Excess savings occur when individuals and businesses accumulate funds beyond their current consumption needs, often leading to reduced spending and slowed economic growth. Negative interest rates encourage borrowing and spending by charging banks for holding excess reserves, aiming to stimulate investment and consumption. Explore how the balance between excess savings and negative interest rates shapes monetary policy and economic stability.

Why it is important

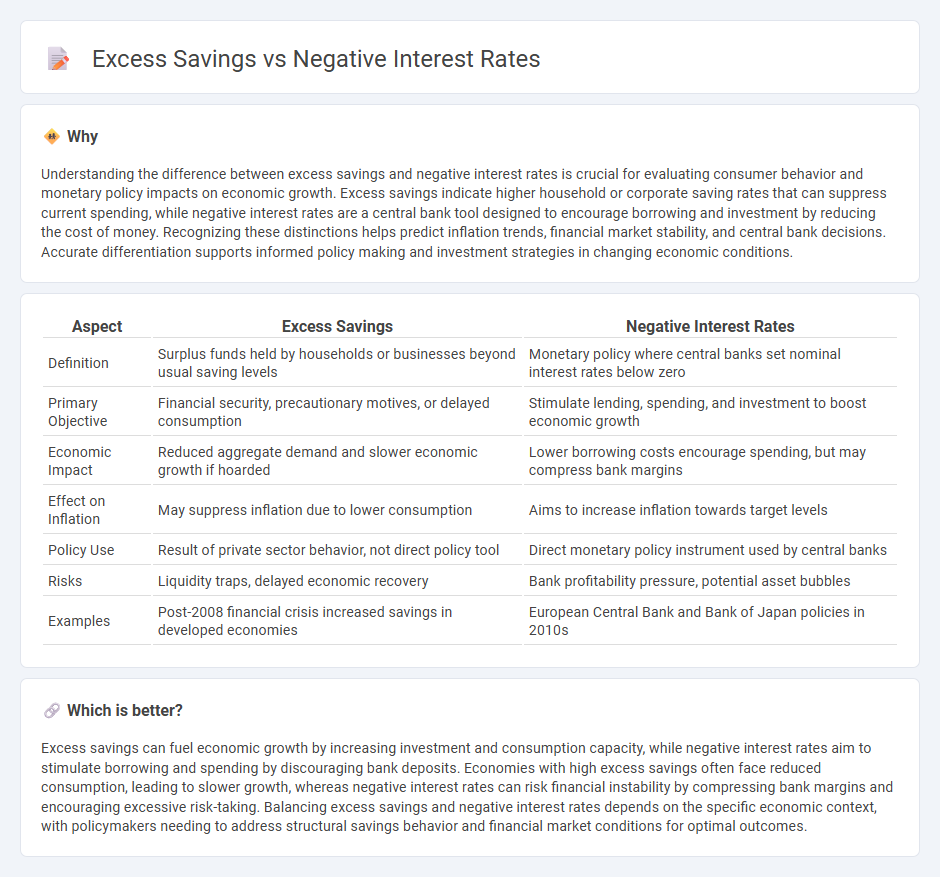

Understanding the difference between excess savings and negative interest rates is crucial for evaluating consumer behavior and monetary policy impacts on economic growth. Excess savings indicate higher household or corporate saving rates that can suppress current spending, while negative interest rates are a central bank tool designed to encourage borrowing and investment by reducing the cost of money. Recognizing these distinctions helps predict inflation trends, financial market stability, and central bank decisions. Accurate differentiation supports informed policy making and investment strategies in changing economic conditions.

Comparison Table

| Aspect | Excess Savings | Negative Interest Rates |

|---|---|---|

| Definition | Surplus funds held by households or businesses beyond usual saving levels | Monetary policy where central banks set nominal interest rates below zero |

| Primary Objective | Financial security, precautionary motives, or delayed consumption | Stimulate lending, spending, and investment to boost economic growth |

| Economic Impact | Reduced aggregate demand and slower economic growth if hoarded | Lower borrowing costs encourage spending, but may compress bank margins |

| Effect on Inflation | May suppress inflation due to lower consumption | Aims to increase inflation towards target levels |

| Policy Use | Result of private sector behavior, not direct policy tool | Direct monetary policy instrument used by central banks |

| Risks | Liquidity traps, delayed economic recovery | Bank profitability pressure, potential asset bubbles |

| Examples | Post-2008 financial crisis increased savings in developed economies | European Central Bank and Bank of Japan policies in 2010s |

Which is better?

Excess savings can fuel economic growth by increasing investment and consumption capacity, while negative interest rates aim to stimulate borrowing and spending by discouraging bank deposits. Economies with high excess savings often face reduced consumption, leading to slower growth, whereas negative interest rates can risk financial instability by compressing bank margins and encouraging excessive risk-taking. Balancing excess savings and negative interest rates depends on the specific economic context, with policymakers needing to address structural savings behavior and financial market conditions for optimal outcomes.

Connection

Excess savings in an economy often lead to increased demand for low-risk assets, pushing central banks to implement negative interest rates to stimulate borrowing and spending. Negative interest rates reduce the cost of borrowing, encouraging businesses and consumers to invest and consume rather than save. This monetary strategy aims to counteract the dampening effect of excess savings on economic growth by promoting liquidity and demand.

Key Terms

Liquidity Trap

Negative interest rates aim to incentivize borrowing and spending by pushing nominal rates below zero, yet their effectiveness is limited during a liquidity trap where excess savings persist despite low rates. Excess savings accumulate as households and businesses prefer liquidity over investment, weakening monetary policy transmission and stalling economic growth. Explore further how central banks navigate liquidity traps amid these complex financial dynamics.

Deflation

Negative interest rates often signal central banks' attempts to stimulate borrowing and spending during periods of deflation, while excess savings create downward pressure on prices by limiting consumer demand. Persistent deflation occurs when excess savings exceed investments, causing an economic imbalance that negative rates alone struggle to offset. Explore the intricate dynamics between these factors and their impact on deflationary risks in global economies.

Central Bank Policy

Central banks implement negative interest rates to stimulate borrowing and spending by charging banks for holding excess reserves, aiming to counteract sluggish economic growth and inflation below target levels. Excess savings, often resulting from high household or corporate saving rates, can lead to reduced consumption and investment, prompting central banks to adjust policies to balance liquidity without triggering deflationary pressures. Explore how central bank strategies evolve to address the complex interplay between negative interest rates and excess savings in modern monetary policy.

Source and External Links

What Are Negative Interest Rates? - Negative interest rates occur when central banks set rates below 0% to stimulate borrowing, spending, and economic growth, typically during recessions, but come with risks like reduced foreign investment and potential financial market disruption.

Negative Interest Rates - Overview, Effects, Risks - As a monetary policy tool, negative interest rates mean borrowers are paid to borrow and savers may be charged to hold deposits, aiming to discourage saving and boost consumption and investment, though prolonged use can hurt bank profitability and lending activity.

Back to Basics: What Are Negative Interest Rates? - Negative interest rates are used by central banks as an unconventional measure to encourage spending and investment over saving, but they can squeeze bank profits and, if not passed to depositors, may destabilize the financial system.

dowidth.com

dowidth.com