Sovereign debt restructuring involves renegotiating a country's external obligations to restore fiscal stability and avoid default, often through debt rescheduling, reduction, or swaps. Pari passu restructuring specifically addresses the equal treatment clause, ensuring all creditors receive proportional payments without preference, which can impact collective creditor negotiations and repayment terms. Explore the distinctions and implications of these approaches to understand their roles in international finance.

Why it is important

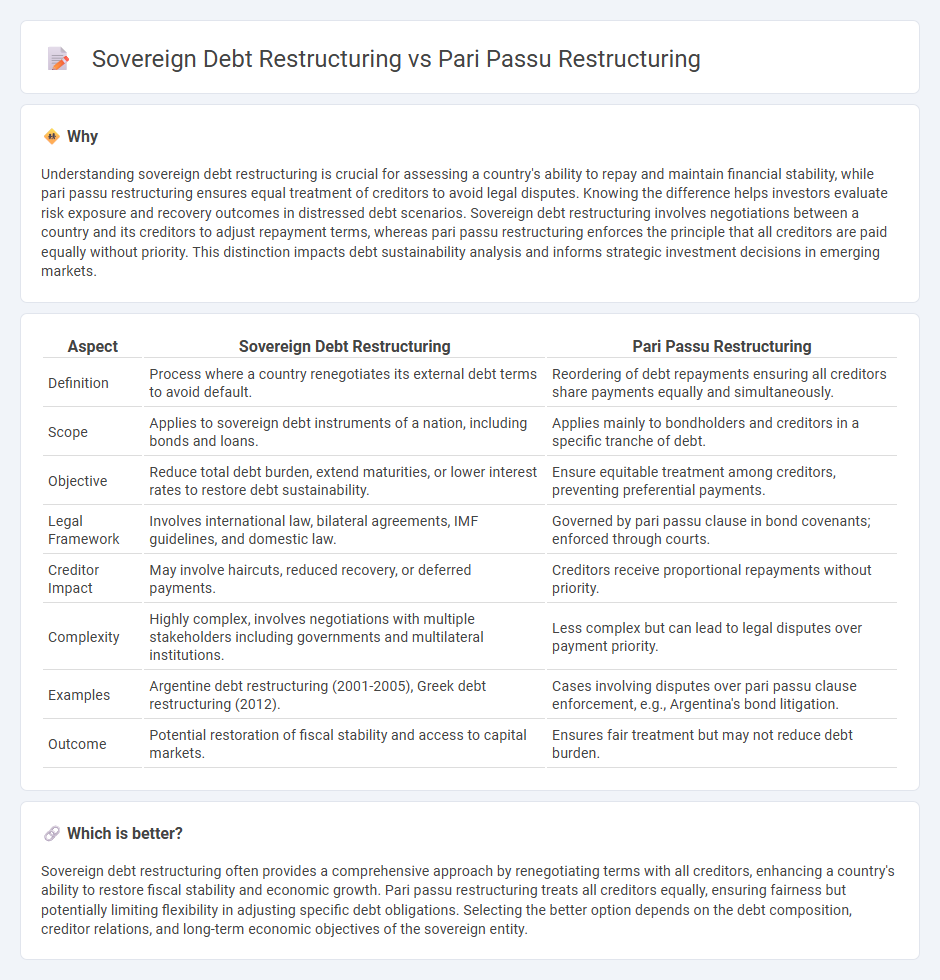

Understanding sovereign debt restructuring is crucial for assessing a country's ability to repay and maintain financial stability, while pari passu restructuring ensures equal treatment of creditors to avoid legal disputes. Knowing the difference helps investors evaluate risk exposure and recovery outcomes in distressed debt scenarios. Sovereign debt restructuring involves negotiations between a country and its creditors to adjust repayment terms, whereas pari passu restructuring enforces the principle that all creditors are paid equally without priority. This distinction impacts debt sustainability analysis and informs strategic investment decisions in emerging markets.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Pari Passu Restructuring |

