Laddered bond ETFs diversify fixed-income investments by holding bonds with staggered maturities, balancing interest rate risk and providing steady income streams. Treasury ETFs focus on U.S. government bonds, offering safety and liquidity with lower credit risk, suitable for conservative portfolios. Explore the key differences between laddered bond ETFs and Treasury ETFs to optimize your investment strategy.

Why it is important

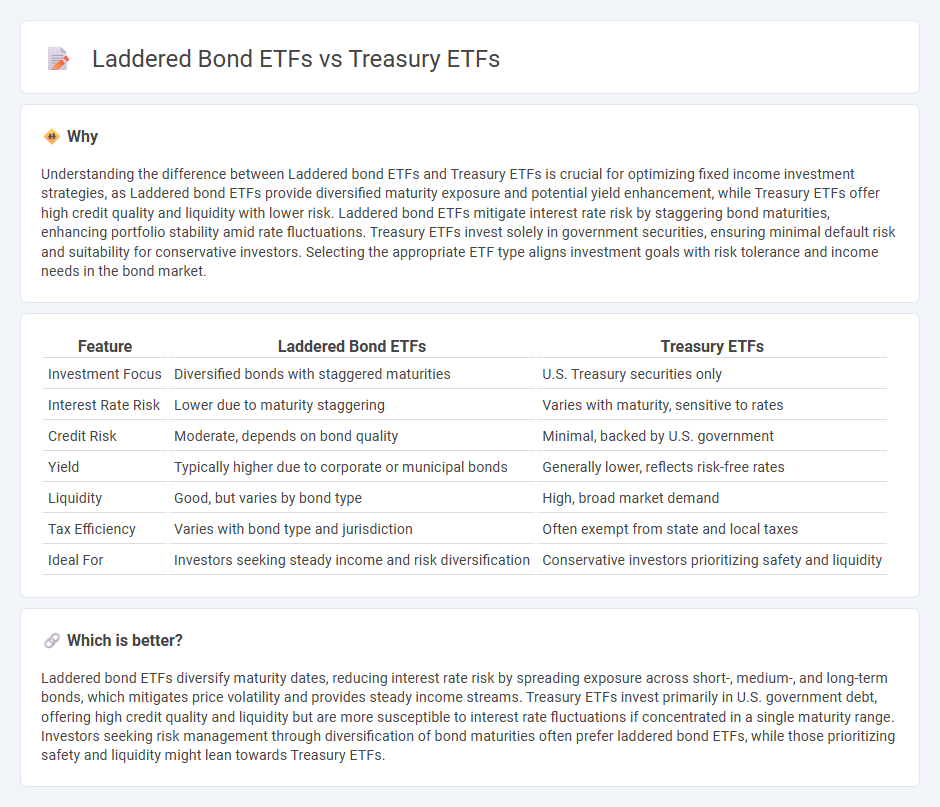

Understanding the difference between Laddered bond ETFs and Treasury ETFs is crucial for optimizing fixed income investment strategies, as Laddered bond ETFs provide diversified maturity exposure and potential yield enhancement, while Treasury ETFs offer high credit quality and liquidity with lower risk. Laddered bond ETFs mitigate interest rate risk by staggering bond maturities, enhancing portfolio stability amid rate fluctuations. Treasury ETFs invest solely in government securities, ensuring minimal default risk and suitability for conservative investors. Selecting the appropriate ETF type aligns investment goals with risk tolerance and income needs in the bond market.

Comparison Table

| Feature | Laddered Bond ETFs | Treasury ETFs |

|---|---|---|

| Investment Focus | Diversified bonds with staggered maturities | U.S. Treasury securities only |

| Interest Rate Risk | Lower due to maturity staggering | Varies with maturity, sensitive to rates |

| Credit Risk | Moderate, depends on bond quality | Minimal, backed by U.S. government |

| Yield | Typically higher due to corporate or municipal bonds | Generally lower, reflects risk-free rates |

| Liquidity | Good, but varies by bond type | High, broad market demand |

| Tax Efficiency | Varies with bond type and jurisdiction | Often exempt from state and local taxes |

| Ideal For | Investors seeking steady income and risk diversification | Conservative investors prioritizing safety and liquidity |

Which is better?

Laddered bond ETFs diversify maturity dates, reducing interest rate risk by spreading exposure across short-, medium-, and long-term bonds, which mitigates price volatility and provides steady income streams. Treasury ETFs invest primarily in U.S. government debt, offering high credit quality and liquidity but are more susceptible to interest rate fluctuations if concentrated in a single maturity range. Investors seeking risk management through diversification of bond maturities often prefer laddered bond ETFs, while those prioritizing safety and liquidity might lean towards Treasury ETFs.

Connection

Laddered bond ETFs and Treasury ETFs both focus on fixed-income securities but differ in maturity strategy and risk profile. Laddered bond ETFs hold bonds with staggered maturities to manage interest rate risk and provide consistent cash flow, while Treasury ETFs invest exclusively in U.S. government securities, offering low credit risk and high liquidity. Together, they provide investors diversified exposure to income generation and capital preservation within a fixed-income portfolio.

Key Terms

Duration

Treasury ETFs primarily invest in U.S. government securities with varying maturities, offering investors liquidity and exposure to risk-free rates; laddered bond ETFs hold bonds with staggered maturities to balance interest rate risk and provide steady income. The key difference lies in duration management: Treasury ETFs may concentrate on short or intermediate terms, while laddered bond ETFs spread duration across multiple points to cushion against interest rate fluctuations. Explore our detailed guide to understand which ETF strategy aligns with your investment goals.

Yield

Treasury ETFs offer exposure to U.S. government debt with typically lower yields but higher safety and liquidity compared to laddered bond ETFs, which diversify maturities to manage interest rate risk and potentially enhance yield. Laddered bond ETFs spread investment across bonds with staggered maturities, allowing for more consistent income streams and reinvestment opportunities at varying coupon rates. Explore further to understand which strategy aligns best with your income objectives and risk tolerance.

Interest Rate Risk

Treasury ETFs primarily hold U.S. government securities with fixed interest rates, making them sensitive to interest rate fluctuations that can lead to price volatility. Laddered bond ETFs diversify maturity dates, reducing interest rate risk by balancing exposure across short, medium, and long-term bonds, which smooths out potential losses during rate changes. Explore the detailed comparison to understand how each strategy manages interest rate risk for optimized bond portfolio performance.

Source and External Links

SCHO | Schwab Short-Term U.S. Treasury ETF - This ETF aims to closely track the total return of short-term U.S. Treasury bonds (1-3 years maturity), offering low-cost, tax-efficient exposure to short-end Treasury yields, suitable for portfolio core holdings.

Treasuries ETF List - ETF Database - Provides a comprehensive list and detailed data on U.S.-traded Treasury ETFs, including performance, dividends, holdings, and expense ratios, reflecting the popular, safe nature of U.S. government bonds.

Invest in US Treasuries with BondBloxx ETFs - BondBloxx offers U.S. Treasury ETFs that provide precise fixed income exposure at lower expense ratios (about 0.06%), designed for cost-effective investing in Treasury securities across various maturities.

dowidth.com

dowidth.com