Neobank stacking leverages multiple digital banking platforms to optimize financial management, offering users seamless access to various services and enhanced interest rates. Credit unions, member-owned financial cooperatives, provide personalized banking solutions with a community-focused approach and lower fees than traditional banks. Explore the benefits and distinctions of neobank stacking and credit unions to determine the best strategy for your financial goals.

Why it is important

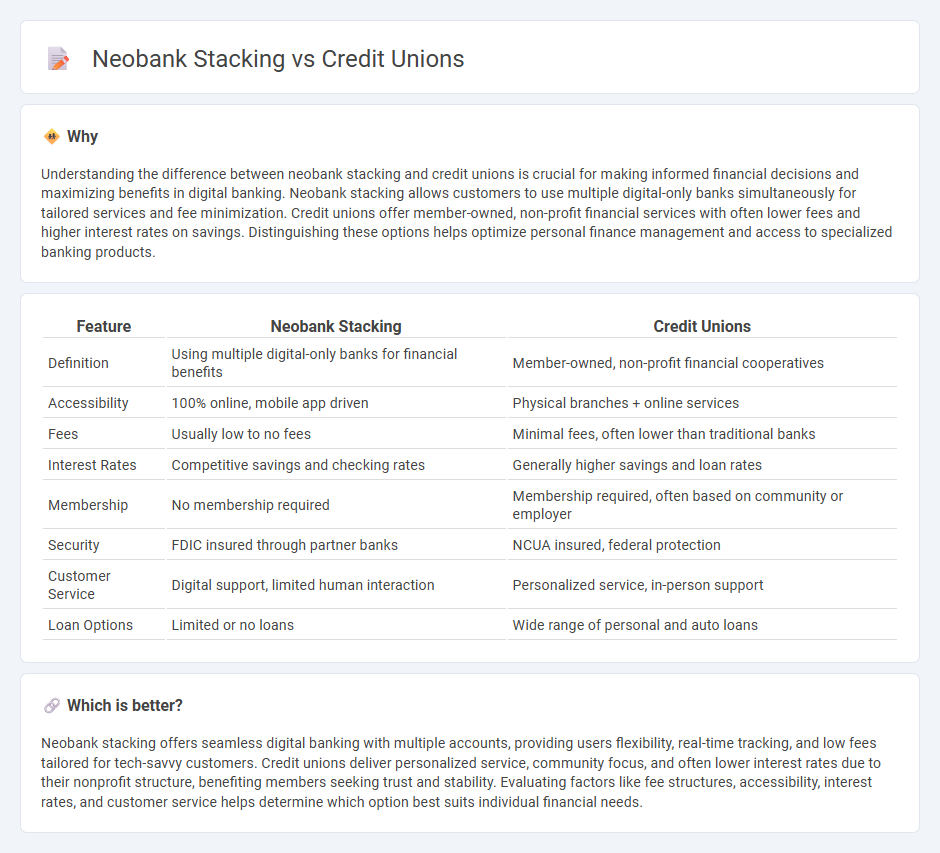

Understanding the difference between neobank stacking and credit unions is crucial for making informed financial decisions and maximizing benefits in digital banking. Neobank stacking allows customers to use multiple digital-only banks simultaneously for tailored services and fee minimization. Credit unions offer member-owned, non-profit financial services with often lower fees and higher interest rates on savings. Distinguishing these options helps optimize personal finance management and access to specialized banking products.

Comparison Table

| Feature | Neobank Stacking | Credit Unions |

|---|---|---|

| Definition | Using multiple digital-only banks for financial benefits | Member-owned, non-profit financial cooperatives |

| Accessibility | 100% online, mobile app driven | Physical branches + online services |

| Fees | Usually low to no fees | Minimal fees, often lower than traditional banks |

| Interest Rates | Competitive savings and checking rates | Generally higher savings and loan rates |

| Membership | No membership required | Membership required, often based on community or employer |

| Security | FDIC insured through partner banks | NCUA insured, federal protection |

| Customer Service | Digital support, limited human interaction | Personalized service, in-person support |

| Loan Options | Limited or no loans | Wide range of personal and auto loans |

Which is better?

Neobank stacking offers seamless digital banking with multiple accounts, providing users flexibility, real-time tracking, and low fees tailored for tech-savvy customers. Credit unions deliver personalized service, community focus, and often lower interest rates due to their nonprofit structure, benefiting members seeking trust and stability. Evaluating factors like fee structures, accessibility, interest rates, and customer service helps determine which option best suits individual financial needs.

Connection

Neobank stacking involves using multiple digital banks to optimize financial management, while credit unions provide member-focused, low-fee financial services. Both operate within the digital economy by prioritizing user-centric approaches and leveraging technology to enhance accessibility and reduce costs. The convergence of neobank stacking and credit union services fosters innovative, efficient financial ecosystems that empower consumers with tailored solutions and improved financial control.

Key Terms

Membership-based lending

Credit unions offer membership-based lending, providing personalized financial products and lower interest rates to their members due to their non-profit structure. Neobanks, while tech-driven and user-friendly, typically lack the community-focused membership model and often rely on partnerships with traditional banks for lending services. Explore the membership-based lending benefits that differentiate credit unions from neobank stacking strategies.

Digital-first banking

Digital-first banking in credit unions often emphasizes member ownership, personalized service, and community roots, contrasted with neobanks which leverage advanced technologies and agile platforms to offer seamless, 24/7 user experiences with minimal fees. Neobanks excel in integrating cutting-edge features like AI-driven financial insights, instant payments, and goal-based savings, attracting tech-savvy customers seeking convenience and efficiency. Explore the evolving landscape of digital-first banking to understand how these models drive innovation and customer engagement.

Interest rate structure

Credit unions typically offer tiered interest rate structures with competitive rates on savings accounts and lower loan rates due to their non-profit status, prioritizing member benefits over profit maximization. Neobanks often provide more straightforward, sometimes higher-yield savings rates facilitated by low overhead costs and technology-driven efficiency, but may have fewer lending options. Explore the detailed differences in interest rate structures to choose the best fit for your financial goals.

Source and External Links

What is a Credit Union? - MyCreditUnion.gov - Credit unions are member-owned, not-for-profit financial institutions that prioritize members' financial well-being by offering deposits, loans, and other financial services at favorable terms such as lower fees and better rates.

Corda Credit Union | Serving Iowa - Corda Credit Union offers easy online applications for account opening, loans, and credit cards, providing products like auto, home, and personal loans tailored for Iowa members.

Cedar Rapids - Community 1st Credit Union - Community 1st Credit Union is a not-for-profit cooperative with over 70,000 members and multiple locations in Iowa, offering a full range of banking services focused on member financial success.

dowidth.com

dowidth.com