Green bonds finance projects with clear environmental benefits, such as renewable energy, energy efficiency, and conservation efforts, targeting investors focused on sustainability. Transition bonds support companies in high-emission sectors to adopt cleaner technologies and reduce their carbon footprint as part of a gradual move toward sustainability. Explore the differences and benefits of green and transition bonds to align your investment strategy with global climate goals.

Why it is important

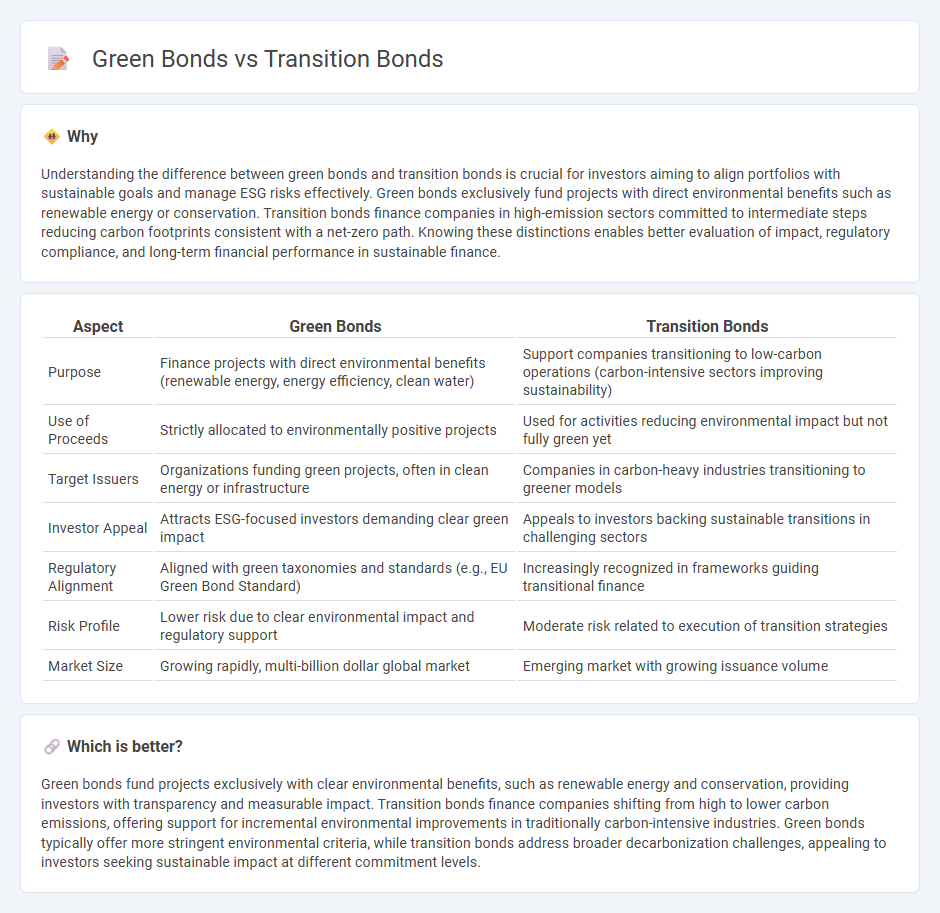

Understanding the difference between green bonds and transition bonds is crucial for investors aiming to align portfolios with sustainable goals and manage ESG risks effectively. Green bonds exclusively fund projects with direct environmental benefits such as renewable energy or conservation. Transition bonds finance companies in high-emission sectors committed to intermediate steps reducing carbon footprints consistent with a net-zero path. Knowing these distinctions enables better evaluation of impact, regulatory compliance, and long-term financial performance in sustainable finance.

Comparison Table

| Aspect | Green Bonds | Transition Bonds |

|---|---|---|

| Purpose | Finance projects with direct environmental benefits (renewable energy, energy efficiency, clean water) | Support companies transitioning to low-carbon operations (carbon-intensive sectors improving sustainability) |

| Use of Proceeds | Strictly allocated to environmentally positive projects | Used for activities reducing environmental impact but not fully green yet |

| Target Issuers | Organizations funding green projects, often in clean energy or infrastructure | Companies in carbon-heavy industries transitioning to greener models |

| Investor Appeal | Attracts ESG-focused investors demanding clear green impact | Appeals to investors backing sustainable transitions in challenging sectors |

| Regulatory Alignment | Aligned with green taxonomies and standards (e.g., EU Green Bond Standard) | Increasingly recognized in frameworks guiding transitional finance |

| Risk Profile | Lower risk due to clear environmental impact and regulatory support | Moderate risk related to execution of transition strategies |

| Market Size | Growing rapidly, multi-billion dollar global market | Emerging market with growing issuance volume |

Which is better?

Green bonds fund projects exclusively with clear environmental benefits, such as renewable energy and conservation, providing investors with transparency and measurable impact. Transition bonds finance companies shifting from high to lower carbon emissions, offering support for incremental environmental improvements in traditionally carbon-intensive industries. Green bonds typically offer more stringent environmental criteria, while transition bonds address broader decarbonization challenges, appealing to investors seeking sustainable impact at different commitment levels.

Connection

Green bonds and transition bonds both serve as innovative financial instruments designed to fund environmentally sustainable projects, with green bonds specifically targeting fully green initiatives like renewable energy or conservation. Transition bonds focus on financing companies in carbon-intensive sectors aiming to reduce their environmental impact through sustainable practices and technology upgrades. Together, they support the global shift toward a low-carbon economy by promoting investment in both established green projects and transitional activities that improve sustainability performance.

Key Terms

Sustainability

Transition bonds finance companies shifting from high-carbon to low-carbon operations, targeting sectors with significant environmental impact but needing time to fully decarbonize. Green bonds exclusively fund projects with direct environmental benefits, such as renewable energy, energy efficiency, or conservation initiatives. Explore more about how these bonds drive sustainability and support the global transition to a greener economy.

Use of Proceeds

Transition bonds allocate proceeds to companies moving towards lower carbon emissions, funding projects that improve sustainability in traditionally high-carbon sectors. Green bonds specifically finance environmentally friendly projects with clear, measurable ecological benefits like renewable energy and conservation. Explore further to understand which bond type aligns best with your sustainable investment goals.

Emissions Reduction Targets

Transition bonds primarily finance projects aimed at reducing carbon emissions in high-impact sectors like energy, manufacturing, and transportation, supporting companies with clear transition plans toward lower carbon footprints. Green bonds focus exclusively on funding environmentally sustainable projects such as renewable energy, energy efficiency, and pollution prevention, aligned with established green standards. Explore our in-depth comparison to understand how both bond types contribute to achieving emissions reduction targets effectively.

Source and External Links

Transition Bonds | Smith School of Business - Transition bonds are a financial instrument used to fund firms' efforts to transition towards lower environmental impact or reduced carbon emissions without requiring the issuer or project to be classified as green, allowing for financing climate transition activities like carbon capture in traditionally high-emission industries.

Transition bonds: What are they and how do they help decarbonize? - Transition bonds are designed to finance projects in carbon-intensive sectors that typically do not qualify for green bonds, supporting companies in the process of reducing emissions, thus bridging financing between green bonds and sustainability-linked bonds.

Transition Finance in the Debt Capital Market - ICMA - Transition finance is conceived as thematic financing realized through green, sustainability, and sustainability-linked bonds, aiding firms, especially in fossil fuel and hard-to-abate sectors, to achieve climate goals, though large-scale bond financing for these transitions remains limited.

dowidth.com

dowidth.com