|---|---|---|

| Definition | Process where a country renegotiates its external debt terms to avoid default. | Reordering of debt repayments ensuring all creditors share payments equally and simultaneously. |

| Scope | Applies to sovereign debt instruments of a nation, including bonds and loans. | Applies mainly to bondholders and creditors in a specific tranche of debt. |

| Objective | Reduce total debt burden, extend maturities, or lower interest rates to restore debt sustainability. | Ensure equitable treatment among creditors, preventing preferential payments. |

| Legal Framework | Involves international law, bilateral agreements, IMF guidelines, and domestic law. | Governed by pari passu clause in bond covenants; enforced through courts. |

| Creditor Impact | May involve haircuts, reduced recovery, or deferred payments. | Creditors receive proportional repayments without priority. |

| Complexity | Highly complex, involves negotiations with multiple stakeholders including governments and multilateral institutions. | Less complex but can lead to legal disputes over payment priority. |

| Examples | Argentine debt restructuring (2001-2005), Greek debt restructuring (2012). | Cases involving disputes over pari passu clause enforcement, e.g., Argentina's bond litigation. |

| Outcome | Potential restoration of fiscal stability and access to capital markets. | Ensures fair treatment but may not reduce debt burden. |

Which is better?

Sovereign debt restructuring often provides a comprehensive approach by renegotiating terms with all creditors, enhancing a country's ability to restore fiscal stability and economic growth. Pari passu restructuring treats all creditors equally, ensuring fairness but potentially limiting flexibility in adjusting specific debt obligations. Selecting the better option depends on the debt composition, creditor relations, and long-term economic objectives of the sovereign entity.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's external debt to restore debt sustainability and prevent default. Pari passu restructuring ensures that all creditors are treated equally and proportionally during the restructuring process, preventing any creditor from gaining preferential treatment. This connection guarantees equitable debt relief distribution, promoting creditor confidence and helping stabilize a nation's financial stability.

Key Terms

Seniority

Pari passu restructuring ensures that creditors of the same seniority class receive equal treatment in sovereign debt workouts, preventing any junior creditor from being unfairly prioritized. Sovereign debt restructuring often involves differentiating between senior and subordinated debt by establishing strict repayment hierarchies based on contractual seniority provisions. Explore detailed frameworks and case studies of pari passu clauses and seniority-based sovereign debt restructurings to understand their implications for creditor negotiations.

Haircut

Pari passu restructuring ensures all creditors receive equal percentage reductions or "haircuts" on their claims, maintaining fairness in debt recovery processes. Sovereign debt restructuring often involves tailored haircuts depending on creditor types, debt instruments, and negotiation leverage, making it more complex and varied. Explore detailed mechanisms and implications of haircuts in these restructuring types to better understand debt resolution strategies.

Collective Action Clause (CAC)

Pari passu restructuring ensures that all creditors are treated equally and paid proportionally, enforcing the principle of equal ranking without preference among creditors. Sovereign debt restructuring often involves activating Collective Action Clauses (CACs), which allow a supermajority of bondholders to agree to restructuring terms that become binding for all, preventing holdouts and enhancing negotiation efficiency. Explore the intricacies of CACs and their pivotal role in sovereign debt workouts for deeper insights into effective debt crisis management.

Source and External Links

The Court of Appeal Judgment in the Adler Restructuring Plan: Pari Passu is Back - A restructuring plan can depart from the pari passu principle when there is a good reason, such as creditors likely being paid in full, and it is acceptable for such plans to impose haircuts while allowing shareholders to retain equity without violating the principle.

The Adler Restructuring Plan: Competing Valuation Evidence - The court sanctioned a restructuring plan under the pari passu principle, emphasizing that a plan might only depart from this fundamental insolvency law principle if there was evidence of a significant shortfall in creditor payments, which was not the case here.

The pari passu clause in sovereign debt instruments (BIS Paper) - The pari passu clause is a standard provision in international debt instruments that aims to ensure equal treatment of creditors, and various contractual mechanisms or "sweeteners" are sometimes included in restructurings to protect or compensate creditors while interpreting this clause.

dowidth.com

dowidth.com