Decentralized Autonomous Organization (DAO) treasuries manage funds through blockchain-based smart contracts, offering transparency and community-driven governance without intermediaries. Mutual funds pool capital from multiple investors, professionally managed by fund managers to diversify risk and aim for steady returns. Explore the differences in control, risk, and governance between these two innovative financial vehicles.

Why it is important

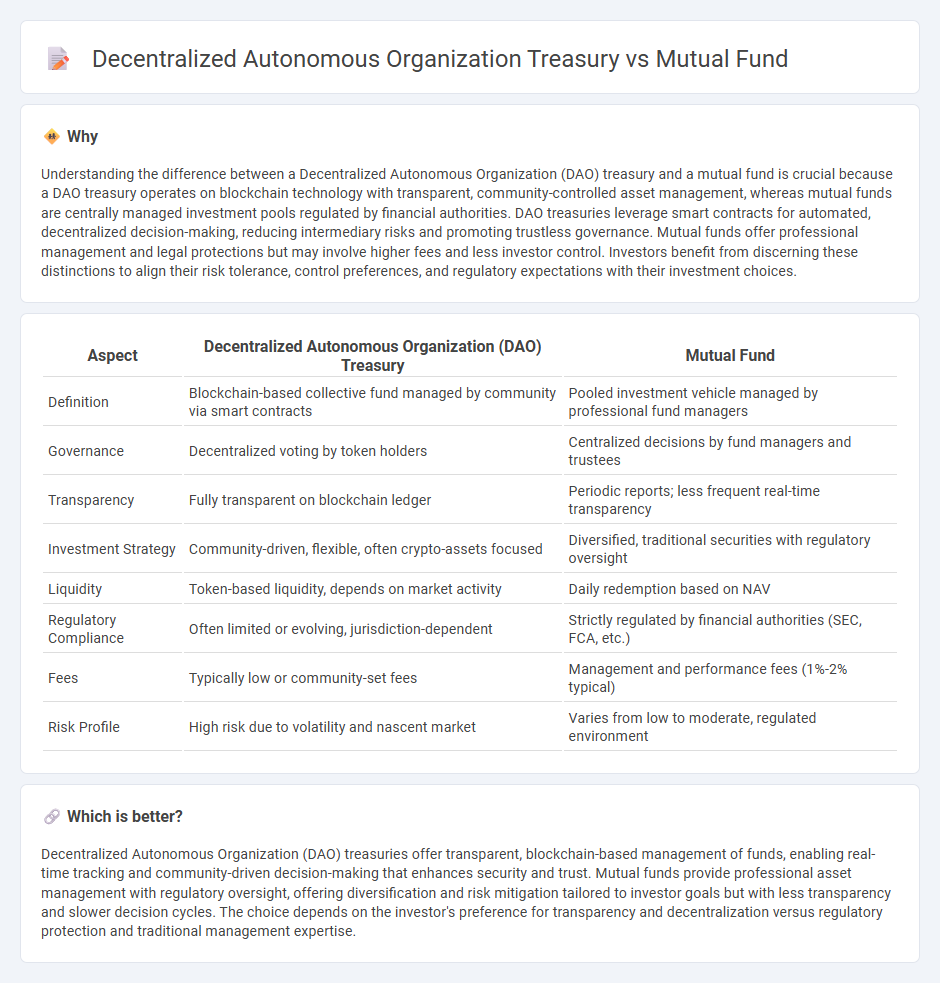

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a mutual fund is crucial because a DAO treasury operates on blockchain technology with transparent, community-controlled asset management, whereas mutual funds are centrally managed investment pools regulated by financial authorities. DAO treasuries leverage smart contracts for automated, decentralized decision-making, reducing intermediary risks and promoting trustless governance. Mutual funds offer professional management and legal protections but may involve higher fees and less investor control. Investors benefit from discerning these distinctions to align their risk tolerance, control preferences, and regulatory expectations with their investment choices.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Mutual Fund |

|---|---|---|

| Definition | Blockchain-based collective fund managed by community via smart contracts | Pooled investment vehicle managed by professional fund managers |

| Governance | Decentralized voting by token holders | Centralized decisions by fund managers and trustees |

| Transparency | Fully transparent on blockchain ledger | Periodic reports; less frequent real-time transparency |

| Investment Strategy | Community-driven, flexible, often crypto-assets focused | Diversified, traditional securities with regulatory oversight |

| Liquidity | Token-based liquidity, depends on market activity | Daily redemption based on NAV |

| Regulatory Compliance | Often limited or evolving, jurisdiction-dependent | Strictly regulated by financial authorities (SEC, FCA, etc.) |

| Fees | Typically low or community-set fees | Management and performance fees (1%-2% typical) |

| Risk Profile | High risk due to volatility and nascent market | Varies from low to moderate, regulated environment |

Which is better?

Decentralized Autonomous Organization (DAO) treasuries offer transparent, blockchain-based management of funds, enabling real-time tracking and community-driven decision-making that enhances security and trust. Mutual funds provide professional asset management with regulatory oversight, offering diversification and risk mitigation tailored to investor goals but with less transparency and slower decision cycles. The choice depends on the investor's preference for transparency and decentralization versus regulatory protection and traditional management expertise.

Connection

Decentralized Autonomous Organization (DAO) treasuries and mutual funds both pool assets to manage investments collectively, leveraging decentralized decision-making and transparency. DAO treasuries utilize blockchain technology for secure, automated governance and real-time tracking of assets, mirroring mutual funds' objective of diversification and risk management. This connection emphasizes the shift towards digital asset management and democratized financial participation in modern finance.

Key Terms

Asset Management

Mutual funds pool capital from investors to professionally manage a diversified portfolio of assets with regulated oversight, ensuring liquidity and risk mitigation. Decentralized Autonomous Organization (DAO) treasuries operate on blockchain, managing assets through community-driven governance and smart contracts, offering transparency but higher volatility. Explore in-depth comparisons to understand which asset management approach aligns best with your investment goals.

Governance Structure

Mutual fund governance relies on a centralized structure with fund managers making key investment decisions under regulatory oversight, ensuring investor protection and compliance. In contrast, a decentralized autonomous organization (DAO) treasury employs blockchain-based smart contracts and community voting, enabling transparent, democratic control without intermediaries. Explore further to understand how these differing governance models impact investor engagement and decision-making efficiency.

Transparency

Mutual funds operate under strict regulatory frameworks requiring detailed financial disclosures, ensuring high transparency for investors regarding asset management and performance. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology, providing real-time, immutable transaction records accessible to all participants, enhancing transparency through decentralized governance. Explore in-depth comparisons to understand how transparency mechanisms impact investor trust and organizational efficiency.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered investment company pooling money from many investors to invest in stocks, bonds, and other securities, offering professional management, diversification, low minimum investments, and liquidity.

Mutual fund - Mutual funds pool money to purchase various securities and can be actively or passively managed, providing economies of scale, diversification, liquidity, and professional management but involve fees.

Understanding mutual funds - Mutual funds offer diversified portfolios managed by professionals, with benefits including diversification, low transaction costs, convenience, and varied investment strategies.

dowidth.com

dowidth.com