Liquidity staking offers flexible access to digital assets while earning rewards, contrasting with certificates of deposit (CDs) that lock funds for fixed terms with guaranteed interest rates. Both financial instruments serve different investor needs, balancing between liquidity and stable returns. Explore the detailed benefits and risks of liquidity staking versus CDs to optimize your investment strategy.

Why it is important

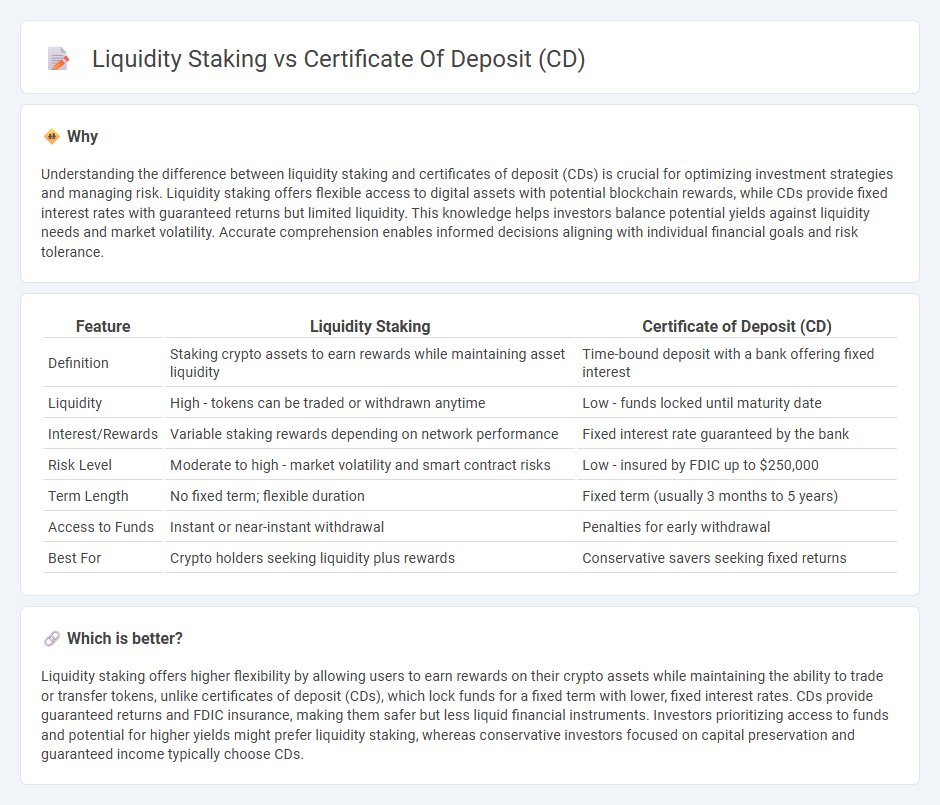

Understanding the difference between liquidity staking and certificates of deposit (CDs) is crucial for optimizing investment strategies and managing risk. Liquidity staking offers flexible access to digital assets with potential blockchain rewards, while CDs provide fixed interest rates with guaranteed returns but limited liquidity. This knowledge helps investors balance potential yields against liquidity needs and market volatility. Accurate comprehension enables informed decisions aligning with individual financial goals and risk tolerance.

Comparison Table

| Feature | Liquidity Staking | Certificate of Deposit (CD) |

|---|---|---|

| Definition | Staking crypto assets to earn rewards while maintaining asset liquidity | Time-bound deposit with a bank offering fixed interest |

| Liquidity | High - tokens can be traded or withdrawn anytime | Low - funds locked until maturity date |

| Interest/Rewards | Variable staking rewards depending on network performance | Fixed interest rate guaranteed by the bank |

| Risk Level | Moderate to high - market volatility and smart contract risks | Low - insured by FDIC up to $250,000 |

| Term Length | No fixed term; flexible duration | Fixed term (usually 3 months to 5 years) |

| Access to Funds | Instant or near-instant withdrawal | Penalties for early withdrawal |

| Best For | Crypto holders seeking liquidity plus rewards | Conservative savers seeking fixed returns |

Which is better?

Liquidity staking offers higher flexibility by allowing users to earn rewards on their crypto assets while maintaining the ability to trade or transfer tokens, unlike certificates of deposit (CDs), which lock funds for a fixed term with lower, fixed interest rates. CDs provide guaranteed returns and FDIC insurance, making them safer but less liquid financial instruments. Investors prioritizing access to funds and potential for higher yields might prefer liquidity staking, whereas conservative investors focused on capital preservation and guaranteed income typically choose CDs.

Connection

Liquidity staking and certificates of deposit (CDs) are connected through their shared goal of earning passive income by locking assets for a fixed period. Liquidity staking involves locking cryptocurrency tokens in a decentralized finance (DeFi) protocol to earn staking rewards while maintaining liquidity, whereas CDs require locking fiat money in a bank for a set term to earn interest. Both financial instruments optimize capital efficiency by balancing asset immobilization with consistent yield generation.

Key Terms

Fixed Interest Rate

A certificate of deposit (CD) offers a fixed interest rate guaranteed by the financial institution for a specified term, providing predictable returns with minimal risk. Liquidity staking, while potentially offering variable yields through decentralized finance (DeFi) platforms, often lacks the fixed interest rate certainty that CDs provide, exposing investors to market fluctuations. Explore how fixed interest rates impact your investment stability and growth potential in both options.

Early Withdrawal Penalty

Certificate of deposit (CD) typically imposes an early withdrawal penalty based on a fixed number of months' interest, reducing overall returns when funds are accessed prematurely. Liquidity staking usually involves variable penalties, including loss of potential rewards or locked tokens that delay access but offer higher yield potential. Explore detailed penalty structures and compare financial impacts to decide which option aligns with your liquidity needs and investment goals.

Tokenized Yield

Certificate of deposit (CD) offers fixed interest rates and principal protection with low liquidity, typically requiring lock-up periods ranging from months to years, ideal for conservative investors seeking predictable yields. Liquidity staking in tokenized yield platforms provides dynamic returns by staking crypto assets while maintaining liquidity through tradable tokens, enabling portfolio flexibility and potentially higher rewards but with increased market risk. Discover the nuanced benefits and risks of both strategies to optimize your yield generation and asset management.

Source and External Links

certificate of deposit (CD) | Wex - Law.Cornell.Edu - A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period during which it accrues interest, with penalties applying for early withdrawal.

What is a certificate of deposit (CD)? - A CD is a type of savings account offered by banks and credit unions where you agree to keep money deposited for a specified period in exchange for earning interest, with penalties for early withdrawal; CDs are FDIC or NCUA insured up to $250,000.

Certificate of Deposit- Fixed Income Products - CDs pay a fixed interest rate over a set term and are federally insured, making them a safe investment option offering steady returns but with risks such as early withdrawal penalties and possible callable features by issuers.

dowidth.com

dowidth.com