Crowdlending enables businesses to raise capital through numerous small loans from individual investors via online platforms, offering flexible financing without equity dilution. Mezzanine financing provides a hybrid of debt and equity, typically involving subordinated debt with warrants or conversion options, suitable for growth-stage companies seeking substantial funding. Explore deeper insights into crowdlending and mezzanine financing to determine the best fit for your financial strategy.

Why it is important

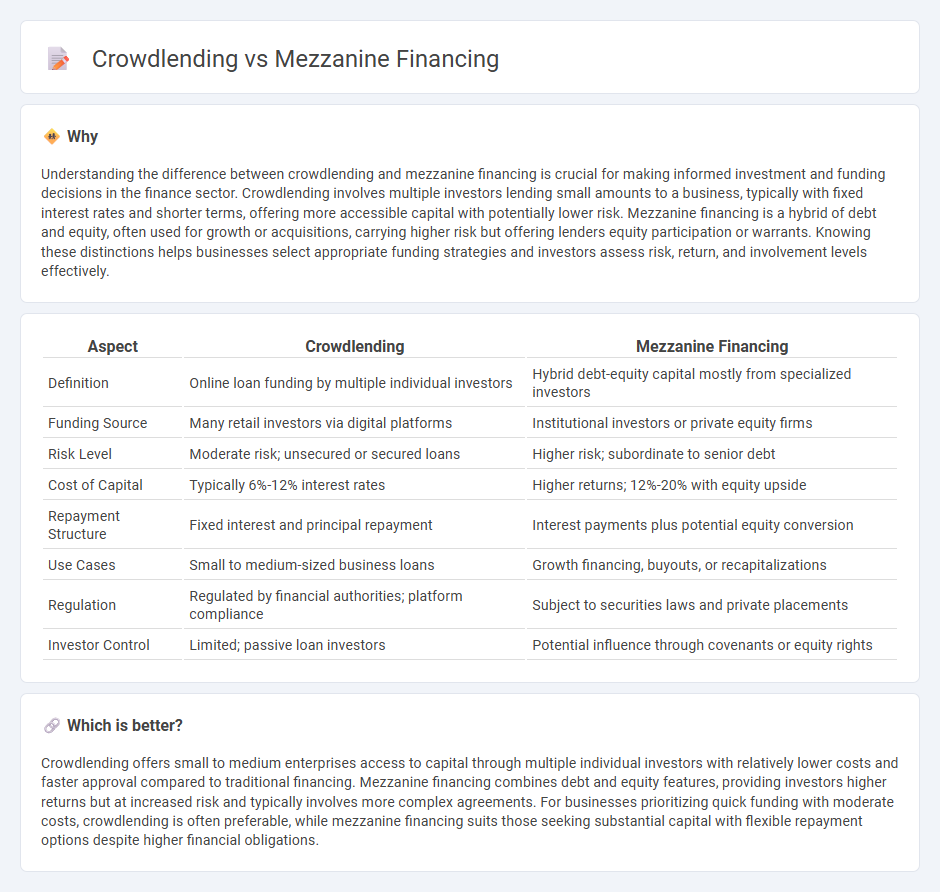

Understanding the difference between crowdlending and mezzanine financing is crucial for making informed investment and funding decisions in the finance sector. Crowdlending involves multiple investors lending small amounts to a business, typically with fixed interest rates and shorter terms, offering more accessible capital with potentially lower risk. Mezzanine financing is a hybrid of debt and equity, often used for growth or acquisitions, carrying higher risk but offering lenders equity participation or warrants. Knowing these distinctions helps businesses select appropriate funding strategies and investors assess risk, return, and involvement levels effectively.

Comparison Table

| Aspect | Crowdlending | Mezzanine Financing |

|---|---|---|

| Definition | Online loan funding by multiple individual investors | Hybrid debt-equity capital mostly from specialized investors |

| Funding Source | Many retail investors via digital platforms | Institutional investors or private equity firms |

| Risk Level | Moderate risk; unsecured or secured loans | Higher risk; subordinate to senior debt |

| Cost of Capital | Typically 6%-12% interest rates | Higher returns; 12%-20% with equity upside |

| Repayment Structure | Fixed interest and principal repayment | Interest payments plus potential equity conversion |

| Use Cases | Small to medium-sized business loans | Growth financing, buyouts, or recapitalizations |

| Regulation | Regulated by financial authorities; platform compliance | Subject to securities laws and private placements |

| Investor Control | Limited; passive loan investors | Potential influence through covenants or equity rights |

Which is better?

Crowdlending offers small to medium enterprises access to capital through multiple individual investors with relatively lower costs and faster approval compared to traditional financing. Mezzanine financing combines debt and equity features, providing investors higher returns but at increased risk and typically involves more complex agreements. For businesses prioritizing quick funding with moderate costs, crowdlending is often preferable, while mezzanine financing suits those seeking substantial capital with flexible repayment options despite higher financial obligations.

Connection

Crowdlending and mezzanine financing are connected as alternative funding sources that bridge the gap between traditional debt and equity financing. Crowdlending provides businesses with direct loans from multiple individual investors, while mezzanine financing combines debt with equity-like features, often used to support business expansion or acquisitions. Both methods offer flexible capital solutions, attractive to companies seeking growth without diluting ownership significantly.

Key Terms

Subordinated Debt

Mezzanine financing typically involves subordinated debt combined with equity options, offering higher returns to investors due to its increased risk profile compared to senior debt. Crowdlending platforms allow multiple investors to participate in subordinated debt financing, democratizing access to growth capital for mid-sized companies. Explore the nuances of subordinated debt structures and their impact on financing strategies to understand which option suits your business needs.

Interest Rate

Mezzanine financing typically features higher interest rates, ranging from 12% to 20%, due to its subordinated debt status and increased risk for lenders. Crowdlending interest rates usually vary between 5% and 12%, influenced by borrower creditworthiness and platform-specific criteria. Explore detailed comparisons to understand which financing option aligns best with your investment goals.

Investor Pool

Mezzanine financing involves a limited, often institutional investor pool providing subordinated debt or equity with higher risk and returns, typically involving detailed due diligence and larger capital commitments. Crowdlending aggregates a broad, diverse group of individual investors contributing smaller amounts through online platforms, increasing accessibility and liquidity but generally offering moderate returns. Discover the unique benefits and risk profiles of each investor pool to determine the best fit for your funding strategy.

Source and External Links

What is Mezzanine Financing? - PGIM Private Capital - Mezzanine financing is a capital source that sits between senior debt and equity, combining features of both, often used to fund growth, acquisitions, or buyouts with a flexible payment structure involving interest and equity components.

What is Mezzanine Financing | BDC.ca - Mezzanine financing is a hybrid of debt and equity with flexible repayment terms, often subordinated to senior debt, used to increase working capital or finance business acquisitions without affecting the company's debt-to-equity ratio.

Mezzanine Financing - Overview, Rate of Return, Benefits - Mezzanine financing bridges the gap between senior debt and equity, usually offered as unsecured debt or preferred stock with higher risk and returns, commonly used for business expansion or acquisitions with returns typically between 12-20%.

dowidth.com

dowidth.com