Shadow banking refers to non-bank financial intermediaries providing services similar to traditional banks but operating outside regular banking regulations, including entities like hedge funds and money market funds. Traditional banking involves regulated institutions such as commercial banks that accept deposits, offer loans, and are overseen by central banks and financial authorities. Explore the distinct roles and risks of shadow banking versus traditional banking to understand their impact on the financial system.

Why it is important

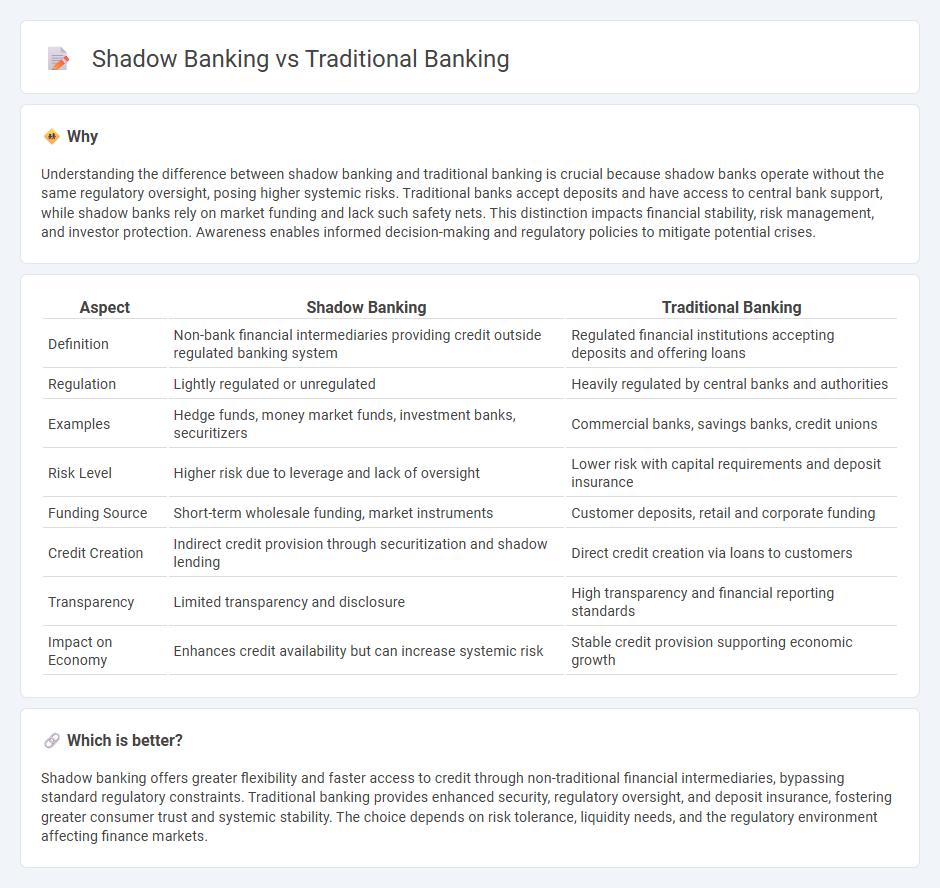

Understanding the difference between shadow banking and traditional banking is crucial because shadow banks operate without the same regulatory oversight, posing higher systemic risks. Traditional banks accept deposits and have access to central bank support, while shadow banks rely on market funding and lack such safety nets. This distinction impacts financial stability, risk management, and investor protection. Awareness enables informed decision-making and regulatory policies to mitigate potential crises.

Comparison Table

| Aspect | Shadow Banking | Traditional Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit outside regulated banking system | Regulated financial institutions accepting deposits and offering loans |

| Regulation | Lightly regulated or unregulated | Heavily regulated by central banks and authorities |

| Examples | Hedge funds, money market funds, investment banks, securitizers | Commercial banks, savings banks, credit unions |

| Risk Level | Higher risk due to leverage and lack of oversight | Lower risk with capital requirements and deposit insurance |

| Funding Source | Short-term wholesale funding, market instruments | Customer deposits, retail and corporate funding |

| Credit Creation | Indirect credit provision through securitization and shadow lending | Direct credit creation via loans to customers |

| Transparency | Limited transparency and disclosure | High transparency and financial reporting standards |

| Impact on Economy | Enhances credit availability but can increase systemic risk | Stable credit provision supporting economic growth |

Which is better?

Shadow banking offers greater flexibility and faster access to credit through non-traditional financial intermediaries, bypassing standard regulatory constraints. Traditional banking provides enhanced security, regulatory oversight, and deposit insurance, fostering greater consumer trust and systemic stability. The choice depends on risk tolerance, liquidity needs, and the regulatory environment affecting finance markets.

Connection

Shadow banking and traditional banking are interconnected through credit intermediation and liquidity transformation, where non-bank financial institutions complement banks by providing alternative lending channels. Shadow banks often rely on traditional banks for funding and collateral, creating a network of financial flows that influences systemic risk and market stability. This interdependence highlights the need for regulatory frameworks to address risks arising from off-balance-sheet activities and credit market complementarities.

Key Terms

Deposits

Traditional banking relies heavily on customer deposits as a primary funding source, offering services such as savings accounts and certificates of deposit insured by the FDIC, ensuring safety and liquidity. Shadow banking, in contrast, operates without deposit insurance and depends on short-term funding instruments like commercial paper and repurchase agreements, which increase systemic risk due to less regulatory oversight. Explore the nuances of deposit roles and risk implications in both systems to deepen your understanding.

Securitization

Securitization in traditional banking involves pooling loans and selling them as securities, enhancing liquidity and risk distribution within regulated frameworks. Shadow banking securitization operates outside conventional regulation, often involving non-bank entities and higher risk due to less transparency and oversight. Explore the complexities of securitization in both sectors to understand their impact on financial stability.

Regulatory oversight

Traditional banking operates under stringent regulatory oversight imposed by central banks and financial authorities, ensuring deposit insurance, capital requirements, and regular audits to protect consumers and maintain financial stability. Shadow banking, encompassing non-bank financial intermediaries like hedge funds and money market funds, functions with limited regulatory supervision, heightening systemic risk due to lack of transparency and fewer safeguards. Explore the complexities and impacts of regulatory frameworks on traditional and shadow banking sectors to better understand their roles in the financial system.

Source and External Links

Online vs. Traditional Banking: Differences, Pros, and Cons - Traditional banking involves physical bank branches and ATMs where customers conduct face-to-face transactions, offering advantages like cash handling, personal relationships, a wide range of financial products, and established reputation with FDIC insurance.

Traditional Banking and Mobile Banking: Differences, Pros, ... - Traditional banking is the conventional system with brick-and-mortar branches providing services in-person, regulated by government licenses, and preferred by those valuing face-to-face interaction and security.

Online Banking vs. Traditional Banking - Traditional banks offer a broader range of services including cash deposits, developed ATM networks, personal customer service at local branches, and relationship banking, though requiring in-person visits that may be inconvenient.

dowidth.com

dowidth.com