Direct indexing offers personalized portfolio customization by owning individual securities, enabling tax-loss harvesting and cost efficiency compared to traditional hedge funds, which pool capital to pursue aggressive, often opaque investment strategies. Hedge funds typically demand higher fees and impose lock-up periods, whereas direct indexing provides greater transparency and flexibility for investors seeking tailored exposure to specific market segments. Explore the distinct advantages and considerations of direct indexing versus hedge funds for informed investment decisions.

Why it is important

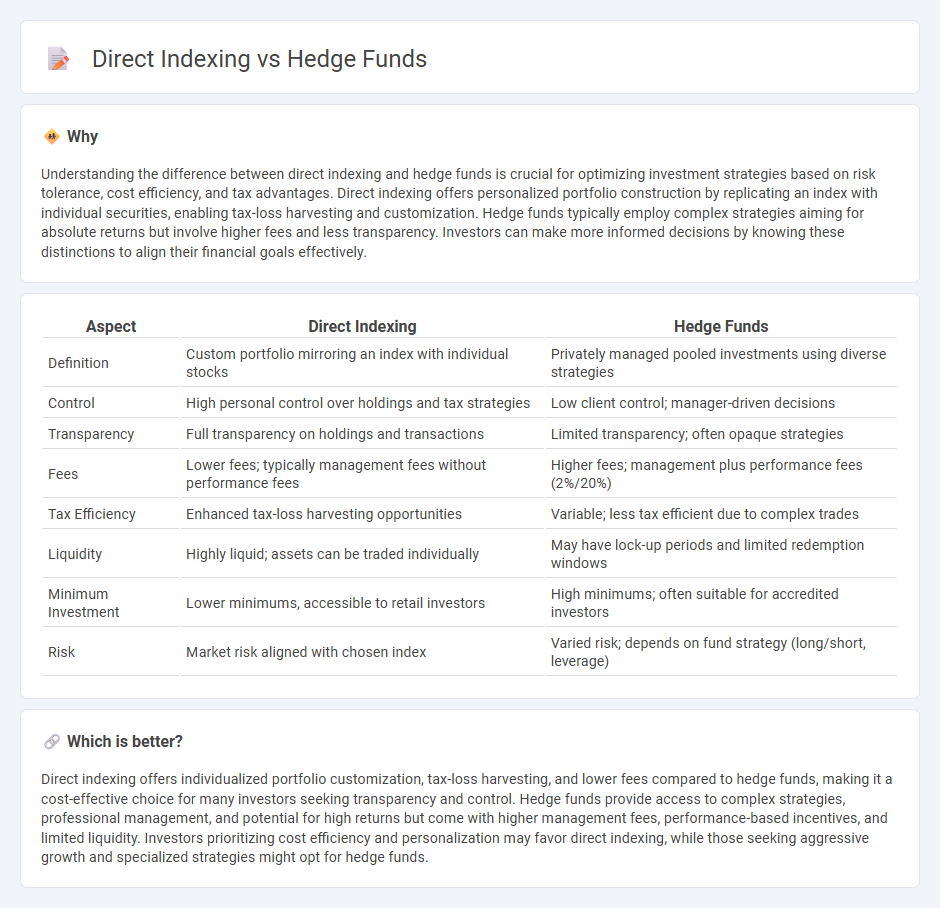

Understanding the difference between direct indexing and hedge funds is crucial for optimizing investment strategies based on risk tolerance, cost efficiency, and tax advantages. Direct indexing offers personalized portfolio construction by replicating an index with individual securities, enabling tax-loss harvesting and customization. Hedge funds typically employ complex strategies aiming for absolute returns but involve higher fees and less transparency. Investors can make more informed decisions by knowing these distinctions to align their financial goals effectively.

Comparison Table

| Aspect | Direct Indexing | Hedge Funds |

|---|---|---|

| Definition | Custom portfolio mirroring an index with individual stocks | Privately managed pooled investments using diverse strategies |

| Control | High personal control over holdings and tax strategies | Low client control; manager-driven decisions |

| Transparency | Full transparency on holdings and transactions | Limited transparency; often opaque strategies |

| Fees | Lower fees; typically management fees without performance fees | Higher fees; management plus performance fees (2%/20%) |

| Tax Efficiency | Enhanced tax-loss harvesting opportunities | Variable; less tax efficient due to complex trades |

| Liquidity | Highly liquid; assets can be traded individually | May have lock-up periods and limited redemption windows |

| Minimum Investment | Lower minimums, accessible to retail investors | High minimums; often suitable for accredited investors |

| Risk | Market risk aligned with chosen index | Varied risk; depends on fund strategy (long/short, leverage) |

Which is better?

Direct indexing offers individualized portfolio customization, tax-loss harvesting, and lower fees compared to hedge funds, making it a cost-effective choice for many investors seeking transparency and control. Hedge funds provide access to complex strategies, professional management, and potential for high returns but come with higher management fees, performance-based incentives, and limited liquidity. Investors prioritizing cost efficiency and personalization may favor direct indexing, while those seeking aggressive growth and specialized strategies might opt for hedge funds.

Connection

Direct indexing allows investors to replicate hedge fund strategies by selectively owning individual securities rather than mutual funds or ETFs, enabling tax-loss harvesting and customized exposure. Hedge funds often employ direct indexing principles to gain tactical advantages through portfolio optimization and risk management tailored to specific market conditions. This connection enhances investment flexibility and potential alpha generation while maintaining cost efficiency compared to traditional hedge fund investments.

Key Terms

Active Management (Hedge Funds)

Hedge funds employ advanced active management strategies, leveraging proprietary algorithms and extensive market research to achieve alpha through diversified, often high-risk investments. Direct indexing enables investors to actively manage their portfolios by customizing index exposure and tax-loss harvesting, offering transparency and cost efficiency. Explore the distinct benefits and strategies of active management in hedge funds versus direct indexing to optimize your investment approach.

Customization (Direct Indexing)

Direct indexing offers superior customization by allowing investors to tailor individual stock selections based on personal values, tax considerations, and specific financial goals, unlike hedge funds that typically follow predefined strategies. This bespoke approach enables precise portfolio alignment with investor preferences, including ESG criteria and tax-loss harvesting opportunities. Explore how customization through direct indexing can enhance your investment strategy today.

Fees/Cost Structure

Hedge funds typically charge a management fee of 2% of assets under management plus 20% of profits, creating a high cost structure that can erode returns over time. Direct indexing generally involves lower fees, often limited to brokerage commissions and platform charges, making it more cost-effective for investors aiming to customize portfolios and minimize tax liabilities. Explore how these differing fee structures impact investment performance and suitability.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that pools capital from institutional and accredited investors to invest in liquid, publicly traded assets using diverse, often aggressive strategies aimed at achieving absolute returns rather than relative ones.

Hedge Funds - Hedge funds are private, unregistered investment funds that use flexible investment strategies to seek positive returns, typically catering to sophisticated individual and institutional investors and are less regulated than mutual funds or ETFs.

Hedge fund - Structured as offshore corporations or partnerships, hedge funds employ complex trading and risk management techniques, often supported by external service providers such as prime brokers and administrators who handle trade clearance, leverage, asset valuation, and accounting.

dowidth.com

dowidth.com