A liquidity crunch occurs when financial institutions face a sudden shortage of cash, limiting their ability to meet short-term obligations and causing market disruptions. Systemic risk refers to the potential collapse of an entire financial system or market due to the interconnectedness of institutions and widespread failures. Explore deeper insights into how liquidity crunches can escalate into systemic risks in global economies.

Why it is important

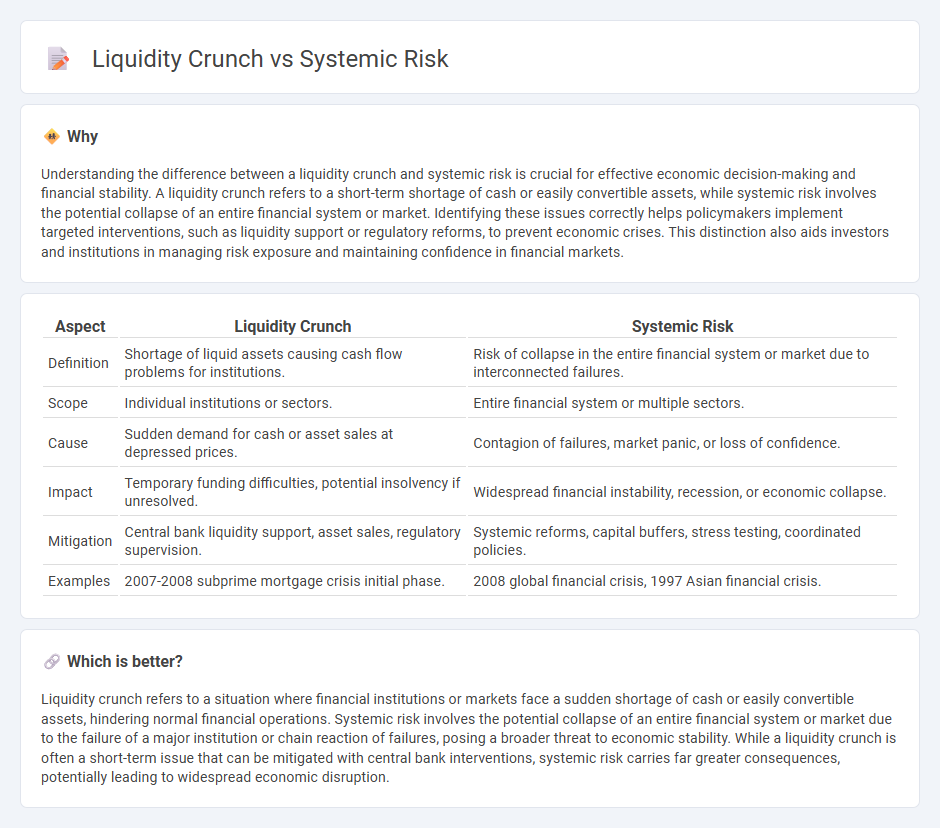

Understanding the difference between a liquidity crunch and systemic risk is crucial for effective economic decision-making and financial stability. A liquidity crunch refers to a short-term shortage of cash or easily convertible assets, while systemic risk involves the potential collapse of an entire financial system or market. Identifying these issues correctly helps policymakers implement targeted interventions, such as liquidity support or regulatory reforms, to prevent economic crises. This distinction also aids investors and institutions in managing risk exposure and maintaining confidence in financial markets.

Comparison Table

| Aspect | Liquidity Crunch | Systemic Risk |

|---|---|---|

| Definition | Shortage of liquid assets causing cash flow problems for institutions. | Risk of collapse in the entire financial system or market due to interconnected failures. |

| Scope | Individual institutions or sectors. | Entire financial system or multiple sectors. |

| Cause | Sudden demand for cash or asset sales at depressed prices. | Contagion of failures, market panic, or loss of confidence. |

| Impact | Temporary funding difficulties, potential insolvency if unresolved. | Widespread financial instability, recession, or economic collapse. |

| Mitigation | Central bank liquidity support, asset sales, regulatory supervision. | Systemic reforms, capital buffers, stress testing, coordinated policies. |

| Examples | 2007-2008 subprime mortgage crisis initial phase. | 2008 global financial crisis, 1997 Asian financial crisis. |

Which is better?

Liquidity crunch refers to a situation where financial institutions or markets face a sudden shortage of cash or easily convertible assets, hindering normal financial operations. Systemic risk involves the potential collapse of an entire financial system or market due to the failure of a major institution or chain reaction of failures, posing a broader threat to economic stability. While a liquidity crunch is often a short-term issue that can be mitigated with central bank interventions, systemic risk carries far greater consequences, potentially leading to widespread economic disruption.

Connection

A liquidity crunch directly impacts the economy by restricting the availability of liquid assets, causing banks and financial institutions to struggle with meeting short-term obligations. This tightening of liquidity increases systemic risk as interconnected financial entities face heightened chances of default, which can trigger widespread instability across markets. The correlation between liquidity shortages and systemic risk emphasizes the importance of robust regulatory frameworks and central bank interventions to maintain economic stability.

Key Terms

Interconnectedness

Systemic risk arises when interconnected financial institutions trigger widespread instability, amplifying the impact of a single entity's failure across the entire network. Liquidity crunch occurs when these interconnections dry up cash flow, causing firms to struggle in meeting short-term obligations despite apparent solvency. Explore how understanding interconnectedness can help manage systemic risk and prevent liquidity crunch scenarios.

Market liquidity

Market liquidity reflects the ease with which assets can be bought or sold without significantly affecting their price, with systemic risk representing widespread financial instability across institutions. A liquidity crunch occurs when market participants cannot access sufficient cash or liquid assets, exacerbating price volatility and triggering fire sales. Explore further to understand how market liquidity influences financial stability and risk management.

Contagion

Systemic risk refers to the potential collapse of an entire financial system due to interconnectedness and spreading failures, whereas a liquidity crunch occurs when institutions face sudden shortages of cash or liquid assets, limiting their operational capacity. Contagion amplifies both phenomena by enabling distress at one institution to quickly transmit through interbank lending, asset fire sales, and weakened market confidence, escalating localized issues into widespread instability. Explore further how contagion mechanisms influence systemic risk and liquidity crunch dynamics.

Source and External Links

Systemic Risk & Management in Finance | Research & Policy Center - Systemic risk is the risk of breakdown of an entire financial system due to interconnectedness, potentially causing severe economic downturns, and policymakers aim to limit its build-up and impact through coordinated global efforts and stronger oversight.

Understanding How Systemic Risk Affects the Economy - Systemic risk involves the potential collapse of an entire economy or financial system, spreading from weaker to healthier institutions with far-reaching ripple effects, leading regulators to implement safeguards after the 2008 crisis to increase financial stability.

Systemic risk - Wikipedia - Systemic risk is the possibility that interlinked institutions will fail together, causing a market-wide collapse, and is a major concern for policymakers who design regulations to protect the overall financial system rather than individual entities.

dowidth.com

dowidth.com