Hard rug pulls involve malicious developers abruptly stealing all funds from a DeFi project, leaving investors with worthless tokens, while front running exploits timely knowledge of pending transactions to gain profitable trades ahead of others. Both practices undermine trust and transparency in decentralized finance ecosystems, causing significant financial losses and market instability. Discover how to identify and protect against these risks in your crypto investments.

Why it is important

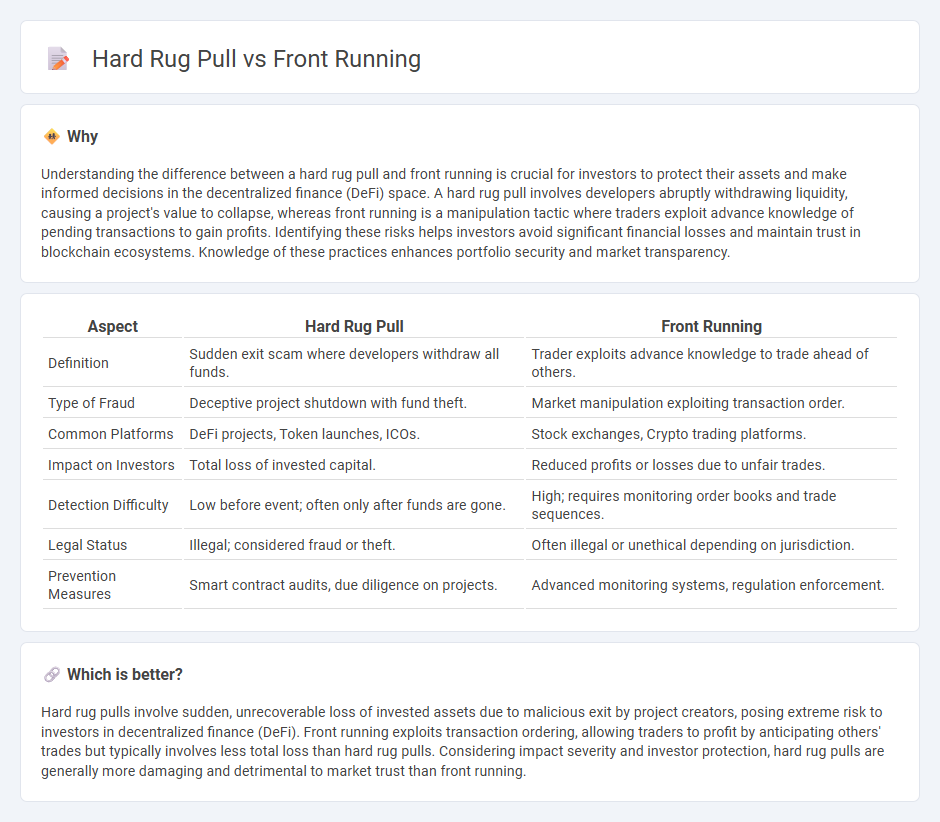

Understanding the difference between a hard rug pull and front running is crucial for investors to protect their assets and make informed decisions in the decentralized finance (DeFi) space. A hard rug pull involves developers abruptly withdrawing liquidity, causing a project's value to collapse, whereas front running is a manipulation tactic where traders exploit advance knowledge of pending transactions to gain profits. Identifying these risks helps investors avoid significant financial losses and maintain trust in blockchain ecosystems. Knowledge of these practices enhances portfolio security and market transparency.

Comparison Table

| Aspect | Hard Rug Pull | Front Running |

|---|---|---|

| Definition | Sudden exit scam where developers withdraw all funds. | Trader exploits advance knowledge to trade ahead of others. |

| Type of Fraud | Deceptive project shutdown with fund theft. | Market manipulation exploiting transaction order. |

| Common Platforms | DeFi projects, Token launches, ICOs. | Stock exchanges, Crypto trading platforms. |

| Impact on Investors | Total loss of invested capital. | Reduced profits or losses due to unfair trades. |

| Detection Difficulty | Low before event; often only after funds are gone. | High; requires monitoring order books and trade sequences. |

| Legal Status | Illegal; considered fraud or theft. | Often illegal or unethical depending on jurisdiction. |

| Prevention Measures | Smart contract audits, due diligence on projects. | Advanced monitoring systems, regulation enforcement. |

Which is better?

Hard rug pulls involve sudden, unrecoverable loss of invested assets due to malicious exit by project creators, posing extreme risk to investors in decentralized finance (DeFi). Front running exploits transaction ordering, allowing traders to profit by anticipating others' trades but typically involves less total loss than hard rug pulls. Considering impact severity and investor protection, hard rug pulls are generally more damaging and detrimental to market trust than front running.

Connection

Rug pulls and front running are interconnected risks in decentralized finance (DeFi) where malicious actors exploit transaction transparency on blockchain networks. Front running involves intercepting and executing trades before pending transactions to manipulate market prices, often setting the stage for a rug pull--an exit scam where developers drain liquidity pools, leaving investors with worthless tokens. Understanding the role of front running in facilitating rug pulls highlights the critical need for enhanced security protocols and transaction privacy in DeFi platforms.

Key Terms

Insider Information

Front running exploits insider information by executing trades ahead of pending large orders to gain unfair profit, often seen in financial markets. Hard rug pull involves insiders or founders abruptly withdrawing all assets from a project, leaving investors with worthless tokens, typically in the crypto space. Discover the key differences and implications of insider information in these deceptive practices.

Liquidity

Front running in cryptocurrency refers to a trader exploiting advance knowledge of pending transactions to execute orders ahead, affecting liquidity by capturing profits before others can act. A hard rug pull involves developers withdrawing all liquidity from a decentralized exchange pool, abruptly collapsing the token's market and leaving investors with worthless assets. Explore in-depth distinctions and protective strategies to navigate these liquidity threats effectively.

Exit Scam

Front running involves exploiting advance knowledge of pending transactions to gain unfair profit, whereas a hard rug pull is a sudden, malicious exit scam where project developers withdraw all funds, leaving investors with worthless tokens. In exit scams, hard rug pulls completely eliminate liquidity and vanish with investor capital, causing irreversible losses, while front running profits from market manipulation without necessarily collapsing the project. Discover detailed insights on distinguishing exit scam tactics and protecting investments.

Source and External Links

Front Running Explained: What Is It, Examples, Is It Legal? - Front running is when a broker trades a financial asset based on non-public information about a large upcoming trade that will influence the asset's price, allowing the broker to profit illegally before executing the client's order.

Front running - Wikipedia - Front running, or tailgating, is the practice of entering into trades or contracts using advance nonpublic knowledge of a large pending transaction to profit, and is considered market manipulation and illegal in many jurisdictions.

FRONT-RUNNING definition | Cambridge English Dictionary - Front-running is the usually illegal act of a dealer buying shares for themselves before fulfilling a customer's large order, anticipating the price rise to make a profit.

dowidth.com

dowidth.com