Locavesting focuses on investing in local businesses to stimulate community economic growth, often emphasizing sustainable and socially responsible projects. Venture capital targets high-growth startups with innovative technologies, seeking significant financial returns through equity stakes and scalable business models. Explore the distinct benefits and strategies of locavesting versus venture capital to determine the best investment approach.

Why it is important

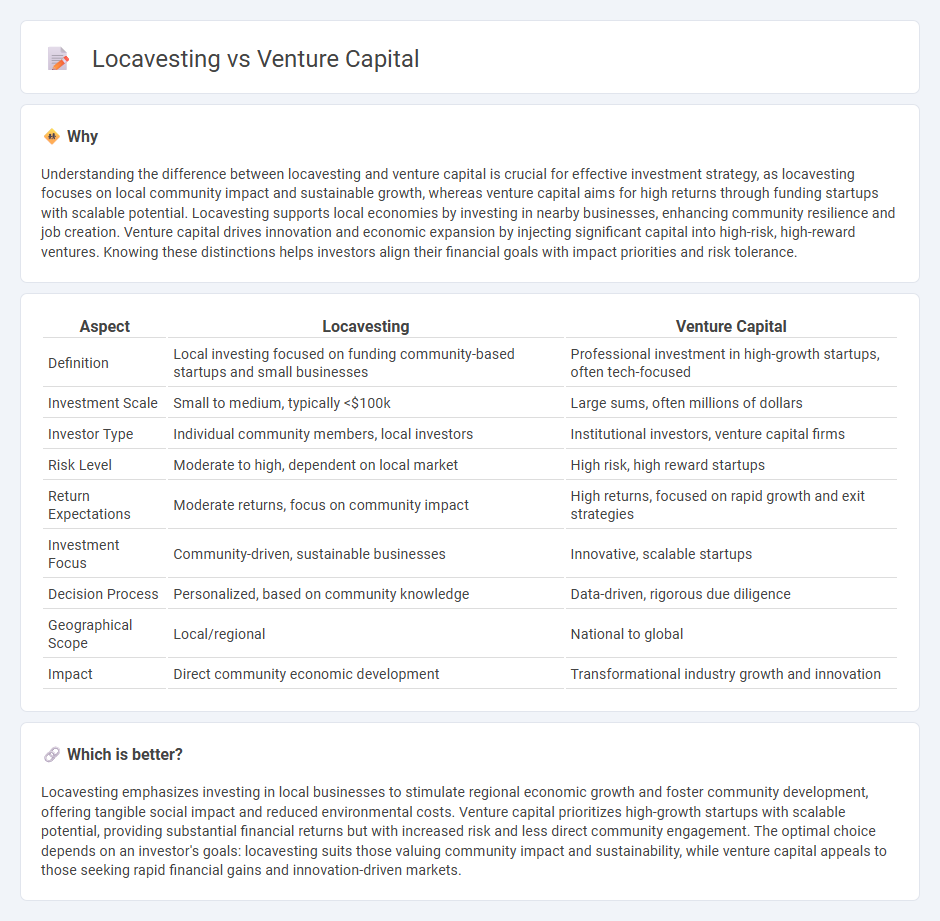

Understanding the difference between locavesting and venture capital is crucial for effective investment strategy, as locavesting focuses on local community impact and sustainable growth, whereas venture capital aims for high returns through funding startups with scalable potential. Locavesting supports local economies by investing in nearby businesses, enhancing community resilience and job creation. Venture capital drives innovation and economic expansion by injecting significant capital into high-risk, high-reward ventures. Knowing these distinctions helps investors align their financial goals with impact priorities and risk tolerance.

Comparison Table

| Aspect | Locavesting | Venture Capital |

|---|---|---|

| Definition | Local investing focused on funding community-based startups and small businesses | Professional investment in high-growth startups, often tech-focused |

| Investment Scale | Small to medium, typically <$100k | Large sums, often millions of dollars |

| Investor Type | Individual community members, local investors | Institutional investors, venture capital firms |

| Risk Level | Moderate to high, dependent on local market | High risk, high reward startups |

| Return Expectations | Moderate returns, focus on community impact | High returns, focused on rapid growth and exit strategies |

| Investment Focus | Community-driven, sustainable businesses | Innovative, scalable startups |

| Decision Process | Personalized, based on community knowledge | Data-driven, rigorous due diligence |

| Geographical Scope | Local/regional | National to global |

| Impact | Direct community economic development | Transformational industry growth and innovation |

Which is better?

Locavesting emphasizes investing in local businesses to stimulate regional economic growth and foster community development, offering tangible social impact and reduced environmental costs. Venture capital prioritizes high-growth startups with scalable potential, providing substantial financial returns but with increased risk and less direct community engagement. The optimal choice depends on an investor's goals: locavesting suits those valuing community impact and sustainability, while venture capital appeals to those seeking rapid financial gains and innovation-driven markets.

Connection

Locavesting supports local economic growth by directing investments into community-based startups and small businesses, creating a fertile environment for venture capital to identify promising opportunities. Venture capital firms often leverage locavesting insights to discover innovative enterprises with strong local market potential, reducing risk through community engagement. This synergy enhances regional development and accelerates the scaling of high-impact ventures.

Key Terms

Funding source

Venture capital typically involves funding from institutional investors or high-net-worth individuals pooling significant capital into startup companies with high growth potential. Locavesting centers on local investors, often community members or regional funds, providing financial support directly to nearby businesses, fostering regional economic development. Explore the distinct advantages and implications of these funding sources to better understand their impact on startup growth.

Investment scale

Venture capital typically involves large-scale investments ranging from millions to billions of dollars, targeting high-growth startups with significant market potential. Locavesting, in contrast, emphasizes smaller, community-focused investments, often under $100,000, fostering local economic development and personal connections. Explore more about how these investment scales impact risk, returns, and community growth.

Community impact

Venture capital typically backs high-growth startups with scalable business models, aiming for substantial financial returns and economic development beyond local borders. Locavesting concentrates on investing in local businesses and projects, fostering community resilience, job creation, and sustainable economic growth within a specific geographic area. Discover how these investment approaches uniquely drive community impact and support regional prosperity.

Source and External Links

What is Venture Capital? - This webpage explains how venture capital transforms ideas into products and services, fueling American jobs and high-growth companies.

Fund your business - This guide from the SBA discusses how to get venture capital funding and the typical requirements for venture capital investments.

What is venture capital? - This article by Silicon Valley Bank explores how venture capital works, including its investment strategy and role in supporting startups.

dowidth.com

dowidth.com