Green bonds finance environmentally sustainable projects aimed at reducing carbon footprints and promoting renewable energy infrastructure. Catastrophe bonds provide insurance-linked securities that transfer risks from natural disasters such as hurricanes and earthquakes to investors. Explore how these innovative financial instruments support risk management and sustainable development.

Why it is important

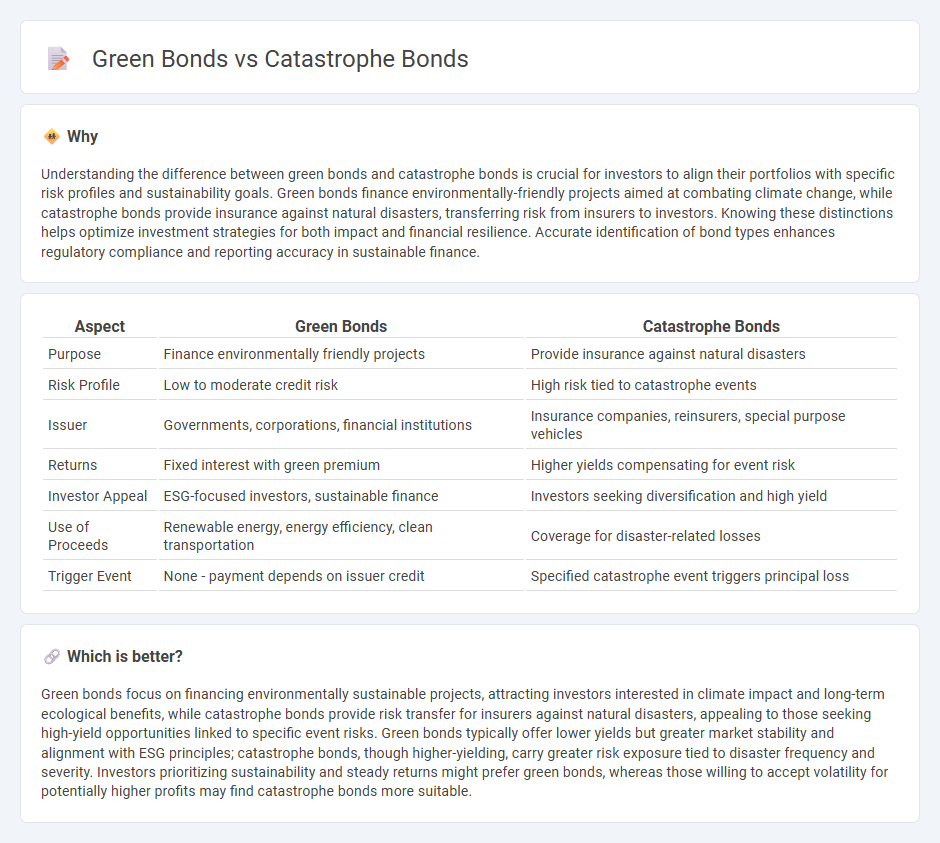

Understanding the difference between green bonds and catastrophe bonds is crucial for investors to align their portfolios with specific risk profiles and sustainability goals. Green bonds finance environmentally-friendly projects aimed at combating climate change, while catastrophe bonds provide insurance against natural disasters, transferring risk from insurers to investors. Knowing these distinctions helps optimize investment strategies for both impact and financial resilience. Accurate identification of bond types enhances regulatory compliance and reporting accuracy in sustainable finance.

Comparison Table

| Aspect | Green Bonds | Catastrophe Bonds |

|---|---|---|

| Purpose | Finance environmentally friendly projects | Provide insurance against natural disasters |

| Risk Profile | Low to moderate credit risk | High risk tied to catastrophe events |

| Issuer | Governments, corporations, financial institutions | Insurance companies, reinsurers, special purpose vehicles |

| Returns | Fixed interest with green premium | Higher yields compensating for event risk |

| Investor Appeal | ESG-focused investors, sustainable finance | Investors seeking diversification and high yield |

| Use of Proceeds | Renewable energy, energy efficiency, clean transportation | Coverage for disaster-related losses |

| Trigger Event | None - payment depends on issuer credit | Specified catastrophe event triggers principal loss |

Which is better?

Green bonds focus on financing environmentally sustainable projects, attracting investors interested in climate impact and long-term ecological benefits, while catastrophe bonds provide risk transfer for insurers against natural disasters, appealing to those seeking high-yield opportunities linked to specific event risks. Green bonds typically offer lower yields but greater market stability and alignment with ESG principles; catastrophe bonds, though higher-yielding, carry greater risk exposure tied to disaster frequency and severity. Investors prioritizing sustainability and steady returns might prefer green bonds, whereas those willing to accept volatility for potentially higher profits may find catastrophe bonds more suitable.

Connection

Green bonds and catastrophe bonds both serve as innovative financial instruments aimed at managing environmental and climate-related risks. Green bonds fund projects that promote environmental sustainability, such as renewable energy and conservation, while catastrophe bonds transfer the financial risk of natural disasters to investors, providing capital relief for insurers and governments. The connection lies in their role in supporting resilience and mitigation efforts against climate change impacts through risk-sharing and sustainable investment strategies.

Key Terms

Risk Transfer

Catastrophe bonds transfer risk from issuers to investors by providing capital for disaster recovery, mitigating financial losses from natural hazards through predefined triggers. Green bonds primarily finance environmentally beneficial projects, focusing on sustainability rather than transferring risk, and offer investors stable returns with lower direct exposure to catastrophe-related risks. Explore the distinctions in risk transfer mechanisms between catastrophe bonds and green bonds to understand their roles in diversified investment strategies.

Environmental Impact

Catastrophe bonds transfer financial risk from natural disasters to investors, providing capital for disaster recovery without direct environmental benefits, whereas green bonds fund projects that explicitly promote renewable energy, pollution reduction, and conservation efforts to mitigate climate change. The environmental impact of catastrophe bonds is indirect, focused on resilience and recovery, while green bonds drive proactive environmental sustainability. Explore the differences in depth to understand how each bond type supports ecological and financial goals.

Coupon Structure

Catastrophe bonds feature higher coupon rates reflecting significant risk transfer to investors, often linked to the occurrence of predefined natural disasters, while green bonds offer typically lower, stable coupons aimed at funding environmentally sustainable projects with lower credit risk. The coupon structure of catastrophe bonds is contingent on event triggers, where investors may lose principal or forgo interest payments if a catastrophe occurs, contrasting with green bonds' fixed or floating coupon payments tied to the issuer's creditworthiness. Explore the differences in coupon mechanics and risk profiles to understand investment suitability across these bond types.

Source and External Links

Catastrophe bond - Catastrophe bonds are insurance-linked securities that transfer specific risks, typically from natural disasters, from insurers to capital market investors, with principal lost if a qualifying catastrophe occurs.

What is a catastrophe bond? - Artemis - Resource Library - These bonds can cover single or multiple catastrophic events, structured to trigger payouts based on predefined loss events, and offer protection for insurers, reinsurers, or even corporate sponsors.

What role do catastrophe bonds play in managing the physical risks from climate change? - Catastrophe bonds allow issuers to shift financial exposure to natural hazards to investors, but face criticism over high costs, payout complexities, and sometimes ineffective triggers based on event parameters rather than actual losses.

dowidth.com

dowidth.com