ESG integration involves incorporating environmental, social, and governance factors into financial analysis to enhance investment decisions, promoting sustainable and responsible growth. Negative screening excludes companies or sectors based on specific ethical criteria, such as tobacco or fossil fuels, to align portfolios with socially responsible values. Explore more to understand the benefits and challenges of each approach in sustainable finance.

Why it is important

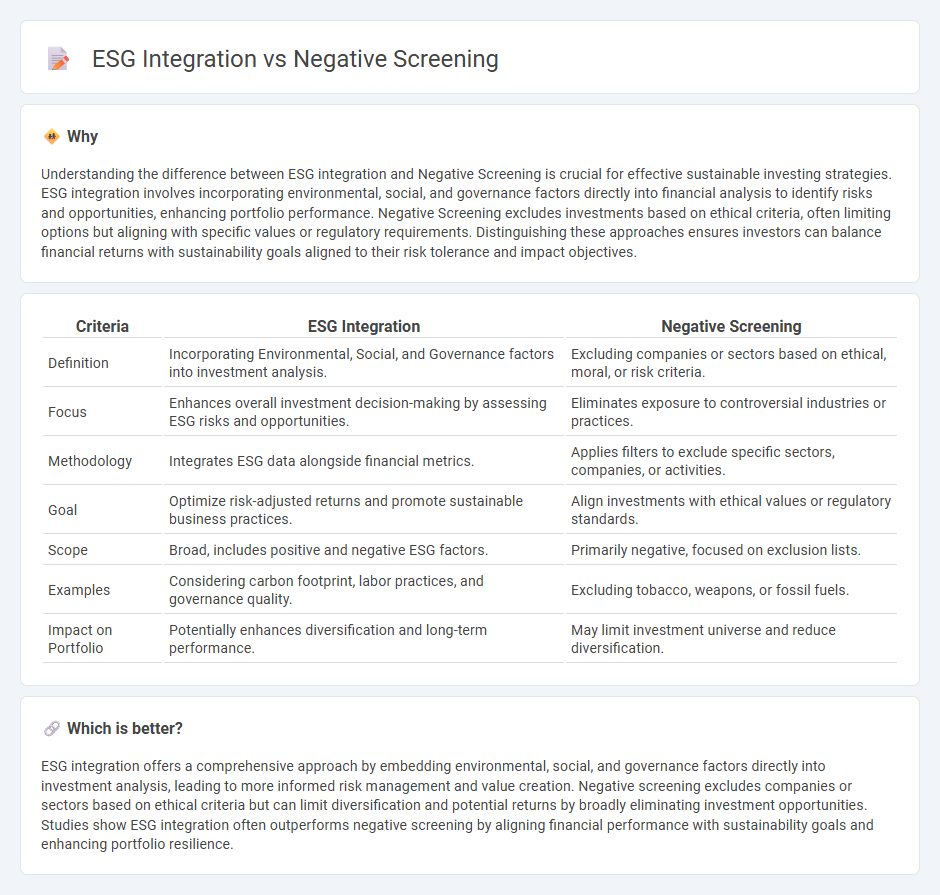

Understanding the difference between ESG integration and Negative Screening is crucial for effective sustainable investing strategies. ESG integration involves incorporating environmental, social, and governance factors directly into financial analysis to identify risks and opportunities, enhancing portfolio performance. Negative Screening excludes investments based on ethical criteria, often limiting options but aligning with specific values or regulatory requirements. Distinguishing these approaches ensures investors can balance financial returns with sustainability goals aligned to their risk tolerance and impact objectives.

Comparison Table

| Criteria | ESG Integration | Negative Screening |

|---|---|---|

| Definition | Incorporating Environmental, Social, and Governance factors into investment analysis. | Excluding companies or sectors based on ethical, moral, or risk criteria. |

| Focus | Enhances overall investment decision-making by assessing ESG risks and opportunities. | Eliminates exposure to controversial industries or practices. |

| Methodology | Integrates ESG data alongside financial metrics. | Applies filters to exclude specific sectors, companies, or activities. |

| Goal | Optimize risk-adjusted returns and promote sustainable business practices. | Align investments with ethical values or regulatory standards. |

| Scope | Broad, includes positive and negative ESG factors. | Primarily negative, focused on exclusion lists. |

| Examples | Considering carbon footprint, labor practices, and governance quality. | Excluding tobacco, weapons, or fossil fuels. |

| Impact on Portfolio | Potentially enhances diversification and long-term performance. | May limit investment universe and reduce diversification. |

Which is better?

ESG integration offers a comprehensive approach by embedding environmental, social, and governance factors directly into investment analysis, leading to more informed risk management and value creation. Negative screening excludes companies or sectors based on ethical criteria but can limit diversification and potential returns by broadly eliminating investment opportunities. Studies show ESG integration often outperforms negative screening by aligning financial performance with sustainability goals and enhancing portfolio resilience.

Connection

ESG integration involves incorporating environmental, social, and governance factors into investment analysis to identify risks and opportunities, while negative screening excludes companies or sectors that do not meet specific ethical or sustainability criteria. Both strategies aim to enhance portfolio sustainability by aligning investments with responsible practices and mitigating potential financial risks associated with non-compliance or poor ESG performance. Combining ESG integration and negative screening supports more informed decision-making, promoting long-term value creation and sustainable growth in the financial sector.

Key Terms

Exclusion Criteria

Negative screening employs exclusion criteria to omit companies involved in unethical or high-risk industries such as tobacco, fossil fuels, or weapons manufacturing. ESG integration evaluates environmental, social, and governance factors proactively within investment analysis to enhance risk management and identify sustainable opportunities. Discover how applying exclusion criteria through negative screening compares to ESG integration in shaping responsible investment strategies.

Materiality

Negative screening excludes companies or sectors based on specific ethical, environmental, or social criteria, often without weighting their overall impact on financial performance. ESG integration involves systematically incorporating material environmental, social, and governance factors into investment analysis and decision-making to enhance risk-adjusted returns. Discover how focusing on materiality can improve sustainable investment strategies and portfolio outcomes.

Risk Assessment

Negative screening excludes companies based on specific ESG criteria to minimize exposure to ethical or sustainability risks, effectively filtering out high-risk investments. ESG integration incorporates comprehensive Environmental, Social, and Governance factors into financial analysis, providing a holistic risk assessment to enhance long-term portfolio resilience. Explore how these approaches differ to optimize risk management in sustainable investing.

Source and External Links

Positive and Negative Investment Screening Explained - Negative screening, or exclusionary screening, removes investments in companies that conflict with the investor's values, such as those involved in "sin industries," poor environmental practices, or countries with poor human rights records.

Does ESG Negative Screening Work? - Negative screening excludes stocks of companies deemed "unsustainable" from an ESG perspective, commonly filtering out sectors like alcohol, tobacco, gambling, and fossil fuels.

Negative screening | Robeco USA - Negative screening identifies and avoids companies that score poorly on ESG factors relative to their peers, focusing on areas like environmental impact, labor relations, and governance issues.

dowidth.com

dowidth.com