Impact investing focuses on generating positive social and environmental outcomes alongside financial returns, targeting sectors like renewable energy and social enterprises. Traditional investing prioritizes maximizing financial gains by allocating capital to stocks, bonds, and other assets without necessarily considering social impact. Explore the differences in strategies and objectives between impact investing and traditional investing to make informed financial decisions.

Why it is important

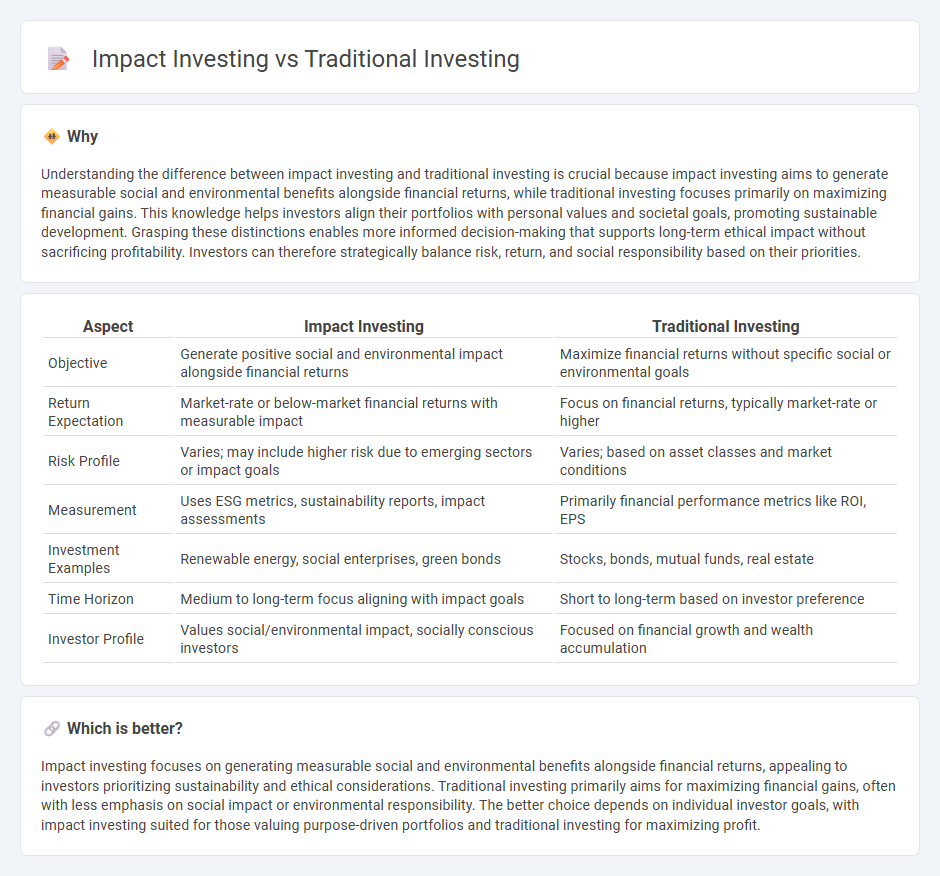

Understanding the difference between impact investing and traditional investing is crucial because impact investing aims to generate measurable social and environmental benefits alongside financial returns, while traditional investing focuses primarily on maximizing financial gains. This knowledge helps investors align their portfolios with personal values and societal goals, promoting sustainable development. Grasping these distinctions enables more informed decision-making that supports long-term ethical impact without sacrificing profitability. Investors can therefore strategically balance risk, return, and social responsibility based on their priorities.

Comparison Table

| Aspect | Impact Investing | Traditional Investing |

|---|---|---|

| Objective | Generate positive social and environmental impact alongside financial returns | Maximize financial returns without specific social or environmental goals |

| Return Expectation | Market-rate or below-market financial returns with measurable impact | Focus on financial returns, typically market-rate or higher |

| Risk Profile | Varies; may include higher risk due to emerging sectors or impact goals | Varies; based on asset classes and market conditions |

| Measurement | Uses ESG metrics, sustainability reports, impact assessments | Primarily financial performance metrics like ROI, EPS |

| Investment Examples | Renewable energy, social enterprises, green bonds | Stocks, bonds, mutual funds, real estate |

| Time Horizon | Medium to long-term focus aligning with impact goals | Short to long-term based on investor preference |

| Investor Profile | Values social/environmental impact, socially conscious investors | Focused on financial growth and wealth accumulation |

Which is better?

Impact investing focuses on generating measurable social and environmental benefits alongside financial returns, appealing to investors prioritizing sustainability and ethical considerations. Traditional investing primarily aims for maximizing financial gains, often with less emphasis on social impact or environmental responsibility. The better choice depends on individual investor goals, with impact investing suited for those valuing purpose-driven portfolios and traditional investing for maximizing profit.

Connection

Impact investing integrates financial returns with measurable social and environmental benefits, aligning closely with traditional investing's focus on capital growth and risk management. Both approaches utilize financial instruments such as stocks, bonds, and mutual funds, but impact investing emphasizes ESG (Environmental, Social, and Governance) criteria to assess portfolio performance. This connection enables investors to achieve competitive financial returns while promoting sustainable development and responsible corporate behavior.

Key Terms

Risk-adjusted return

Traditional investing primarily emphasizes maximizing financial returns based on historical performance and market trends, often measured by metrics such as Sharpe ratio and alpha to evaluate risk-adjusted returns. Impact investing integrates environmental, social, and governance (ESG) factors into financial analysis, seeking competitive returns while generating positive societal outcomes, with growing evidence showing comparable or superior risk-adjusted performance. Explore deeper insights on how impact investing aligns financial goals with sustainability objectives for informed portfolio decisions.

ESG (Environmental, Social, Governance)

Traditional investing primarily aims for financial returns, often overlooking environmental, social, and governance (ESG) criteria. Impact investing integrates ESG factors to generate measurable social and environmental benefits alongside competitive financial performance. Explore how aligning investments with ESG principles can drive sustainable change and value creation.

Fiduciary duty

Traditional investing prioritizes maximizing financial returns for beneficiaries while strictly adhering to fiduciary duties that emphasize prudence and loyalty. Impact investing integrates environmental, social, and governance (ESG) criteria into investment decisions, aiming to generate measurable social or environmental benefits alongside financial returns without breaching fiduciary responsibilities. Explore how evolving interpretations of fiduciary duty influence the growing adoption of impact investing strategies.

Source and External Links

Traditional Investment Strategies: A Guide for Modern Investors - Traditional investing focuses on asset allocation and diversification across stocks, bonds, and cash equivalents to manage risk and pursue long-term growth.

Best Long-Term Investment Strategy - Traditional vs. Alternatives? - Traditional investments like stocks, bonds, and mutual funds are known for their liquidity, transparency, and regulatory oversight, making them accessible and easier to monitor than alternative assets.

7 Types of Traditional Investments | Further - Traditional investments include a range of options such as bank products, stocks, and bonds, offering a reliable way to diversify a portfolio and work toward financial goals over time.

dowidth.com

dowidth.com