Retail algorithmic trading leverages automated systems to execute high-frequency trades based on complex mathematical models and real-time market data, minimizing human bias and increasing trade efficiency. Swing trading involves holding positions for several days to weeks, relying on technical analysis to capture price momentum and short- to medium-term trends. Explore the key differences and strategies behind retail algorithmic trading and swing trading to optimize your investment approach.

Why it is important

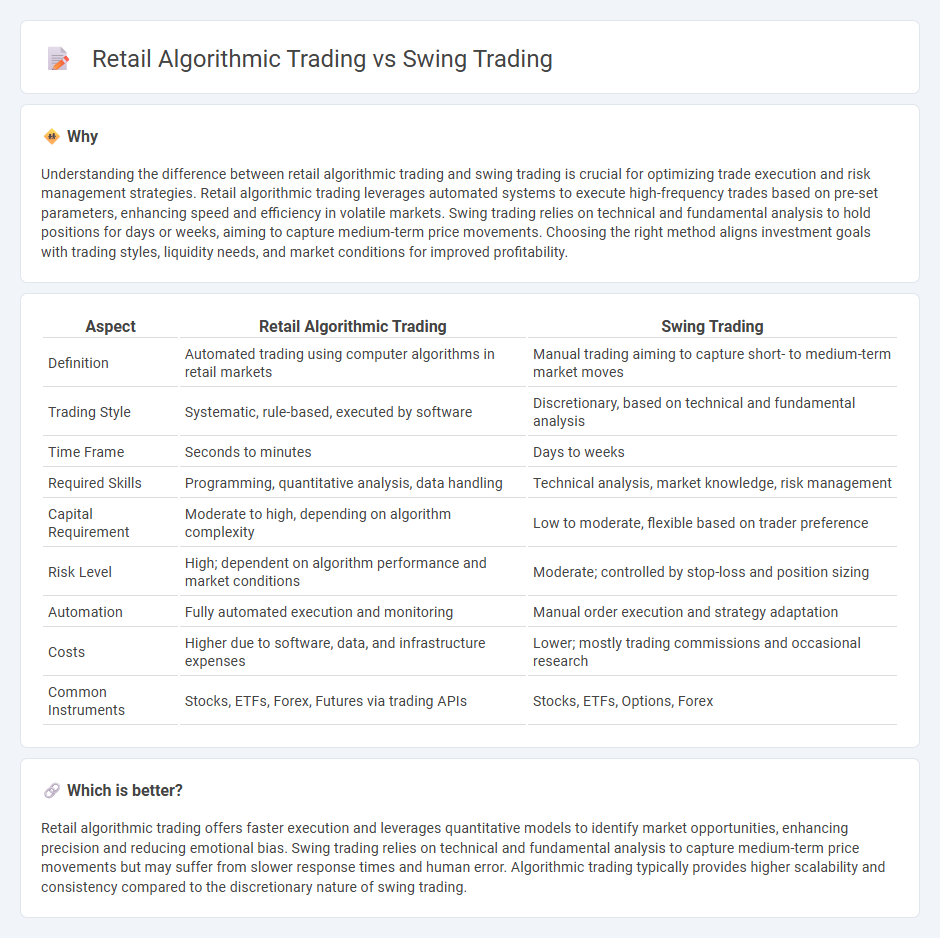

Understanding the difference between retail algorithmic trading and swing trading is crucial for optimizing trade execution and risk management strategies. Retail algorithmic trading leverages automated systems to execute high-frequency trades based on pre-set parameters, enhancing speed and efficiency in volatile markets. Swing trading relies on technical and fundamental analysis to hold positions for days or weeks, aiming to capture medium-term price movements. Choosing the right method aligns investment goals with trading styles, liquidity needs, and market conditions for improved profitability.

Comparison Table

| Aspect | Retail Algorithmic Trading | Swing Trading |

|---|---|---|

| Definition | Automated trading using computer algorithms in retail markets | Manual trading aiming to capture short- to medium-term market moves |

| Trading Style | Systematic, rule-based, executed by software | Discretionary, based on technical and fundamental analysis |

| Time Frame | Seconds to minutes | Days to weeks |

| Required Skills | Programming, quantitative analysis, data handling | Technical analysis, market knowledge, risk management |

| Capital Requirement | Moderate to high, depending on algorithm complexity | Low to moderate, flexible based on trader preference |

| Risk Level | High; dependent on algorithm performance and market conditions | Moderate; controlled by stop-loss and position sizing |

| Automation | Fully automated execution and monitoring | Manual order execution and strategy adaptation |

| Costs | Higher due to software, data, and infrastructure expenses | Lower; mostly trading commissions and occasional research |

| Common Instruments | Stocks, ETFs, Forex, Futures via trading APIs | Stocks, ETFs, Options, Forex |

Which is better?

Retail algorithmic trading offers faster execution and leverages quantitative models to identify market opportunities, enhancing precision and reducing emotional bias. Swing trading relies on technical and fundamental analysis to capture medium-term price movements but may suffer from slower response times and human error. Algorithmic trading typically provides higher scalability and consistency compared to the discretionary nature of swing trading.

Connection

Retail algorithmic trading leverages automated strategies to execute trades based on predefined criteria, enhancing efficiency and minimizing emotional bias. Swing trading, focused on capturing short- to medium-term price movements, benefits from algorithmic models that identify optimal entry and exit points using technical indicators and market patterns. This synergy allows retail traders to systematically implement swing trading strategies with greater precision and consistent risk management.

Key Terms

Swing Trading:

Swing trading involves holding positions for several days to weeks to capitalize on short- to medium-term price movements, relying on technical analysis and market trends for decision-making. It contrasts with retail algorithmic trading, which automates trades based on predefined algorithms designed to exploit market inefficiencies at high frequency. Explore detailed strategies and risk management techniques to optimize your swing trading performance.

Technical Analysis

Swing trading relies heavily on technical analysis by identifying price patterns and key support and resistance levels to capitalize on medium-term market trends. Retail algorithmic trading uses complex technical indicators and quantitative models to execute trades at higher speeds with minimal human intervention. Explore the detailed strategies and tools each method employs to optimize trading performance.

Holding Period

Swing trading typically involves holding positions for several days to weeks, aiming to capitalize on short- to medium-term price movements. Retail algorithmic trading, in contrast, can operate on varied holding periods, from seconds in high-frequency trading to days in systematic swing strategies, driven by predefined algorithms and market signals. Explore more to understand how holding periods influence risk management and strategy performance in both trading styles.

Source and External Links

Swing trading - Wikipedia - Swing trading is a strategy where an asset is held for days to profit from price swings, using technical or fundamental analysis and often following rule-based systems to time entries and exits without needing perfect market timing.

What is swing trading & how does it work? - Saxo Bank - Swing trading aims to profit from price movements by strategies like breakout trading and trend trading, using technical indicators such as moving averages and relative strength index to identify potential entry and exit points.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading appeals to trend-spotters who capitalize on short-term price changes over days or weeks, combining technical and fundamental analysis, and sits between day trading and long-term trend trading in holding period.

dowidth.com

dowidth.com