Altcoins staking involves locking up cryptocurrency tokens to support blockchain network operations while earning rewards, often providing passive income with varying levels of risk and return. NFT staking allows users to stake non-fungible tokens, leveraging digital asset ownership for benefits such as yield generation, access to exclusive content, or governance rights. Explore deeper insights into how altcoin and NFT staking strategies can optimize your crypto portfolio.

Why it is important

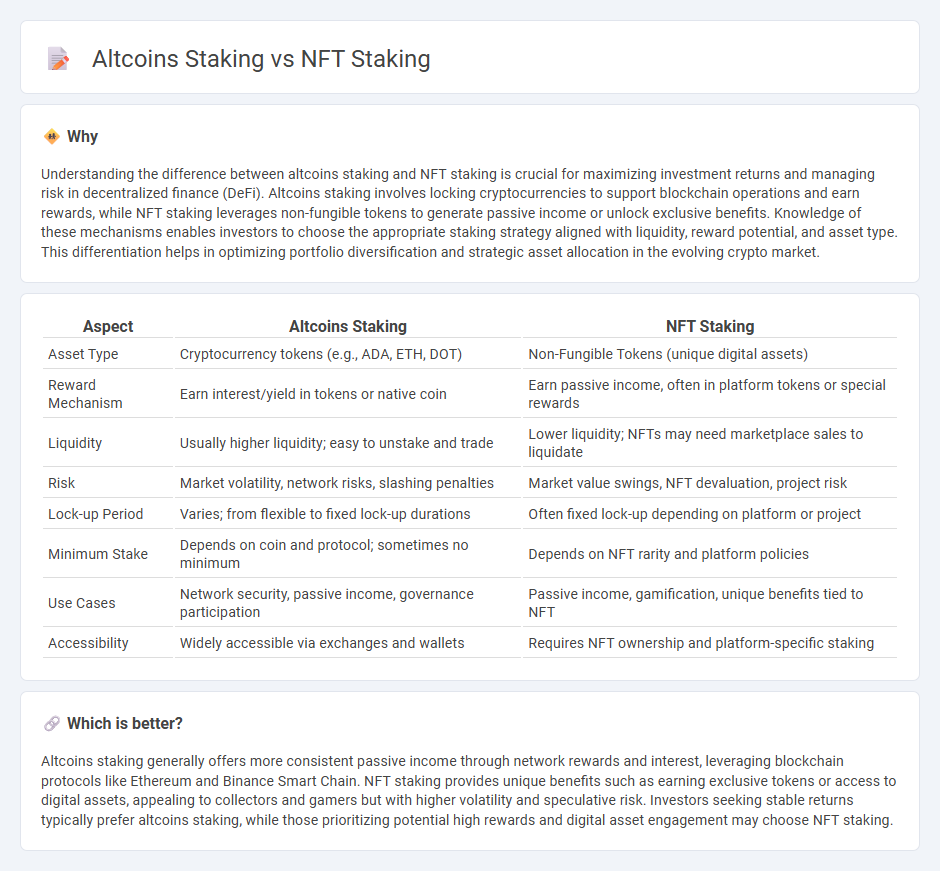

Understanding the difference between altcoins staking and NFT staking is crucial for maximizing investment returns and managing risk in decentralized finance (DeFi). Altcoins staking involves locking cryptocurrencies to support blockchain operations and earn rewards, while NFT staking leverages non-fungible tokens to generate passive income or unlock exclusive benefits. Knowledge of these mechanisms enables investors to choose the appropriate staking strategy aligned with liquidity, reward potential, and asset type. This differentiation helps in optimizing portfolio diversification and strategic asset allocation in the evolving crypto market.

Comparison Table

| Aspect | Altcoins Staking | NFT Staking |

|---|---|---|

| Asset Type | Cryptocurrency tokens (e.g., ADA, ETH, DOT) | Non-Fungible Tokens (unique digital assets) |

| Reward Mechanism | Earn interest/yield in tokens or native coin | Earn passive income, often in platform tokens or special rewards |

| Liquidity | Usually higher liquidity; easy to unstake and trade | Lower liquidity; NFTs may need marketplace sales to liquidate |

| Risk | Market volatility, network risks, slashing penalties | Market value swings, NFT devaluation, project risk |

| Lock-up Period | Varies; from flexible to fixed lock-up durations | Often fixed lock-up depending on platform or project |

| Minimum Stake | Depends on coin and protocol; sometimes no minimum | Depends on NFT rarity and platform policies |

| Use Cases | Network security, passive income, governance participation | Passive income, gamification, unique benefits tied to NFT |

| Accessibility | Widely accessible via exchanges and wallets | Requires NFT ownership and platform-specific staking |

Which is better?

Altcoins staking generally offers more consistent passive income through network rewards and interest, leveraging blockchain protocols like Ethereum and Binance Smart Chain. NFT staking provides unique benefits such as earning exclusive tokens or access to digital assets, appealing to collectors and gamers but with higher volatility and speculative risk. Investors seeking stable returns typically prefer altcoins staking, while those prioritizing potential high rewards and digital asset engagement may choose NFT staking.

Connection

Altcoins staking and NFT staking both involve locking digital assets to earn rewards, leveraging blockchain technology for passive income generation. Altcoins staking secures networks by validating transactions through Proof of Stake mechanisms, while NFT staking often unlocks exclusive benefits or yields based on collectible digital assets. Both methods enhance liquidity and user engagement within decentralized finance (DeFi) ecosystems by incentivizing asset holding and participation.

Key Terms

Yield Generation

NFT staking offers yield generation through locking digital collectibles in decentralized platforms, often providing unique rewards tied to the NFT's scarcity and utility. Altcoins staking involves locking native tokens of alternative cryptocurrencies, earning rewards based on network consensus mechanisms like Proof of Stake, usually yielding predictable passive income. Explore in-depth comparisons of NFT and altcoin staking to maximize your crypto portfolio's returns.

Liquidity

NFT staking often offers lower liquidity compared to altcoins staking because NFTs are unique and cannot be easily traded or converted into cash. Altcoins staking involves locking fungible tokens that are generally more liquid, allowing participants to trade or withdraw their assets more flexibly. Explore detailed insights on how liquidity impacts your returns and staking strategies.

Asset Ownership

NFT staking allows users to retain full ownership of unique digital assets while earning rewards, leveraging the scarcity and individuality of non-fungible tokens. Altcoins staking involves locking up fungible cryptocurrencies to support network operations and gain interest, with ownership represented by divisible tokens. Explore deeper insights into how asset ownership impacts staking strategies in the blockchain ecosystem.

Source and External Links

Understanding NFT Staking: How It Operates and Its Advantages - NFT staking involves locking NFTs in smart contracts, allowing owners to earn rewards or privileges without selling their assets, thus incentivizing long-term ownership and engagement in a project's ecosystem.

NFT Staking: How to Earn Passive Income with Non-Fungible Tokens - NFT staking lets holders lock their NFTs in blockchain protocols to earn rewards, typically by transferring NFTs to staking smart contracts, generating passive income from various types of NFTs like digital art or gaming assets.

What is NFT Staking and How Does It Work? - OSL - NFT staking is an emerging practice where users lock NFTs in smart contracts for a period to earn cryptocurrency or token rewards, adding utility to NFTs beyond ownership and promoting active participation in blockchain ecosystems.

dowidth.com

dowidth.com