estate and insurance landscapes.

Why it is important

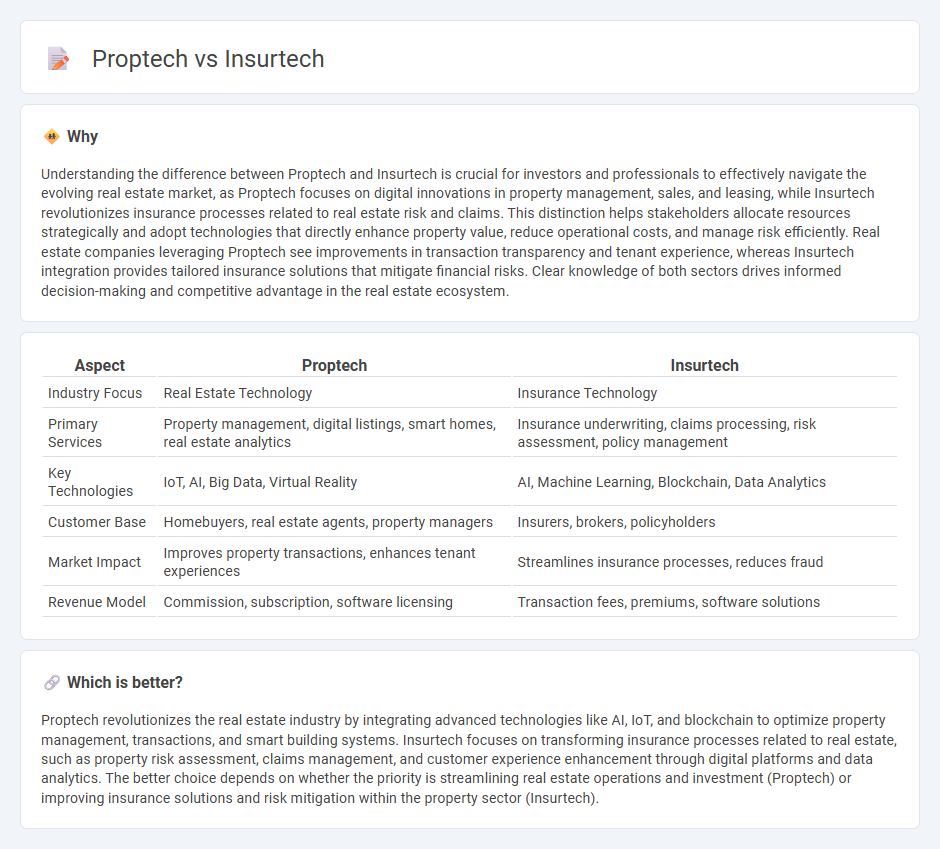

Understanding the difference between Proptech and Insurtech is crucial for investors and professionals to effectively navigate the evolving real estate market, as Proptech focuses on digital innovations in property management, sales, and leasing, while Insurtech revolutionizes insurance processes related to real estate risk and claims. This distinction helps stakeholders allocate resources strategically and adopt technologies that directly enhance property value, reduce operational costs, and manage risk efficiently. Real estate companies leveraging Proptech see improvements in transaction transparency and tenant experience, whereas Insurtech integration provides tailored insurance solutions that mitigate financial risks. Clear knowledge of both sectors drives informed decision-making and competitive advantage in the real estate ecosystem.

Comparison Table

| Aspect | Proptech | Insurtech |

|---|---|---|

| Industry Focus | Real Estate Technology | Insurance Technology |

| Primary Services | Property management, digital listings, smart homes, real estate analytics | Insurance underwriting, claims processing, risk assessment, policy management |

| Key Technologies | IoT, AI, Big Data, Virtual Reality | AI, Machine Learning, Blockchain, Data Analytics |

| Customer Base | Homebuyers, real estate agents, property managers | Insurers, brokers, policyholders |

| Market Impact | Improves property transactions, enhances tenant experiences | Streamlines insurance processes, reduces fraud |

| Revenue Model | Commission, subscription, software licensing | Transaction fees, premiums, software solutions |

Which is better?

Proptech revolutionizes the real estate industry by integrating advanced technologies like AI, IoT, and blockchain to optimize property management, transactions, and smart building systems. Insurtech focuses on transforming insurance processes related to real estate, such as property risk assessment, claims management, and customer experience enhancement through digital platforms and data analytics. The better choice depends on whether the priority is streamlining real estate operations and investment (Proptech) or improving insurance solutions and risk mitigation within the property sector (Insurtech).

Connection

Proptech leverages digital innovations like AI and IoT to streamline property management, while Insurtech applies similar technologies to enhance insurance underwriting and claims processing. Both sectors share data-driven platforms that improve risk assessment and customer experience in real estate transactions. Integration of Proptech and Insurtech facilitates real-time property risk monitoring and personalized insurance products tailored to specific asset profiles.

Key Terms

Digital Platforms

Insurtech and Proptech leverage digital platforms to revolutionize insurance and real estate sectors through automation, data analytics, and customer-centric solutions. Insurtech enhances underwriting accuracy and claims processing by integrating AI and IoT, while Proptech optimizes property management and smart building operations using IoT sensors and blockchain for transparency. Explore how these digital platforms transform industry practices and unlock new efficiencies in your domain.

Risk Assessment

Insurtech leverages advanced data analytics, machine learning, and AI to enhance risk assessment accuracy, enabling personalized insurance policies and dynamic pricing models. Proptech integrates IoT sensors, smart building technologies, and real-time data to evaluate property risks such as structural integrity, environmental hazards, and occupancy trends. Explore the latest innovations in Insurtech and Proptech risk assessment to understand their impact on industry transformation.

Automation

Insurtech leverages automation to streamline underwriting, claims processing, and risk assessment, enhancing efficiency and accuracy in insurance services. Proptech integrates automation to optimize property management, smart home technologies, and real estate transactions, driving innovation in the housing market. Explore the latest trends and impacts of automation in Insurtech and Proptech to understand their transformative potential.

Source and External Links

What Is Insurtech? A Guide For Brokers and Carriers | Salesforce US - Insurtech is the integration of technology such as AI and automation into insurance to modernize systems, speed up processes like claims and policy management, and enhance value, personalization, and efficiency for underwriters, brokers, and policyholders.

InsurTech NY - The #1 resource for the InsurTech community - InsurTech NY connects carriers, brokers, investors, and startups through events and programs to foster innovation in insurance, helping the industry find new technology solutions and business models.

Insurtech Insights | World's Largest Insurtech Community - Insurtech Insights is a global community and event organizer that promotes collaboration among insurers, tech entrepreneurs, and investors, focusing on innovations like AI-driven automated claims which improve efficiency and customer experience.

dowidth.com

dowidth.com