Thematic ETFs focus on specific sectors, trends, or investment themes such as technology, clean energy, or healthcare innovation, offering targeted exposure within global markets. International ETFs provide diversified access to broad geographic regions or countries, enabling investors to tap into global economic growth and currency variations. Explore detailed comparisons to determine which ETF type aligns best with your investment goals and risk tolerance.

Why it is important

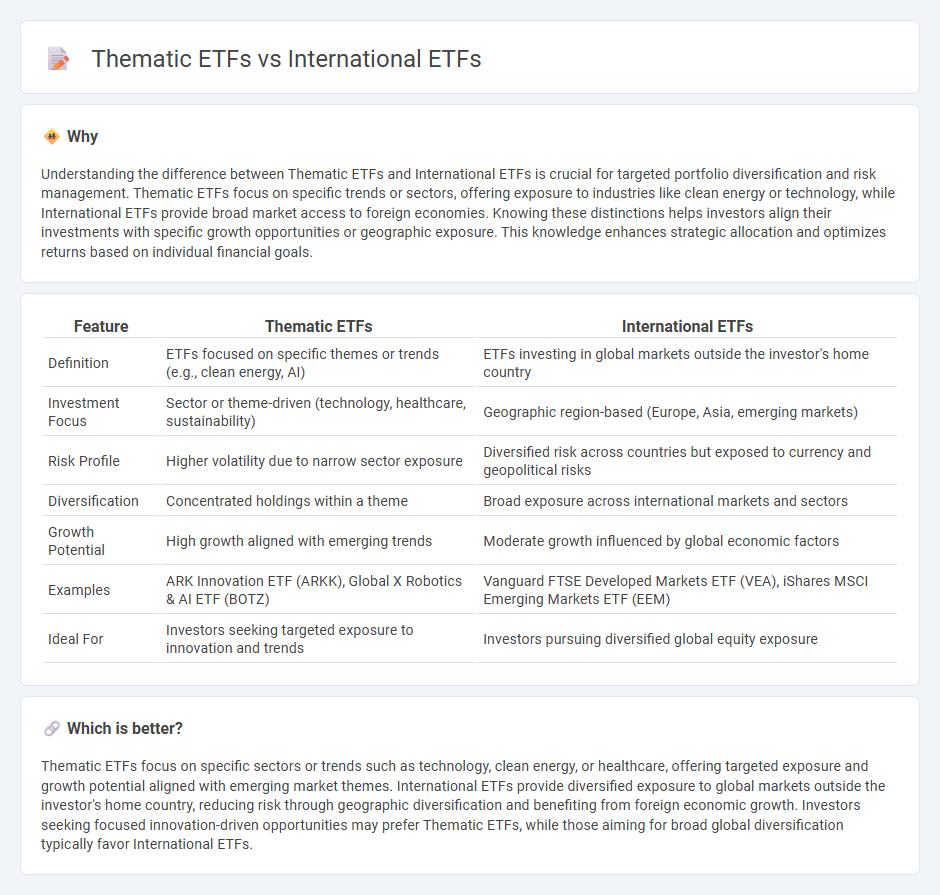

Understanding the difference between Thematic ETFs and International ETFs is crucial for targeted portfolio diversification and risk management. Thematic ETFs focus on specific trends or sectors, offering exposure to industries like clean energy or technology, while International ETFs provide broad market access to foreign economies. Knowing these distinctions helps investors align their investments with specific growth opportunities or geographic exposure. This knowledge enhances strategic allocation and optimizes returns based on individual financial goals.

Comparison Table

| Feature | Thematic ETFs | International ETFs |

|---|---|---|

| Definition | ETFs focused on specific themes or trends (e.g., clean energy, AI) | ETFs investing in global markets outside the investor's home country |

| Investment Focus | Sector or theme-driven (technology, healthcare, sustainability) | Geographic region-based (Europe, Asia, emerging markets) |

| Risk Profile | Higher volatility due to narrow sector exposure | Diversified risk across countries but exposed to currency and geopolitical risks |

| Diversification | Concentrated holdings within a theme | Broad exposure across international markets and sectors |

| Growth Potential | High growth aligned with emerging trends | Moderate growth influenced by global economic factors |

| Examples | ARK Innovation ETF (ARKK), Global X Robotics & AI ETF (BOTZ) | Vanguard FTSE Developed Markets ETF (VEA), iShares MSCI Emerging Markets ETF (EEM) |

| Ideal For | Investors seeking targeted exposure to innovation and trends | Investors pursuing diversified global equity exposure |

Which is better?

Thematic ETFs focus on specific sectors or trends such as technology, clean energy, or healthcare, offering targeted exposure and growth potential aligned with emerging market themes. International ETFs provide diversified exposure to global markets outside the investor's home country, reducing risk through geographic diversification and benefiting from foreign economic growth. Investors seeking focused innovation-driven opportunities may prefer Thematic ETFs, while those aiming for broad global diversification typically favor International ETFs.

Connection

Thematic ETFs focus on specific investment themes like technology, clean energy, or healthcare, often including companies from multiple countries, which naturally incorporates an international dimension. International ETFs provide exposure to global markets by tracking indices outside the investor's home country, potentially encompassing thematic sectors abroad. Combining thematic and international ETFs allows investors to target global growth trends while diversifying across diverse geographic regions and market sectors.

Key Terms

Diversification

International ETFs offer broad exposure to global markets across multiple sectors and countries, enhancing portfolio diversification by reducing country-specific risks. Thematic ETFs concentrate on specific trends or industries, such as renewable energy or biotechnology, providing targeted growth opportunities but potentially higher volatility. Explore the advantages of each ETF type to optimize your diversified investment strategy.

Geographic Exposure

International ETFs provide broad geographic exposure by investing in multiple countries across regions, offering diversification and access to global markets such as Europe, Asia, and emerging economies. Thematic ETFs concentrate on specific trends or sectors, often with a more targeted geographic focus that aligns with the thematic investment, such as clean energy or technology hubs. Explore how each ETF type can optimize your portfolio's geographic diversification strategy.

Sector Focus

International ETFs provide diversified exposure across global markets, targeting broad sectors such as technology, healthcare, and finance with geographic flexibility. Thematic ETFs concentrate investments on specific trends or innovations like clean energy, artificial intelligence, or cybersecurity, offering focused growth potential within particular sectors. Explore our detailed analysis to understand how sector focus influences your investment strategy in these ETF categories.

Source and External Links

8 International Stock ETFs Outpacing the S&P 500 in 2025 | etf.com - In 2025, international stock ETFs, especially those focused on Europe, China, and defense sectors, have outperformed US ETFs, with examples like Vanguard Total International Stock ETF (VXUS) up 9%, and Select STOXX Europe Aerospace & Defense ETF (EUAD) up 46% due to geopolitical factors and economic growth.

What Are International ETFs? - Fidelity Investments - International ETFs offer diversification benefits due to their lower correlation to US equities and come in broad-based and targeted varieties, including developed, emerging markets, and regional ETFs geared towards different risk tolerances and investment strategies.

3 Top International ETFs for 2025 and Beyond | Morningstar - Top international ETFs to consider include Vanguard Total International Stock ETF (VXUS), iShares Core MSCI EAFE ETF (IEFA), and Vanguard International High Dividend Yield ETF (VYMI), valued for broad diversification across thousands of foreign stocks with low fees and long-term potential.

dowidth.com

dowidth.com