Tax loss harvesting involves selling investments at a loss to offset capital gains taxes, effectively reducing taxable income. Qualified opportunity zones invest in designated low-income areas, providing tax deferrals and potential exclusions on capital gains. Explore how these strategies can optimize your tax outcomes and investment growth.

Why it is important

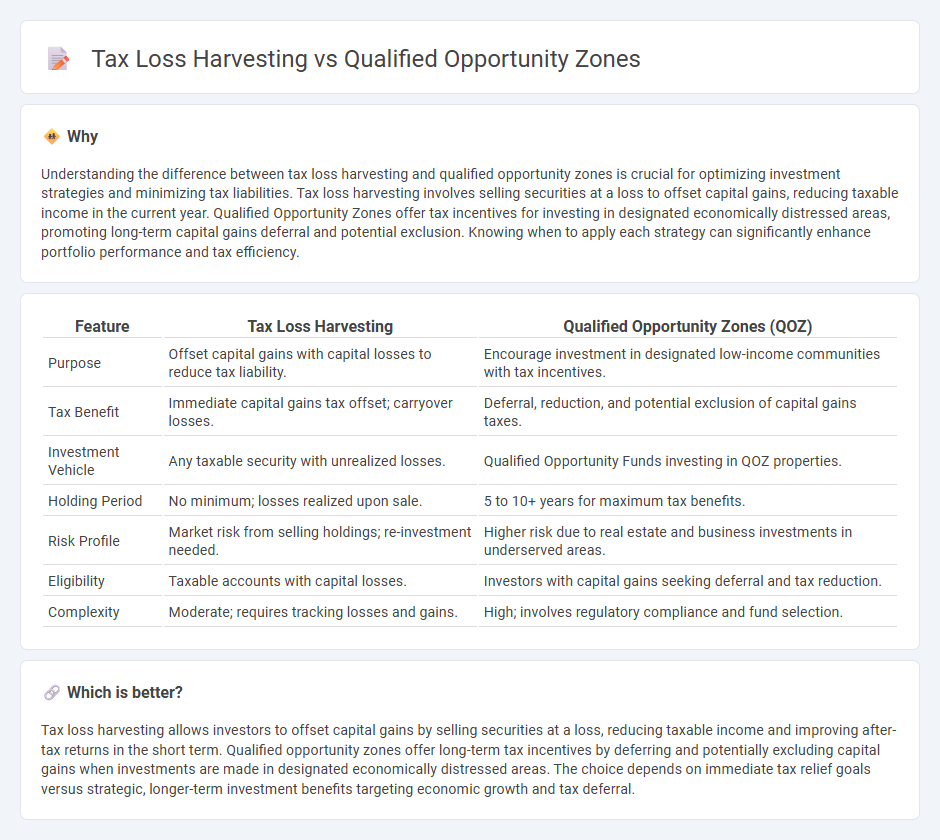

Understanding the difference between tax loss harvesting and qualified opportunity zones is crucial for optimizing investment strategies and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income in the current year. Qualified Opportunity Zones offer tax incentives for investing in designated economically distressed areas, promoting long-term capital gains deferral and potential exclusion. Knowing when to apply each strategy can significantly enhance portfolio performance and tax efficiency.

Comparison Table

| Feature | Tax Loss Harvesting | Qualified Opportunity Zones (QOZ) |

|---|---|---|

| Purpose | Offset capital gains with capital losses to reduce tax liability. | Encourage investment in designated low-income communities with tax incentives. |

| Tax Benefit | Immediate capital gains tax offset; carryover losses. | Deferral, reduction, and potential exclusion of capital gains taxes. |

| Investment Vehicle | Any taxable security with unrealized losses. | Qualified Opportunity Funds investing in QOZ properties. |

| Holding Period | No minimum; losses realized upon sale. | 5 to 10+ years for maximum tax benefits. |

| Risk Profile | Market risk from selling holdings; re-investment needed. | Higher risk due to real estate and business investments in underserved areas. |

| Eligibility | Taxable accounts with capital losses. | Investors with capital gains seeking deferral and tax reduction. |

| Complexity | Moderate; requires tracking losses and gains. | High; involves regulatory compliance and fund selection. |

Which is better?

Tax loss harvesting allows investors to offset capital gains by selling securities at a loss, reducing taxable income and improving after-tax returns in the short term. Qualified opportunity zones offer long-term tax incentives by deferring and potentially excluding capital gains when investments are made in designated economically distressed areas. The choice depends on immediate tax relief goals versus strategic, longer-term investment benefits targeting economic growth and tax deferral.

Connection

Tax loss harvesting enables investors to offset capital gains by realizing losses, which can then be reinvested into Qualified Opportunity Zones (QOZs) to defer or reduce taxes on those gains. Investing in QOZs through Opportunity Funds offers potential tax deferrals and exclusions, enhancing overall portfolio tax efficiency. This strategic combination leverages IRS provisions to maximize after-tax returns while supporting economically distressed communities.

Key Terms

Capital Gains

Qualified Opportunity Zones provide investors with tax incentives by allowing deferral and potential exclusion of capital gains if reinvested in designated areas, promoting long-term economic growth. Tax loss harvesting involves selling investments at a loss to offset capital gains, reducing taxable income in the short term but without the reinvestment benefits linked to Opportunity Zones. Explore more about leveraging these strategies to optimize your capital gains tax liabilities effectively.

Deferral

Qualified Opportunity Zones enable deferral of capital gains taxes by investing in designated low-income areas, allowing investors to postpone tax payments until the earlier of the sale of the investment or December 31, 2026. Tax loss harvesting involves selling securities at a loss to offset realized gains, effectively reducing current taxable income but does not provide deferral on gains unrelated to the harvested losses. Explore how deferral strategies differ in impact and compliance by learning more about each method's unique tax advantages.

Basis

Qualified Opportunity Zones (QOZ) offer tax deferral and potential exclusion of capital gains by reinvesting into designated areas, with basis adjustments made after holding the investment for specific periods, increasing the asset's basis by up to 15% after 7 years and to fair market value after 10 years. Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing the basis of replacement securities and optimizing tax liabilities without specific time or location constraints. Explore how these strategies impact your asset basis and tax outcomes to make informed investment decisions.

Source and External Links

Opportunity zones | Internal Revenue Service - Qualified Opportunity Zones are low-income community census tracts designated by the U.S. Treasury under the Tax Cuts and Jobs Act of 2017 to encourage investment through tax benefits, aiming to spur economic growth and job creation nationwide via Qualified Opportunity Funds.

Opportunity Zones Program - FloridaJobs.org - Opportunity Zones are federally designated areas meant to stimulate economic development and job creation in distressed communities; Florida has 427 such zones, designated through a nomination and review process focusing on poverty and unemployment rates.

Qualified Opportunity Zones - PA Department of Community & Economic Development - Created by the Tax Cuts and Jobs Act of 2017, Qualified Opportunity Zones allow governors to designate up to 25% of eligible census tracts with high poverty or low median incomes to promote long-term private investments by offering federal tax deferrals or exclusions on capital gains.

dowidth.com

dowidth.com