Shadow inflation occurs when the prices of goods rise unnoticed due to subtle changes in product size or quality, masking the true cost increase experienced by consumers. Transitory inflation refers to short-term price hikes driven by temporary factors like supply chain disruptions or seasonal demand spikes, expected to stabilize over time. Explore the nuances between these inflation types to better understand their impact on your purchasing power and the broader economy.

Why it is important

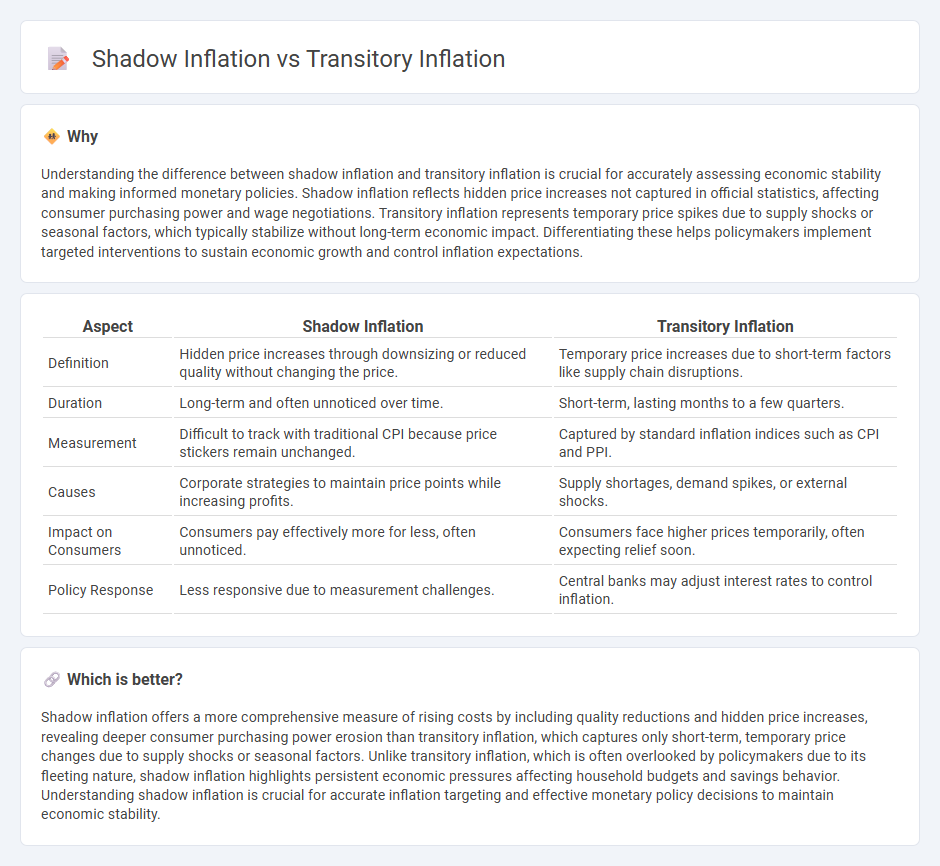

Understanding the difference between shadow inflation and transitory inflation is crucial for accurately assessing economic stability and making informed monetary policies. Shadow inflation reflects hidden price increases not captured in official statistics, affecting consumer purchasing power and wage negotiations. Transitory inflation represents temporary price spikes due to supply shocks or seasonal factors, which typically stabilize without long-term economic impact. Differentiating these helps policymakers implement targeted interventions to sustain economic growth and control inflation expectations.

Comparison Table

| Aspect | Shadow Inflation | Transitory Inflation |

|---|---|---|

| Definition | Hidden price increases through downsizing or reduced quality without changing the price. | Temporary price increases due to short-term factors like supply chain disruptions. |

| Duration | Long-term and often unnoticed over time. | Short-term, lasting months to a few quarters. |

| Measurement | Difficult to track with traditional CPI because price stickers remain unchanged. | Captured by standard inflation indices such as CPI and PPI. |

| Causes | Corporate strategies to maintain price points while increasing profits. | Supply shortages, demand spikes, or external shocks. |

| Impact on Consumers | Consumers pay effectively more for less, often unnoticed. | Consumers face higher prices temporarily, often expecting relief soon. |

| Policy Response | Less responsive due to measurement challenges. | Central banks may adjust interest rates to control inflation. |

Which is better?

Shadow inflation offers a more comprehensive measure of rising costs by including quality reductions and hidden price increases, revealing deeper consumer purchasing power erosion than transitory inflation, which captures only short-term, temporary price changes due to supply shocks or seasonal factors. Unlike transitory inflation, which is often overlooked by policymakers due to its fleeting nature, shadow inflation highlights persistent economic pressures affecting household budgets and savings behavior. Understanding shadow inflation is crucial for accurate inflation targeting and effective monetary policy decisions to maintain economic stability.

Connection

Shadow inflation and transitory inflation are interconnected as both reflect hidden price increases that affect consumer purchasing power differently. Shadow inflation captures unobserved changes through quality adjustments or product substitutions, while transitory inflation refers to temporary price rises influenced by supply chain disruptions and market volatility. Understanding their relationship helps economists predict long-term inflationary trends and develop targeted monetary policies.

Key Terms

Price Index

Transitory inflation refers to short-term price increases often driven by supply chain disruptions or one-off fiscal policies, which typically normalize within months, whereas shadow inflation captures hidden cost pressures like shrinking package sizes or downgraded product quality that do not directly show up in official Price Index calculations. The Consumer Price Index (CPI) may understate true inflation in the presence of shadow inflation due to its reliance on fixed-weight baskets and quality adjustments, leading to discrepancies between reported inflation and consumers' lived experiences. Explore further insights on how Price Index methodologies adapt to evolving inflation dynamics and consumer impact.

Market Basket

Transitory inflation refers to temporary price increases in a market basket of goods that are expected to normalize over time, whereas shadow inflation captures hidden costs like downsizing product sizes or quality reductions without price changes. Market basket analysis reveals transitory inflation through direct price tracking, while shadow inflation requires scrutiny of product attributes and quantity adjustments to gauge true cost impact. Explore deeper insights into how these inflation types reshape consumer purchasing power and economic measurements.

Hidden Costs

Transitory inflation reflects short-term price increases driven by temporary factors such as supply chain disruptions or seasonal demand, whereas shadow inflation involves hidden costs where product sizes shrink or quality diminishes without obvious price hikes. These hidden costs erode consumer purchasing power, making it difficult to detect the true inflation rate through traditional price indexes. Explore more to understand how shadow inflation impacts your budget and financial planning.

Source and External Links

What Does 'Transitory Inflation' Really Mean? | AIER - Transitory inflation refers to a temporary increase in inflation that is eventually followed by a period of lower inflation or deflation, bringing the price level back to its original growth path without permanently elevated prices.

What Is Transitory Inflation? - SmartAsset - Transitory inflation is a temporary rise in prices that doesn't cause a lasting increase in inflation rates or permanently harm the economy; however, its use was criticized during the 2021-2022 inflation surge when inflation remained persistently high for an extended period.

dowidth.com

dowidth.com