Biodiversity credits represent quantified environmental benefits that companies or individuals can purchase to offset adverse impacts on ecosystems, promoting conservation and restoration efforts. Habitat banking involves creating, enhancing, or preserving natural habitats in designated areas, generating credits that can be sold to developers needing to compensate for habitat loss elsewhere. Explore how these innovative market-based mechanisms drive sustainable economic growth and environmental stewardship.

Why it is important

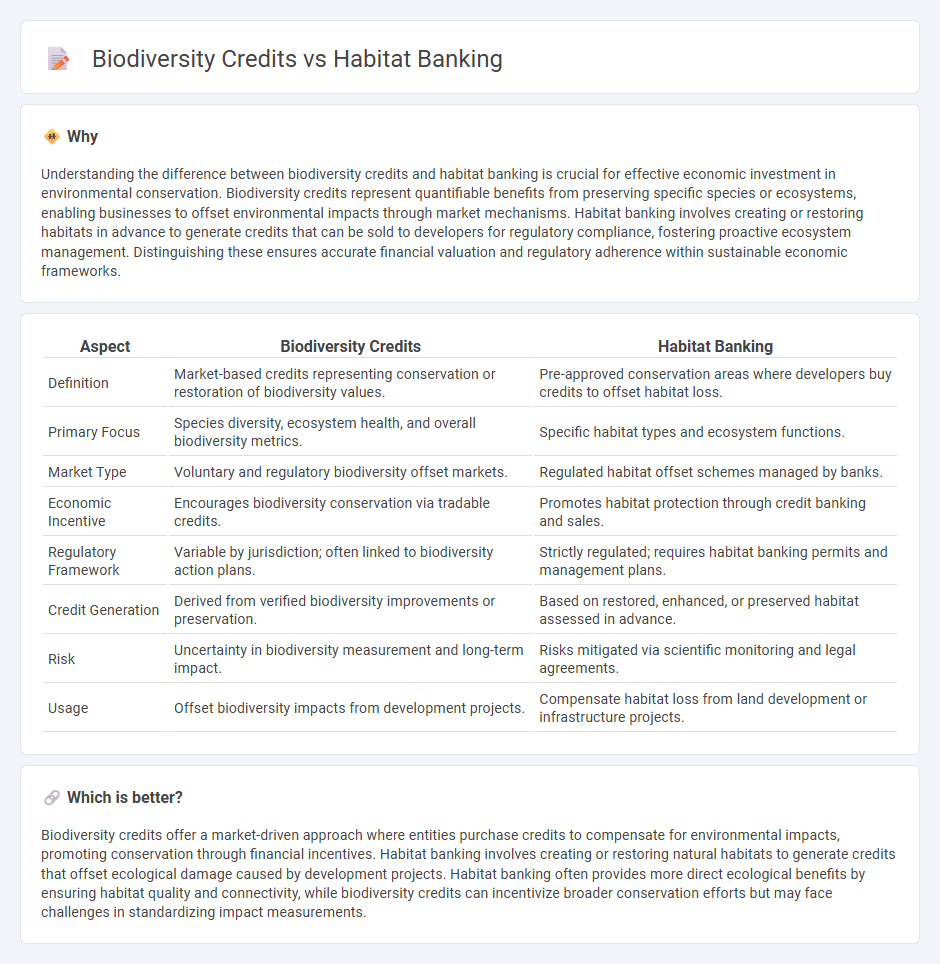

Understanding the difference between biodiversity credits and habitat banking is crucial for effective economic investment in environmental conservation. Biodiversity credits represent quantifiable benefits from preserving specific species or ecosystems, enabling businesses to offset environmental impacts through market mechanisms. Habitat banking involves creating or restoring habitats in advance to generate credits that can be sold to developers for regulatory compliance, fostering proactive ecosystem management. Distinguishing these ensures accurate financial valuation and regulatory adherence within sustainable economic frameworks.

