Greenium refers to the premium investors are willing to pay for green bonds due to their environmental benefits and lower risk profile, reflecting strong demand in sustainable finance markets. Transition bonds finance companies shifting from high carbon footprints toward greener operations, addressing sectors not yet fully sustainable but committed to improvement. Explore further to understand how greenium impacts investment returns and the evolving role of transition bonds in climate finance strategies.

Why it is important

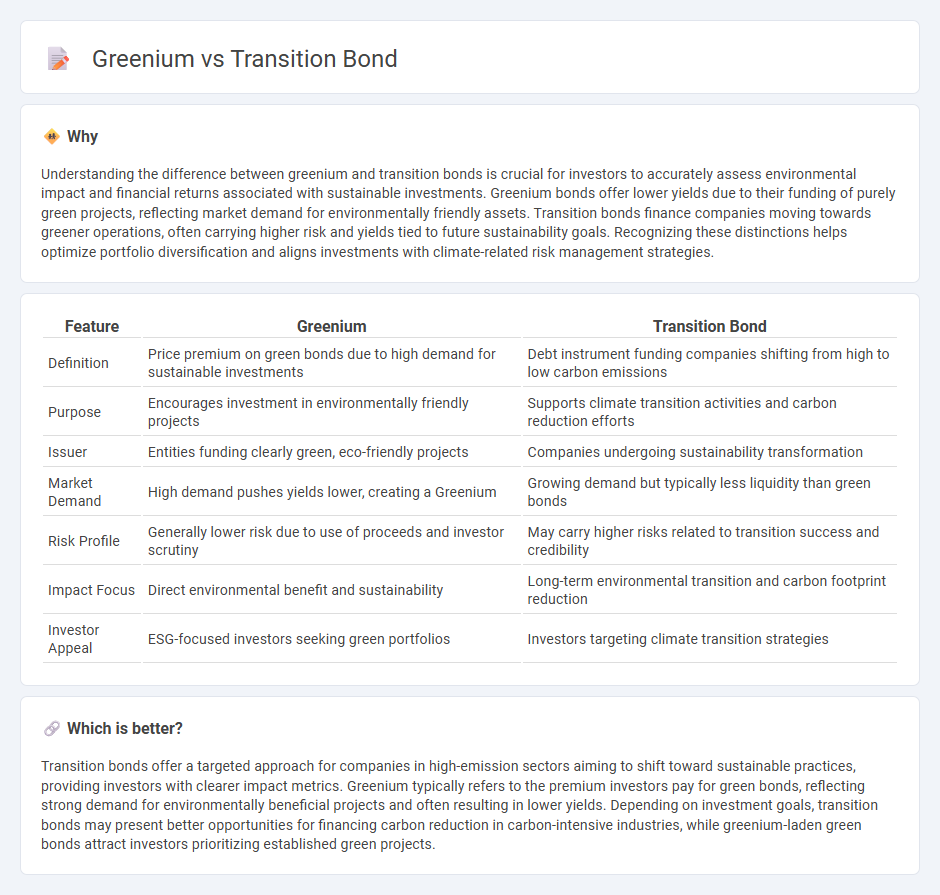

Understanding the difference between greenium and transition bonds is crucial for investors to accurately assess environmental impact and financial returns associated with sustainable investments. Greenium bonds offer lower yields due to their funding of purely green projects, reflecting market demand for environmentally friendly assets. Transition bonds finance companies moving towards greener operations, often carrying higher risk and yields tied to future sustainability goals. Recognizing these distinctions helps optimize portfolio diversification and aligns investments with climate-related risk management strategies.

Comparison Table

| Feature | Greenium | Transition Bond |

|---|---|---|

| Definition | Price premium on green bonds due to high demand for sustainable investments | Debt instrument funding companies shifting from high to low carbon emissions |

| Purpose | Encourages investment in environmentally friendly projects | Supports climate transition activities and carbon reduction efforts |

| Issuer | Entities funding clearly green, eco-friendly projects | Companies undergoing sustainability transformation |

| Market Demand | High demand pushes yields lower, creating a Greenium | Growing demand but typically less liquidity than green bonds |

| Risk Profile | Generally lower risk due to use of proceeds and investor scrutiny | May carry higher risks related to transition success and credibility |

| Impact Focus | Direct environmental benefit and sustainability | Long-term environmental transition and carbon footprint reduction |

| Investor Appeal | ESG-focused investors seeking green portfolios | Investors targeting climate transition strategies |

Which is better?

Transition bonds offer a targeted approach for companies in high-emission sectors aiming to shift toward sustainable practices, providing investors with clearer impact metrics. Greenium typically refers to the premium investors pay for green bonds, reflecting strong demand for environmentally beneficial projects and often resulting in lower yields. Depending on investment goals, transition bonds may present better opportunities for financing carbon reduction in carbon-intensive industries, while greenium-laden green bonds attract investors prioritizing established green projects.

Connection

Greenium represents the premium investors are willing to pay for green bonds due to their environmental benefits, leading to lower yields compared to conventional bonds. Transition bonds finance companies moving toward sustainable practices, often benefiting from the greenium when they demonstrate credible environmental progress. This connection incentivizes firms to accelerate their low-carbon transition by accessing cheaper capital through transition bonds attracting greenium-seeking investors.

Key Terms

Sustainable Finance

Transition bonds finance companies shifting toward greener operations, facilitating gradual decarbonization in sectors with high carbon footprints. Greenium refers to the premium investors are willing to pay for green bonds due to their environmental benefits and lower risk perception, often resulting in marginally lower yields compared to conventional bonds. Explore how these mechanisms drive funding in sustainable finance and impact investor behavior.

Yield Spread

Transition bonds typically exhibit a lower yield spread compared to traditional bonds due to growing investor demand for sustainable finance, while greenium refers to the yield premium investors accept for green bonds, often resulting in slightly reduced yields. Yield spreads in transition bonds reflect risks associated with the issuer's shift toward greener operations, whereas greenium embodies investor willingness to accept lower returns for environmental benefits. Explore more to understand how yield spreads influence strategic investment decisions in sustainable fixed income markets.

Use of Proceeds

Transition bonds finance projects that support companies in shifting from high to lower carbon emissions, focusing on sectors like energy and manufacturing for environmental improvement. Greenium refers to the premium investors pay for green bonds, reflecting demand for assets with clear environmental benefits and verified Use of Proceeds dedicated to sustainable initiatives. Explore more to understand how these financial instruments drive sustainable investment strategies.

Source and External Links

Transition Bonds | Smith School of Business - Transition bonds are bonds issued to fund a company's transition towards reducing environmental impact or carbon emissions, using proceeds exclusively for climate transition-related projects without requiring the issuer to be fully green initially.

Transition bonds: What are they and how do they help decarbonize? - Transition bonds finance specific projects aimed at lowering carbon footprints of companies still transitioning to sustainable operations, differing from green bonds by allowing issuers not yet fully sustainable but committing to reducing emissions.

DBJ Transition Bonds|Investor Relations|Development Bank of Japan - DBJ Transition Bonds support companies with credible long-term climate strategies aligned with the Paris Agreement, funding actions and loans to facilitate transitions to decarbonization towards net zero greenhouse gas emissions by 2050.

dowidth.com

dowidth.com