Sovereign debt restructuring involves renegotiating the terms of a country's existing debt obligations to improve repayment conditions, often including interest rate reductions, extended maturities, or partial debt forgiveness. Debt moratorium refers to a temporary suspension of debt payments, providing immediate relief but not addressing long-term debt sustainability. Explore the key differences and implications of these financial strategies for sovereign nations.

Why it is important

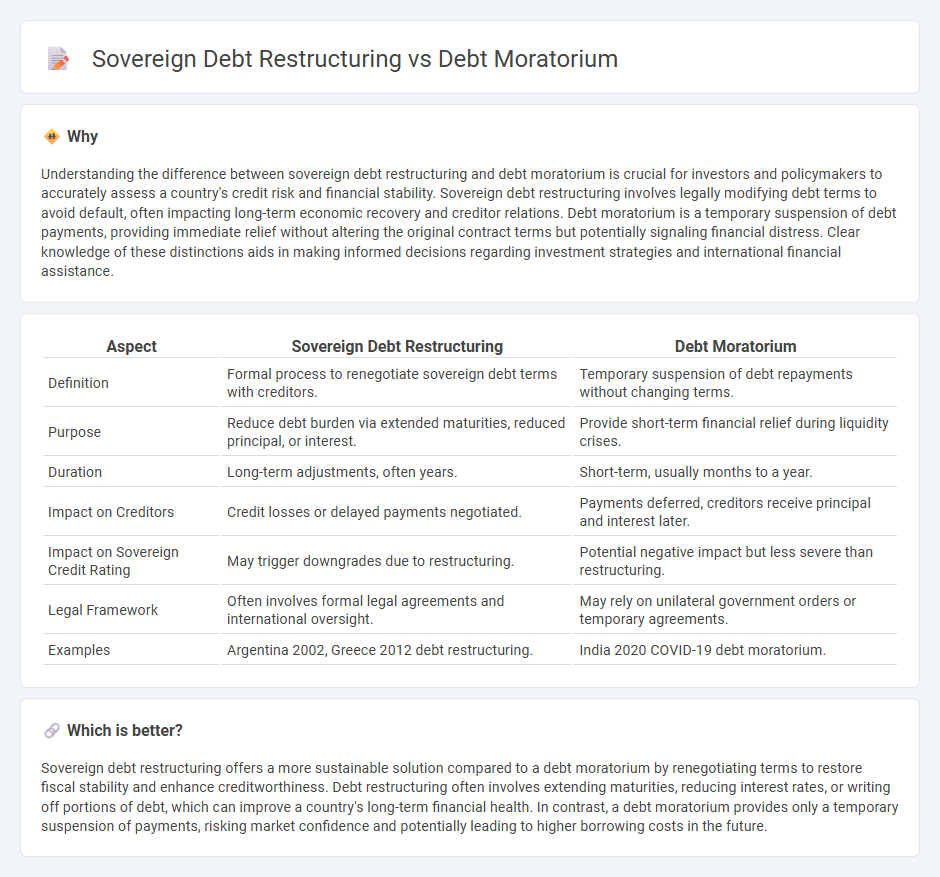

Understanding the difference between sovereign debt restructuring and debt moratorium is crucial for investors and policymakers to accurately assess a country's credit risk and financial stability. Sovereign debt restructuring involves legally modifying debt terms to avoid default, often impacting long-term economic recovery and creditor relations. Debt moratorium is a temporary suspension of debt payments, providing immediate relief without altering the original contract terms but potentially signaling financial distress. Clear knowledge of these distinctions aids in making informed decisions regarding investment strategies and international financial assistance.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Moratorium |

|---|---|---|

| Definition | Formal process to renegotiate sovereign debt terms with creditors. | Temporary suspension of debt repayments without changing terms. |

| Purpose | Reduce debt burden via extended maturities, reduced principal, or interest. | Provide short-term financial relief during liquidity crises. |

| Duration | Long-term adjustments, often years. | Short-term, usually months to a year. |

| Impact on Creditors | Credit losses or delayed payments negotiated. | Payments deferred, creditors receive principal and interest later. |

| Impact on Sovereign Credit Rating | May trigger downgrades due to restructuring. | Potential negative impact but less severe than restructuring. |

| Legal Framework | Often involves formal legal agreements and international oversight. | May rely on unilateral government orders or temporary agreements. |

| Examples | Argentina 2002, Greece 2012 debt restructuring. | India 2020 COVID-19 debt moratorium. |

Which is better?

Sovereign debt restructuring offers a more sustainable solution compared to a debt moratorium by renegotiating terms to restore fiscal stability and enhance creditworthiness. Debt restructuring often involves extending maturities, reducing interest rates, or writing off portions of debt, which can improve a country's long-term financial health. In contrast, a debt moratorium provides only a temporary suspension of payments, risking market confidence and potentially leading to higher borrowing costs in the future.

Connection

Sovereign debt restructuring involves renegotiating the terms of existing debt to improve a country's repayment ability, often triggered by financial distress. A debt moratorium, which temporarily suspends debt payments, can serve as a crucial initial phase within the broader framework of sovereign debt restructuring. Both strategies aim to restore fiscal sustainability while maintaining creditor relations and stabilizing the affected nation's economy.

Key Terms

Payment Suspension

Debt moratorium involves a temporary suspension of sovereign debt payments, allowing countries to pause principal and interest obligations without immediate penalties. Sovereign debt restructuring, by contrast, typically entails renegotiating terms such as reducing principal, extending maturities, or lowering interest rates, often triggered by prolonged payment difficulties. Explore detailed differences and implications of these debt relief strategies to understand their impact on sovereign financial stability.

Haircut

A debt moratorium temporarily suspends debt repayments without altering the principal amount, offering short-term relief to sovereign borrowers. Sovereign debt restructuring involves renegotiating the terms of debt, often including a haircut, which reduces the principal amount owed to creditors to improve debt sustainability. Explore detailed comparisons and implications of haircuts in sovereign debt management to understand their impact on global financial stability.

Creditor Negotiation

Debt moratorium pauses sovereign debt payments temporarily, providing immediate relief without altering the debt's original terms, while sovereign debt restructuring involves renegotiating terms such as interest rates, maturity, or principal to ensure long-term sustainability. Creditor negotiation in moratoriums focuses on gaining consent for payment deferrals, whereas restructuring requires more complex discussions to adjust contractual obligations. Discover how strategic creditor engagement shapes the success of sovereign debt solutions.

Source and External Links

Debt moratorium - Wikipedia - A debt moratorium is a delay in the payment of debts or obligations, often declared by national governments in times of political or commercial stress to suspend debt repayments partially or fully to protect citizens' welfare.

Moratorium - Overview, Applications, and Examples - A moratorium is a temporary deferral of obligations such as debt payments, often imposed by governments or central banks during crises like wars or natural disasters, although interest may continue to accrue on the outstanding loans.

Debt relief order. The moratorium period for debts - StepChange - A debt moratorium can be an agreed period during which debt repayments are paused, such as the 12-month moratorium for debts under a Debt Relief Order in the UK, after which debts may be written off if conditions are met.

dowidth.com

dowidth.com