Liability-driven investing (LDI) focuses on matching assets to specific future liabilities, minimizing risks associated with interest rates and inflation to ensure pension or insurance obligations are met. Absolute return investing aims to generate positive returns regardless of market conditions, utilizing diverse strategies to outperform benchmarks and preserve capital. Explore the differences and benefits of each approach to optimize your investment strategy.

Why it is important

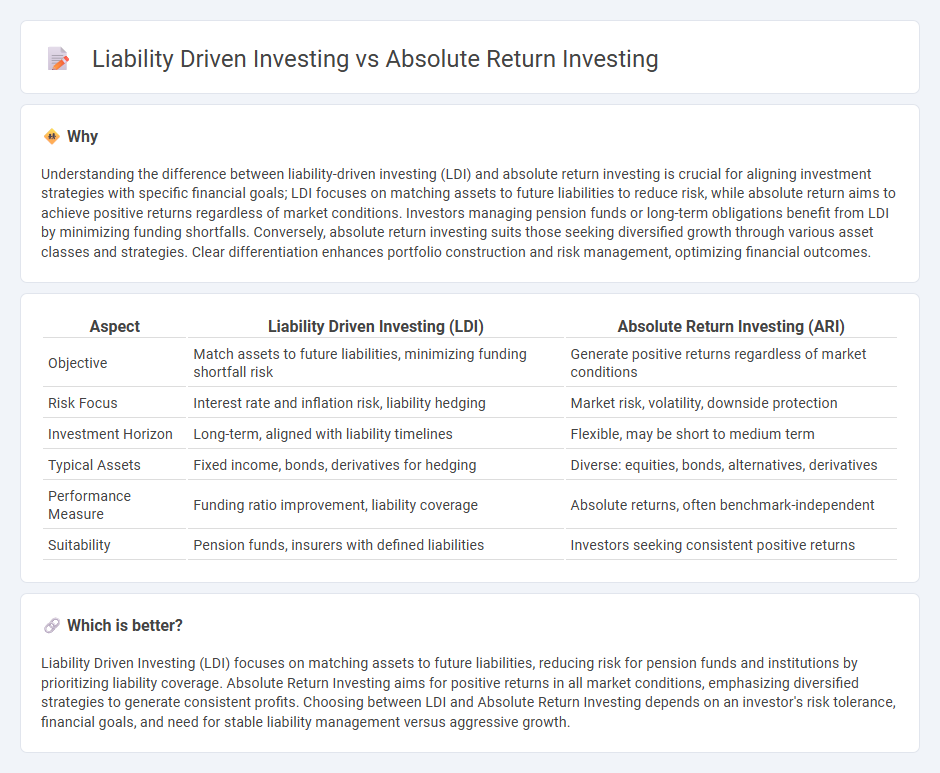

Understanding the difference between liability-driven investing (LDI) and absolute return investing is crucial for aligning investment strategies with specific financial goals; LDI focuses on matching assets to future liabilities to reduce risk, while absolute return aims to achieve positive returns regardless of market conditions. Investors managing pension funds or long-term obligations benefit from LDI by minimizing funding shortfalls. Conversely, absolute return investing suits those seeking diversified growth through various asset classes and strategies. Clear differentiation enhances portfolio construction and risk management, optimizing financial outcomes.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Absolute Return Investing (ARI) |

|---|---|---|

| Objective | Match assets to future liabilities, minimizing funding shortfall risk | Generate positive returns regardless of market conditions |

| Risk Focus | Interest rate and inflation risk, liability hedging | Market risk, volatility, downside protection |

| Investment Horizon | Long-term, aligned with liability timelines | Flexible, may be short to medium term |

| Typical Assets | Fixed income, bonds, derivatives for hedging | Diverse: equities, bonds, alternatives, derivatives |

| Performance Measure | Funding ratio improvement, liability coverage | Absolute returns, often benchmark-independent |

| Suitability | Pension funds, insurers with defined liabilities | Investors seeking consistent positive returns |

Which is better?

Liability Driven Investing (LDI) focuses on matching assets to future liabilities, reducing risk for pension funds and institutions by prioritizing liability coverage. Absolute Return Investing aims for positive returns in all market conditions, emphasizing diversified strategies to generate consistent profits. Choosing between LDI and Absolute Return Investing depends on an investor's risk tolerance, financial goals, and need for stable liability management versus aggressive growth.

Connection

Liability driven investing (LDI) and absolute return investing both focus on managing financial risks and achieving stable returns. LDI aligns investment strategies with future liabilities, primarily used by pension funds to ensure obligations are met, while absolute return investing seeks positive returns regardless of market conditions. Their connection lies in balancing risk and return to secure predictable financial outcomes and protect portfolios from market volatility.

Key Terms

Absolute Return Investing:

Absolute return investing aims to achieve positive returns regardless of market conditions by utilizing diverse strategies such as long/short equities, global macro, and arbitrage. It emphasizes capital preservation and risk-adjusted performance through active management and flexible asset allocation. Explore the principles and advantages of absolute return investing to optimize your portfolio's resilience.

Alpha

Absolute return investing targets positive returns regardless of market conditions by actively seeking alpha through diverse strategies such as long/short equity, global macro, and arbitrage. Liability-driven investing (LDI) focuses on matching asset performance with specific future obligations, prioritizing risk mitigation over alpha generation. Explore how integrating alpha-driven tactics within LDI frameworks can optimize portfolio outcomes.

Benchmark

Absolute return investing targets positive returns regardless of market conditions, focusing on strategies that generate alpha without relying on traditional benchmarks. Liability-driven investing (LDI) centers on matching asset returns to specific liability profiles, emphasizing risk control by aligning investments with the present value and duration of liabilities, often linked to pension obligations. Explore further to understand how benchmark selection impacts portfolio construction and risk management in each approach.

Source and External Links

Absolute Return - Overview, How To Calculate, Features - Absolute return investing aims to generate positive gains regardless of market conditions by using diversified strategies to spread risk and reduce volatility, measuring returns as the absolute gain or loss over a specific period.

Absolute return - Wikipedia - Absolute return investing focuses on achieving positive returns independent of market direction, often through hedge fund strategies including short selling and leverage, and differs from relative return strategies benchmarked against indices.

Absolute Return Portfolio-APFC - The Alaska Permanent Fund's Absolute Return strategy targets returns outperforming inflation plus 5% through investments in hedge fund managers with low market correlation, emphasizing downside protection and diversified investment approaches.

dowidth.com

dowidth.com