Tokenization of real-world assets revolutionizes finance by converting physical assets into digital tokens, offering increased liquidity, transparency, and fractional ownership compared to traditional mutual funds. Unlike mutual funds, which pool investor money to buy diversified portfolios managed by professionals, tokenization enables direct investment and faster settlement with reduced intermediaries. Explore how tokenization is reshaping asset management beyond conventional mutual fund frameworks.

Why it is important

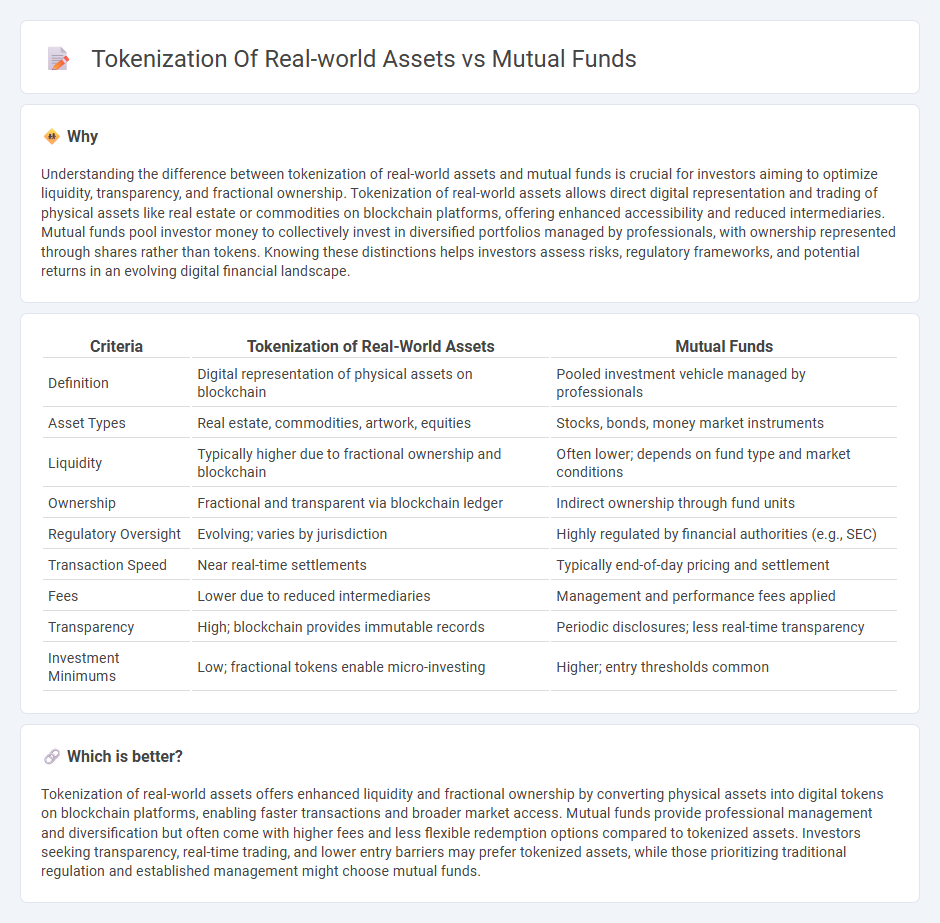

Understanding the difference between tokenization of real-world assets and mutual funds is crucial for investors aiming to optimize liquidity, transparency, and fractional ownership. Tokenization of real-world assets allows direct digital representation and trading of physical assets like real estate or commodities on blockchain platforms, offering enhanced accessibility and reduced intermediaries. Mutual funds pool investor money to collectively invest in diversified portfolios managed by professionals, with ownership represented through shares rather than tokens. Knowing these distinctions helps investors assess risks, regulatory frameworks, and potential returns in an evolving digital financial landscape.

Comparison Table

| Criteria | Tokenization of Real-World Assets | Mutual Funds |

|---|---|---|

| Definition | Digital representation of physical assets on blockchain | Pooled investment vehicle managed by professionals |

| Asset Types | Real estate, commodities, artwork, equities | Stocks, bonds, money market instruments |

| Liquidity | Typically higher due to fractional ownership and blockchain | Often lower; depends on fund type and market conditions |

| Ownership | Fractional and transparent via blockchain ledger | Indirect ownership through fund units |

| Regulatory Oversight | Evolving; varies by jurisdiction | Highly regulated by financial authorities (e.g., SEC) |

| Transaction Speed | Near real-time settlements | Typically end-of-day pricing and settlement |

| Fees | Lower due to reduced intermediaries | Management and performance fees applied |

| Transparency | High; blockchain provides immutable records | Periodic disclosures; less real-time transparency |

| Investment Minimums | Low; fractional tokens enable micro-investing | Higher; entry thresholds common |

Which is better?

Tokenization of real-world assets offers enhanced liquidity and fractional ownership by converting physical assets into digital tokens on blockchain platforms, enabling faster transactions and broader market access. Mutual funds provide professional management and diversification but often come with higher fees and less flexible redemption options compared to tokenized assets. Investors seeking transparency, real-time trading, and lower entry barriers may prefer tokenized assets, while those prioritizing traditional regulation and established management might choose mutual funds.

Connection

Tokenization of real-world assets transforms physical investments like real estate or commodities into digital tokens, enhancing liquidity and accessibility. Mutual funds can integrate tokenized assets to diversify portfolios and enable fractional ownership, simplifying investment entry for smaller investors. This connection facilitates transparent, efficient trading and broadens participation in traditional financial markets.

Key Terms

Net Asset Value (NAV)

Mutual funds calculate Net Asset Value (NAV) daily based on the total value of underlying securities divided by outstanding shares, providing a clear measure for investor transactions. Tokenization of real-world assets leverages blockchain technology to create digital tokens representing fractions of assets, enabling more frequent and transparent NAV updates with real-time market data. Explore how innovations in NAV calculation impact investment strategies by learning more about these evolving financial instruments.

Liquidity

Mutual funds offer liquidity through regular redemption opportunities on specified dates, while tokenization of real-world assets provides potentially continuous liquidity by enabling fractional ownership and peer-to-peer trading on blockchain platforms. Tokenized assets bypass traditional intermediaries, lowering transaction costs and increasing market accessibility. Explore further to understand how these liquidity mechanisms impact investment strategy and asset management.

Fractional Ownership

Mutual funds offer investors pooled ownership in a diversified portfolio of assets managed by financial professionals, providing fractional ownership through shares but often with limited liquidity and higher fees. Tokenization of real-world assets utilizes blockchain technology to create digital tokens that represent fractional ownership of tangible assets like real estate or commodities, enabling increased transparency, faster settlement, and enhanced liquidity. Explore how the shift toward blockchain-based fractional ownership reshapes investment opportunities and democratizes access to valuable assets.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered open-end investment company pooling money from many investors to buy diversified assets like stocks and bonds, managed professionally, offering liquidity and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool investor money to purchase securities, come in types like money market, bond, equity, or hybrid funds, and may be actively or passively managed; they offer diversification, liquidity, professional management, but involve fees.

Understanding mutual funds - Charles Schwab - Mutual funds pool money to invest in stocks and bonds, providing diversification, professional management, lower transaction costs, and convenience for investors seeking varied investment styles.

dowidth.com

dowidth.com