Payment for order flow involves brokers receiving compensation from market makers for directing client orders to them, potentially impacting trade execution quality. Auction markets, such as stock exchanges, match buy and sell orders transparently through a competitive bidding process, often prioritizing price and speed. Explore the key differences and implications of these trading mechanisms to better understand their effects on market efficiency and investor outcomes.

Why it is important

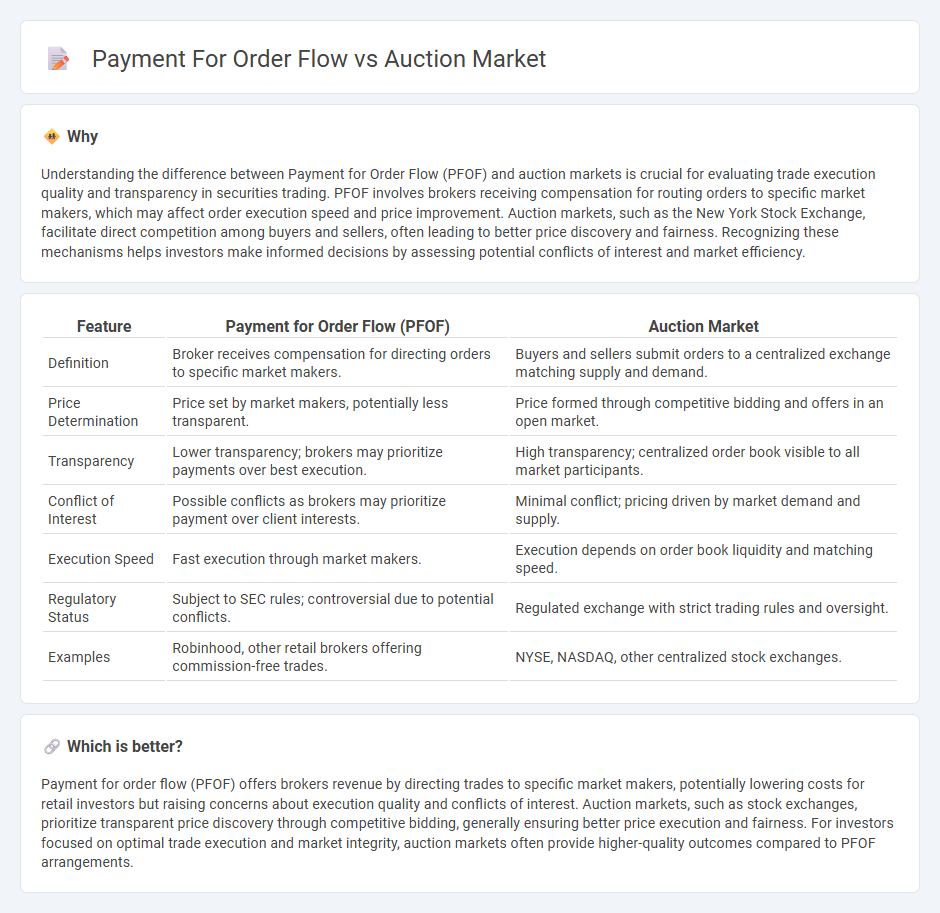

Understanding the difference between Payment for Order Flow (PFOF) and auction markets is crucial for evaluating trade execution quality and transparency in securities trading. PFOF involves brokers receiving compensation for routing orders to specific market makers, which may affect order execution speed and price improvement. Auction markets, such as the New York Stock Exchange, facilitate direct competition among buyers and sellers, often leading to better price discovery and fairness. Recognizing these mechanisms helps investors make informed decisions by assessing potential conflicts of interest and market efficiency.

Comparison Table

| Feature | Payment for Order Flow (PFOF) | Auction Market |

|---|---|---|

| Definition | Broker receives compensation for directing orders to specific market makers. | Buyers and sellers submit orders to a centralized exchange matching supply and demand. |

| Price Determination | Price set by market makers, potentially less transparent. | Price formed through competitive bidding and offers in an open market. |

| Transparency | Lower transparency; brokers may prioritize payments over best execution. | High transparency; centralized order book visible to all market participants. |

| Conflict of Interest | Possible conflicts as brokers may prioritize payment over client interests. | Minimal conflict; pricing driven by market demand and supply. |

| Execution Speed | Fast execution through market makers. | Execution depends on order book liquidity and matching speed. |

| Regulatory Status | Subject to SEC rules; controversial due to potential conflicts. | Regulated exchange with strict trading rules and oversight. |

| Examples | Robinhood, other retail brokers offering commission-free trades. | NYSE, NASDAQ, other centralized stock exchanges. |

Which is better?

Payment for order flow (PFOF) offers brokers revenue by directing trades to specific market makers, potentially lowering costs for retail investors but raising concerns about execution quality and conflicts of interest. Auction markets, such as stock exchanges, prioritize transparent price discovery through competitive bidding, generally ensuring better price execution and fairness. For investors focused on optimal trade execution and market integrity, auction markets often provide higher-quality outcomes compared to PFOF arrangements.

Connection

Payment for order flow incentivizes brokers to route retail trades to specific market makers who execute orders in auction markets, ensuring liquidity and price transparency. Auction markets aggregate buy and sell orders, determining the best possible prices through matching mechanisms that benefit from the increased order volume driven by payment for order flow. This connection enhances market efficiency but raises concerns about potential conflicts of interest in trade execution quality.

Key Terms

Price Discovery

Auction markets enhance price discovery by aggregating multiple buy and sell orders, enabling transparent and competitive price formation based on supply and demand dynamics. Payment for order flow can obscure true market prices by directing orders to specific market makers, potentially impacting the fairness and efficiency of price discovery. Explore the mechanisms behind these trading models to understand their effects on market transparency and investor outcomes.

Order Routing

Order routing plays a crucial role in both auction markets and payment for order flow (PFOF) systems, determining how and where trade orders are executed to achieve the best possible prices. In auction markets, orders are routed to centralized exchanges where price discovery occurs through competitive bidding, while PFOF directs orders to third-party market makers who pay brokers for order flow, potentially impacting execution quality. Explore how these differences influence trading strategies and execution efficiency for a deeper understanding.

Liquidity

Auction markets aggregate buy and sell orders, facilitating price discovery through transparent competition, which enhances liquidity by matching multiple participants simultaneously. Payment for order flow incentivizes brokers to direct orders to specific market makers, potentially impacting liquidity quality by concentrating order flow but providing faster execution and tighter spreads. Explore how these mechanisms influence market liquidity and trading efficiency in detail.

Source and External Links

Auction markets: What is it, types, Importance, Example, FAQ | POEMS - An auction market is where buyers and sellers compete against each other by submitting bids and offers for trading assets, with prices determined dynamically based on these bids without pre-setting, applicable to financial instruments like stocks, bonds, and commodities.

AUCTION MARKET: Easy explanation. - YouTube - The auction market process matches buyers' highest bid prices with sellers' lowest ask prices, completing transactions when bids and asks align, exemplified by exchanges like the NYSE and CME that operate auction-based systems.

Auction markets - Ch2sec5 - Auction markets often have a physical location such as Wall Street, where equity shares of large firms trade through an organized auction mechanism, with major examples including the NYSE, AMEX, Tokyo Stock Exchange, and London Stock Exchange.

dowidth.com

dowidth.com