Tax loss harvesting strategically offsets capital gains by selling securities at a loss to reduce taxable income, enhancing after-tax returns. Managed accounts offer personalized portfolio management, tailored to investors' goals, risk tolerance, and tax situations for optimal growth and tax efficiency. Explore further to understand how these strategies can maximize your investment benefits.

Why it is important

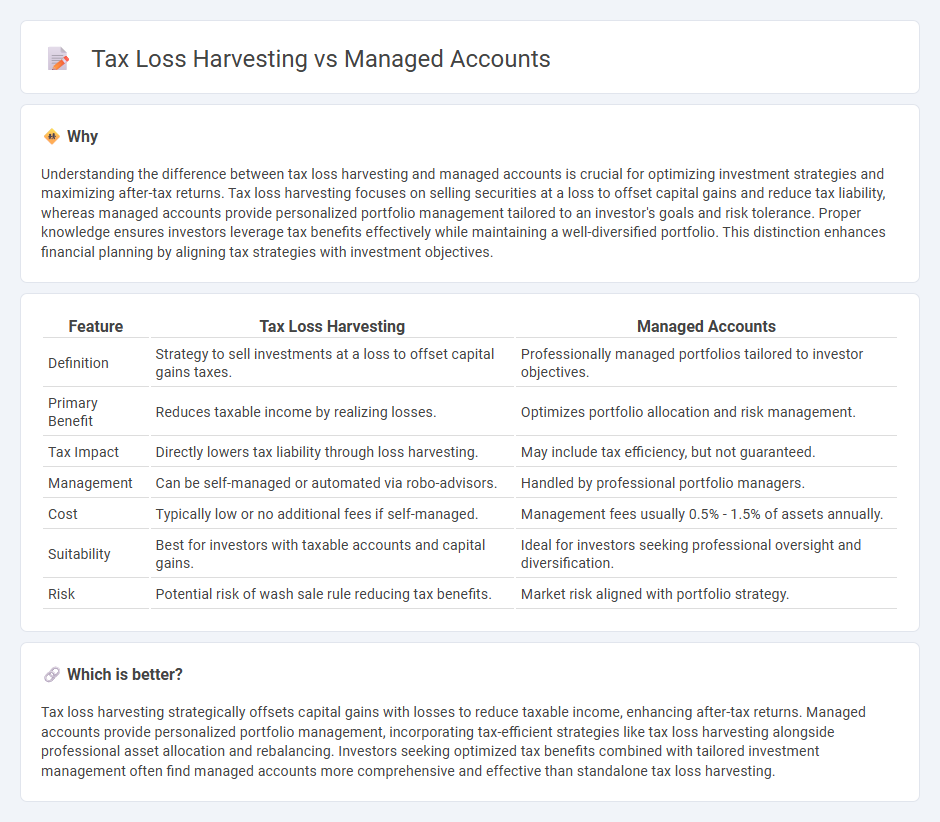

Understanding the difference between tax loss harvesting and managed accounts is crucial for optimizing investment strategies and maximizing after-tax returns. Tax loss harvesting focuses on selling securities at a loss to offset capital gains and reduce tax liability, whereas managed accounts provide personalized portfolio management tailored to an investor's goals and risk tolerance. Proper knowledge ensures investors leverage tax benefits effectively while maintaining a well-diversified portfolio. This distinction enhances financial planning by aligning tax strategies with investment objectives.

Comparison Table

| Feature | Tax Loss Harvesting | Managed Accounts |

|---|---|---|

| Definition | Strategy to sell investments at a loss to offset capital gains taxes. | Professionally managed portfolios tailored to investor objectives. |

| Primary Benefit | Reduces taxable income by realizing losses. | Optimizes portfolio allocation and risk management. |

| Tax Impact | Directly lowers tax liability through loss harvesting. | May include tax efficiency, but not guaranteed. |

| Management | Can be self-managed or automated via robo-advisors. | Handled by professional portfolio managers. |

| Cost | Typically low or no additional fees if self-managed. | Management fees usually 0.5% - 1.5% of assets annually. |

| Suitability | Best for investors with taxable accounts and capital gains. | Ideal for investors seeking professional oversight and diversification. |

| Risk | Potential risk of wash sale rule reducing tax benefits. | Market risk aligned with portfolio strategy. |

Which is better?

Tax loss harvesting strategically offsets capital gains with losses to reduce taxable income, enhancing after-tax returns. Managed accounts provide personalized portfolio management, incorporating tax-efficient strategies like tax loss harvesting alongside professional asset allocation and rebalancing. Investors seeking optimized tax benefits combined with tailored investment management often find managed accounts more comprehensive and effective than standalone tax loss harvesting.

Connection

Tax loss harvesting enhances managed accounts by strategically selling securities at a loss to offset gains, reducing taxable income within the portfolio. Managed accounts utilize this technique to optimize after-tax returns by systematically identifying loss positions without disrupting the overall investment strategy. This integration allows for personalized tax-efficient investing, aligning with clients' financial goals and risk tolerance.

Key Terms

Portfolio Management

Managed accounts offer personalized portfolio management with continuous monitoring and adjustments tailored to an investor's risk tolerance and financial goals. Tax loss harvesting specifically targets the reduction of taxable income by strategically selling securities at a loss to offset gains, enhancing after-tax returns within a managed portfolio. Explore how integrating tax loss harvesting within managed accounts can optimize overall investment performance and tax efficiency.

Tax Efficiency

Managed accounts offer personalized portfolio management tailored to tax efficiency, utilizing strategies like tax loss harvesting to minimize taxable gains. Tax loss harvesting strategically sells underperforming assets to offset capital gains, reducing overall tax liability within managed accounts. Explore how integrating tax-efficient managed accounts can optimize your investment returns and reduce tax burdens.

Customization

Managed accounts offer high levels of customization, allowing investors to tailor portfolios to specific risk tolerances, investment goals, and tax considerations. Tax loss harvesting, often integrated within managed accounts, involves strategically selling securities at a loss to offset capital gains, enhancing tax efficiency without sacrificing personalized investment strategies. Explore how these customizable solutions can optimize your investment performance and tax outcomes.

Source and External Links

What Is a Managed Account? (Advantages and Disadvantages) - A managed account is an investment portfolio overseen by a financial expert who makes autonomous decisions on behalf of the client to grow investments, typically including financial assets, cash, and property titles, offering professional management in exchange for fees and minimum investment requirements.

Managed account - In banking, a managed account is a fee-based investment product primarily for high-net-worth individuals providing access to professional money managers, customization, tax efficiencies, and greater transparency, liquidity, and control compared to other investment products.

Separately Managed Accounts - A separately managed account (SMA) is a portfolio of individual securities managed by a professional firm, offering investors choice, quality, flexibility, transparency, and value through direct ownership of assets and tailored investment strategies.

dowidth.com

dowidth.com