Fractional shares allow investors to buy portions of a whole share, enabling diversification and accessibility in portfolios with limited capital. Scrip dividends offer shareholders the option to receive dividends in additional shares instead of cash, helping companies preserve cash while rewarding investors. Explore the advantages and implications of these financial strategies to enhance your investment approach.

Why it is important

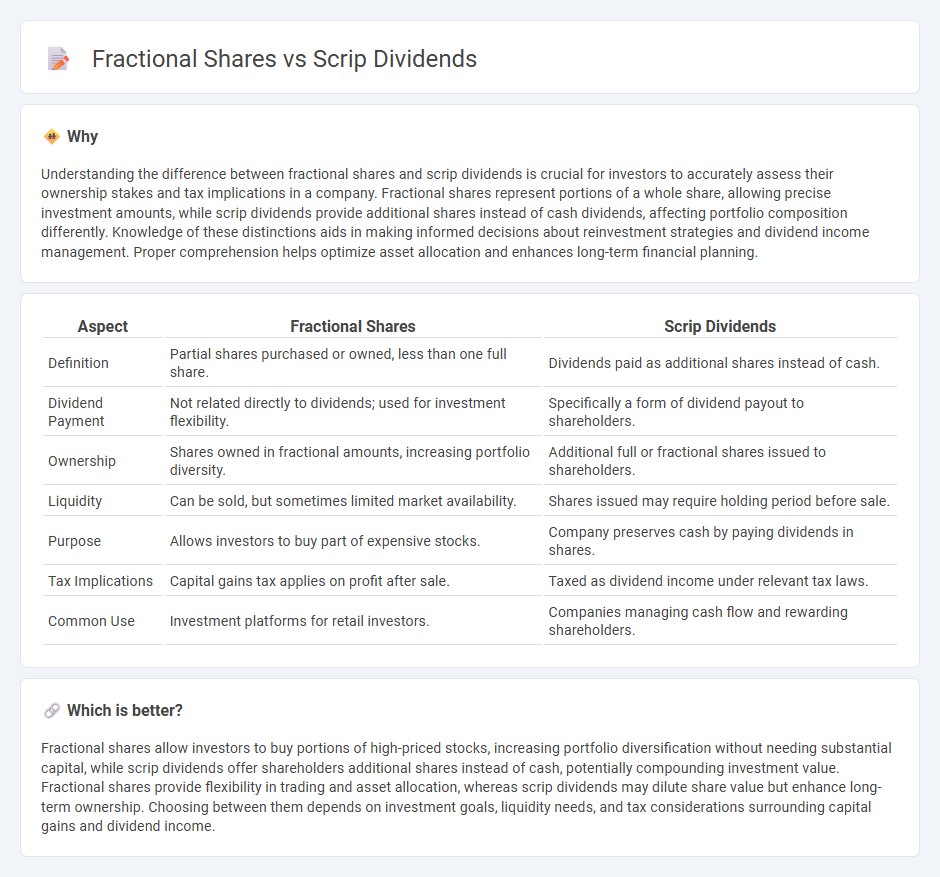

Understanding the difference between fractional shares and scrip dividends is crucial for investors to accurately assess their ownership stakes and tax implications in a company. Fractional shares represent portions of a whole share, allowing precise investment amounts, while scrip dividends provide additional shares instead of cash dividends, affecting portfolio composition differently. Knowledge of these distinctions aids in making informed decisions about reinvestment strategies and dividend income management. Proper comprehension helps optimize asset allocation and enhances long-term financial planning.

Comparison Table

| Aspect | Fractional Shares | Scrip Dividends |

|---|---|---|

| Definition | Partial shares purchased or owned, less than one full share. | Dividends paid as additional shares instead of cash. |

| Dividend Payment | Not related directly to dividends; used for investment flexibility. | Specifically a form of dividend payout to shareholders. |

| Ownership | Shares owned in fractional amounts, increasing portfolio diversity. | Additional full or fractional shares issued to shareholders. |

| Liquidity | Can be sold, but sometimes limited market availability. | Shares issued may require holding period before sale. |

| Purpose | Allows investors to buy part of expensive stocks. | Company preserves cash by paying dividends in shares. |

| Tax Implications | Capital gains tax applies on profit after sale. | Taxed as dividend income under relevant tax laws. |

| Common Use | Investment platforms for retail investors. | Companies managing cash flow and rewarding shareholders. |

Which is better?

Fractional shares allow investors to buy portions of high-priced stocks, increasing portfolio diversification without needing substantial capital, while scrip dividends offer shareholders additional shares instead of cash, potentially compounding investment value. Fractional shares provide flexibility in trading and asset allocation, whereas scrip dividends may dilute share value but enhance long-term ownership. Choosing between them depends on investment goals, liquidity needs, and tax considerations surrounding capital gains and dividend income.

Connection

Fractional shares and scrip dividends are connected through the mechanism of distributing dividends in the form of additional shares rather than cash. When companies issue scrip dividends, shareholders may receive partial shares, resulting in fractional shares that represent proportional ownership without requiring whole-share transactions. This process enhances liquidity and enables investors to reinvest dividends seamlessly, optimizing portfolio growth and ownership efficiency.

Key Terms

Share issuance

Scrip dividends allow companies to issue new shares to shareholders instead of cash payments, effectively increasing the total share count and diluting ownership proportionally. Fractional shares arise when dividend reinvestment plans or stock splits distribute portions of shares that are less than a whole, often requiring special handling or cash adjustments. Explore the benefits and implications of these share issuance methods to optimize your investment strategy.

Dividend reinvestment

Scrip dividends allow shareholders to receive dividends in the form of additional shares instead of cash, enabling full reinvestment without fractional share issues commonly resulting from cash dividends. Fractional shares arise when dividend reinvestment plans (DRIPs) allocate partial shares to match dividend amounts precisely, enhancing portfolio growth through continuous compounding. Explore the detailed benefits and mechanisms of dividend reinvestment strategies for maximizing shareholder value.

Ownership proportion

Scrip dividends allow shareholders to receive additional shares instead of cash payments, preserving their ownership proportion without immediate dilution. Fractional shares arise when dividends or stock splits do not translate neatly into whole shares, potentially altering precise ownership percentages if not managed properly. Explore how each method impacts your equity stake and investment strategy in detail.

Source and External Links

Barclays - What is a Scrip Dividend? - Scrip dividends allow shareholders to choose additional shares instead of cash, helping companies retain cash and potentially offering tax benefits to investors.

National Grid - Scrip Dividend Scheme - The scheme lets shareholders opt for new shares instead of cash dividends, with no stamp duty or commission, and the share value is based on market averages around the ex-dividend date.

Wikipedia - Scrip issue - Unlike mandatory bonus issues, scrip dividends let shareholders choose between cash or new shares, increasing share count without raising company value, and are taxed as income not capital gains.

dowidth.com

dowidth.com