Comparison Table

| Aspect | Biodiversity Credits | Habitat Banking |

|---|---|---|

| Definition | Market-based credits representing conservation or restoration of biodiversity values. | Pre-approved conservation areas where developers buy credits to offset habitat loss. |

| Primary Focus | Species diversity, ecosystem health, and overall biodiversity metrics. | Specific habitat types and ecosystem functions. |

| Market Type | Voluntary and regulatory biodiversity offset markets. | Regulated habitat offset schemes managed by banks. |

| Economic Incentive | Encourages biodiversity conservation via tradable credits. | Promotes habitat protection through credit banking and sales. |

| Regulatory Framework | Variable by jurisdiction; often linked to biodiversity action plans. | Strictly regulated; requires habitat banking permits and management plans. |

| Credit Generation | Derived from verified biodiversity improvements or preservation. | Based on restored, enhanced, or preserved habitat assessed in advance. |

| Risk | Uncertainty in biodiversity measurement and long-term impact. | Risks mitigated via scientific monitoring and legal agreements. |

| Usage | Offset biodiversity impacts from development projects. | Compensate habitat loss from land development or infrastructure projects. |

Which is better?

Biodiversity credits offer a market-driven approach where entities purchase credits to compensate for environmental impacts, promoting conservation through financial incentives. Habitat banking involves creating or restoring natural habitats to generate credits that offset ecological damage caused by development projects. Habitat banking often provides more direct ecological benefits by ensuring habitat quality and connectivity, while biodiversity credits can incentivize broader conservation efforts but may face challenges in standardizing impact measurements.

Connection

Biodiversity credits and habitat banking are interconnected mechanisms that promote environmental conservation through economic incentives. Habitat banking allows developers to purchase biodiversity credits generated by conserving or restoring habitats, offsetting their environmental impact. This market-based approach fosters sustainable land use while preserving ecosystems and supporting biodiversity.

Key Terms

Offset Mechanism

Habitat banking and biodiversity credits both serve as market-based offset mechanisms aimed at compensating for environmental impacts by preserving or restoring ecosystems, with habitat banking typically involving the creation or enhancement of specific habitats that generate credits traded for development projects. Biodiversity credits encompass a broader scope, including various ecosystem services and species protection metrics, enabling flexible conservation investments aligned with regulatory requirements or voluntary commitments. Explore the nuances and applications of these offset mechanisms to understand their potential in advancing effective biodiversity conservation strategies.

Tradable Credits

Habitat banking involves creating or restoring natural habitats to generate tradable credits that offset environmental impacts, whereas biodiversity credits represent quantifiable units of biodiversity gains from conservation efforts, also intended for trade. Both systems enable developers and companies to comply with legal or voluntary biodiversity offsetting requirements by purchasing these credits to mitigate their ecological footprint. Explore deeper insights into how habitat banking and biodiversity credits function within global conservation finance markets.

Ecosystem Services

Habitat banking and biodiversity credits both aim to conserve and restore ecosystem services, with habitat banking focusing on creating or improving habitats to offset environmental impacts, while biodiversity credits quantify the value of specific species or habitat characteristics. Ecosystem services such as water purification, pollination, and carbon sequestration are integral to both systems, ensuring that development projects maintain ecological balance. Explore how habitat banking and biodiversity credits drive sustainable environmental management and support ecosystem service preservation.

Source and External Links

Habitat Banking Explained - This PDF explains how habitat banks function by generating revenue through the sale of compensation credits mandated by environmental laws, investing in large-scale conservation projects.

Can Habitat Banks Save Nature? - This article discusses habitat banks as a conservation tool, highlighting their role in preserving biodiversity by creating and selling biodiversity credits.

Habitat Banks: A Pathway to Restoring Biodiversity - This article explores habitat banks as a profitable way to address biodiversity loss by aligning conservation goals with business interests through the sale of biodiversity credits.

dowidth.com

dowidth.com