Unretirement refers to individuals returning to work after retiring, often driven by financial needs or a desire for engagement, while delayed retirement involves postponing retirement beyond the traditional age to maximize pension benefits and Social Security income. Both trends impact labor markets by increasing workforce participation among older adults and influencing economic productivity. Explore the nuances of unretirement and delayed retirement to understand their effects on the economy and personal financial planning.

Why it is important

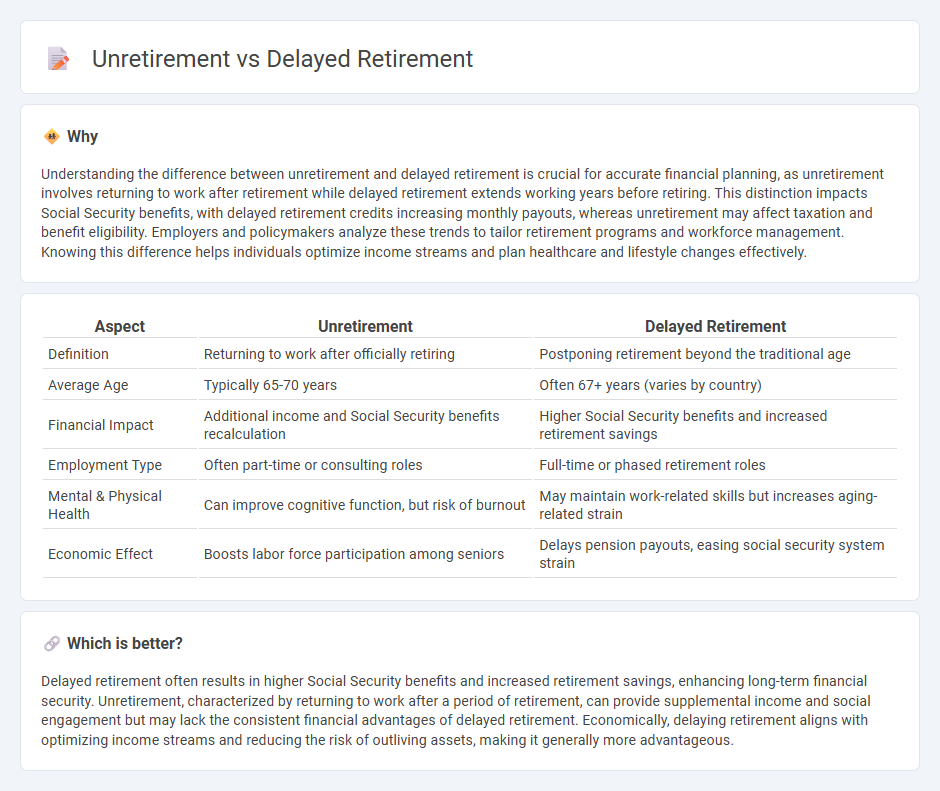

Understanding the difference between unretirement and delayed retirement is crucial for accurate financial planning, as unretirement involves returning to work after retirement while delayed retirement extends working years before retiring. This distinction impacts Social Security benefits, with delayed retirement credits increasing monthly payouts, whereas unretirement may affect taxation and benefit eligibility. Employers and policymakers analyze these trends to tailor retirement programs and workforce management. Knowing this difference helps individuals optimize income streams and plan healthcare and lifestyle changes effectively.

Comparison Table

| Aspect | Unretirement | Delayed Retirement |

|---|---|---|

| Definition | Returning to work after officially retiring | Postponing retirement beyond the traditional age |

| Average Age | Typically 65-70 years | Often 67+ years (varies by country) |

| Financial Impact | Additional income and Social Security benefits recalculation | Higher Social Security benefits and increased retirement savings |

| Employment Type | Often part-time or consulting roles | Full-time or phased retirement roles |

| Mental & Physical Health | Can improve cognitive function, but risk of burnout | May maintain work-related skills but increases aging-related strain |

| Economic Effect | Boosts labor force participation among seniors | Delays pension payouts, easing social security system strain |

Which is better?

Delayed retirement often results in higher Social Security benefits and increased retirement savings, enhancing long-term financial security. Unretirement, characterized by returning to work after a period of retirement, can provide supplemental income and social engagement but may lack the consistent financial advantages of delayed retirement. Economically, delaying retirement aligns with optimizing income streams and reducing the risk of outliving assets, making it generally more advantageous.

Connection

Unretirement, where individuals return to the workforce after retirement, often results from delayed retirement decisions influenced by economic factors such as insufficient savings or rising healthcare costs. Delayed retirement increases labor force participation among older adults, helping to sustain Social Security systems and support economic growth by mitigating the impact of aging populations. Both trends reflect shifting financial needs and evolving attitudes toward work-life balance in modern economies.

Key Terms

Labor Force Participation

Delayed retirement extends workforce engagement by postponing the official retirement age, leading to higher labor force participation rates among older adults. Unretirement involves re-entering the workforce after an initial retirement, often motivated by financial needs or personal fulfillment, impacting labor force dynamics differently. Explore deeper insights on how these trends shape economic participation and retirement planning.

Pension Systems

Delayed retirement extends workforce participation beyond traditional retirement age, enhancing pension system sustainability by increasing contributions and reducing payout duration. Unretirement involves individuals returning to work after retirement, providing additional income streams and alleviating financial pressure on pension funds. Explore the dynamics between delayed retirement and unretirement to understand their impact on modern pension systems.

Human Capital

Delayed retirement allows individuals to extend their accumulation of human capital by continuing to work, thereby maintaining skills and professional networks while boosting lifetime earnings. Unretirement involves re-entering the workforce after a period of inactivity, which may require significant skill reacquisition and adaptation to evolving industry demands. Explore strategies to effectively manage human capital across these retirement transitions.

Source and External Links

Understanding Delayed Retirement Credits: What to Know - Delayed retirement credits increase your monthly Social Security benefits for each month you delay past your full retirement age, up to age 70, which results in a larger payout although with fewer payments overall.

What Are Delayed Retirement Credits? - Bankers Life - By waiting to claim Social Security benefits beyond full retirement age, you earn 2/3 of 1% more per month (up to an 8% per year increase), maximizing the benefit if you wait until age 70.

Types of Retirement - OPM - Deferred retirement allows former federal employees to apply for retirement benefits starting at age 62 or Minimum Retirement Age, postponing annuity receipt to increase benefit amounts.

dowidth.com

dowidth.com