Funflation describes rising prices fueled by increased consumer spending on entertainment and leisure, contrasting with deflation, where declining prices reflect reduced demand and economic contraction. This phenomenon impacts consumer behavior, inflation rates, and monetary policy decisions, influencing economic stability. Explore the dynamics of funflation versus deflation to understand their effects on market trends and financial strategies.

Why it is important

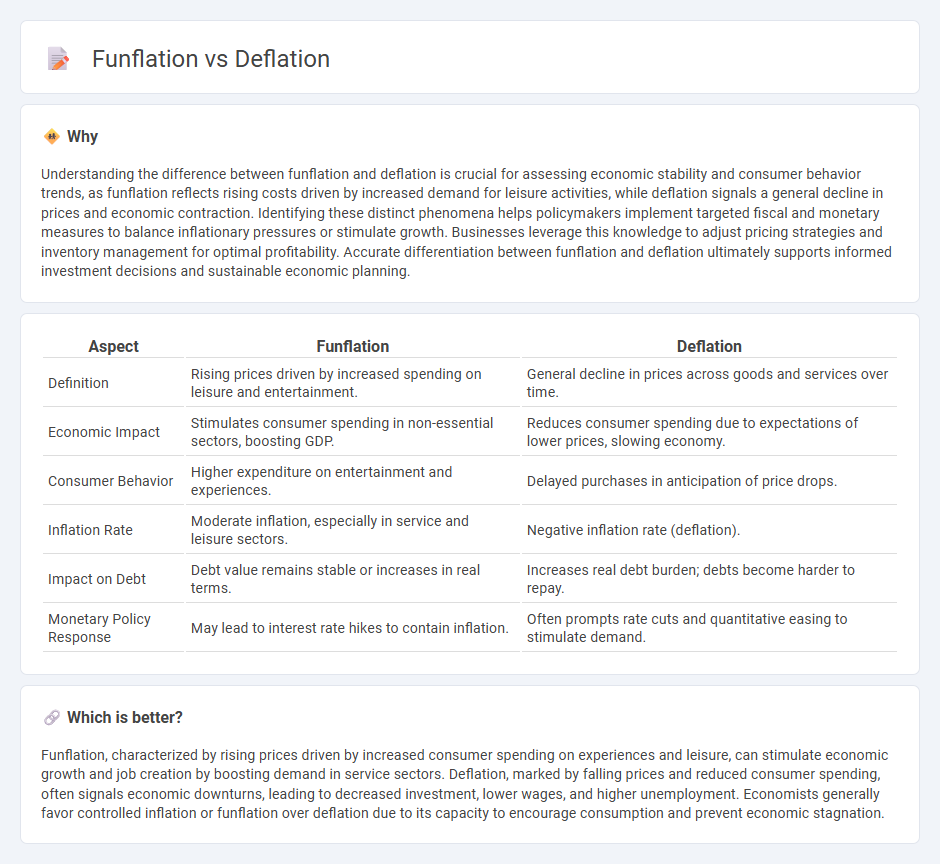

Understanding the difference between funflation and deflation is crucial for assessing economic stability and consumer behavior trends, as funflation reflects rising costs driven by increased demand for leisure activities, while deflation signals a general decline in prices and economic contraction. Identifying these distinct phenomena helps policymakers implement targeted fiscal and monetary measures to balance inflationary pressures or stimulate growth. Businesses leverage this knowledge to adjust pricing strategies and inventory management for optimal profitability. Accurate differentiation between funflation and deflation ultimately supports informed investment decisions and sustainable economic planning.

Comparison Table

| Aspect | Funflation | Deflation |

|---|---|---|

| Definition | Rising prices driven by increased spending on leisure and entertainment. | General decline in prices across goods and services over time. |

| Economic Impact | Stimulates consumer spending in non-essential sectors, boosting GDP. | Reduces consumer spending due to expectations of lower prices, slowing economy. |

| Consumer Behavior | Higher expenditure on entertainment and experiences. | Delayed purchases in anticipation of price drops. |

| Inflation Rate | Moderate inflation, especially in service and leisure sectors. | Negative inflation rate (deflation). |

| Impact on Debt | Debt value remains stable or increases in real terms. | Increases real debt burden; debts become harder to repay. |

| Monetary Policy Response | May lead to interest rate hikes to contain inflation. | Often prompts rate cuts and quantitative easing to stimulate demand. |

Which is better?

Funflation, characterized by rising prices driven by increased consumer spending on experiences and leisure, can stimulate economic growth and job creation by boosting demand in service sectors. Deflation, marked by falling prices and reduced consumer spending, often signals economic downturns, leading to decreased investment, lower wages, and higher unemployment. Economists generally favor controlled inflation or funflation over deflation due to its capacity to encourage consumption and prevent economic stagnation.

Connection

Funflation and deflation are connected through their impact on consumer spending and price expectations in the economy. Funflation, characterized by rising prices in entertainment and leisure sectors despite broader economic challenges, contrasts with deflation's general decrease in prices and consumer demand. Both phenomena influence inflationary trends and purchasing behavior, shaping monetary policy decisions and economic growth.

Key Terms

Price Level

Deflation is characterized by a sustained decrease in the general price level, leading to increased purchasing power and potential economic slowdown due to reduced consumer spending. Funflation refers to rising prices specifically in entertainment, leisure, and lifestyle sectors, driven by increased demand and evolving consumer preferences despite overall inflation trends. Explore more about how these contrasting price level dynamics impact different economic sectors.

Consumer Demand

Deflation leads to decreased consumer demand as falling prices encourage delayed purchases, shrinking overall economic growth, whereas funflation boosts consumer spending by enhancing the value and enjoyment of goods and experiences despite rising costs. Funflation taps into emotional spending, driving demand through innovative, engaging products and services that justify higher prices. Explore how these contrasting economic forces shape market trends and consumer behavior more deeply.

Monetary Policy

Deflation, characterized by a sustained decrease in general price levels, impacts monetary policy by prompting central banks to lower interest rates and implement quantitative easing to stimulate economic activity. Funflation, a less conventional term describing rising prices driven by increased spending on entertainment and lifestyle experiences, challenges traditional monetary tools as it reflects shifting consumer priorities rather than pure economic contraction. Explore how central banks adapt their strategies to manage these contrasting inflation dynamics and their broader economic implications.

Source and External Links

Deflation | EBSCO Research Starters - Deflation is an economic phenomenon marked by decreased money supply or credit, causing a fall in prices, often signaling recession and leading to job losses, wage cuts, and business failures.

Deflation - Definition, Causes, Effects, Impact - Deflation is negative inflation where prices decline due to falling aggregate demand or rising aggregate supply, often linked to tight monetary policy and economic recessions.

Deflation - Wikipedia - Deflation occurs when inflation falls below 0%, increasing currency value but increasing real debt burden and possibly causing a deflationary spiral, typically resulting from excess supply or reduced demand.

dowidth.com

dowidth.com