Carbon border adjustment imposes tariffs on imported goods based on their carbon emissions, encouraging cleaner production globally. Pollution permits, or cap-and-trade systems, allocate emission allowances that companies can buy or sell, creating a market-driven approach to reducing pollution. Explore how these mechanisms shape international trade and environmental policy for a sustainable economy.

Why it is important

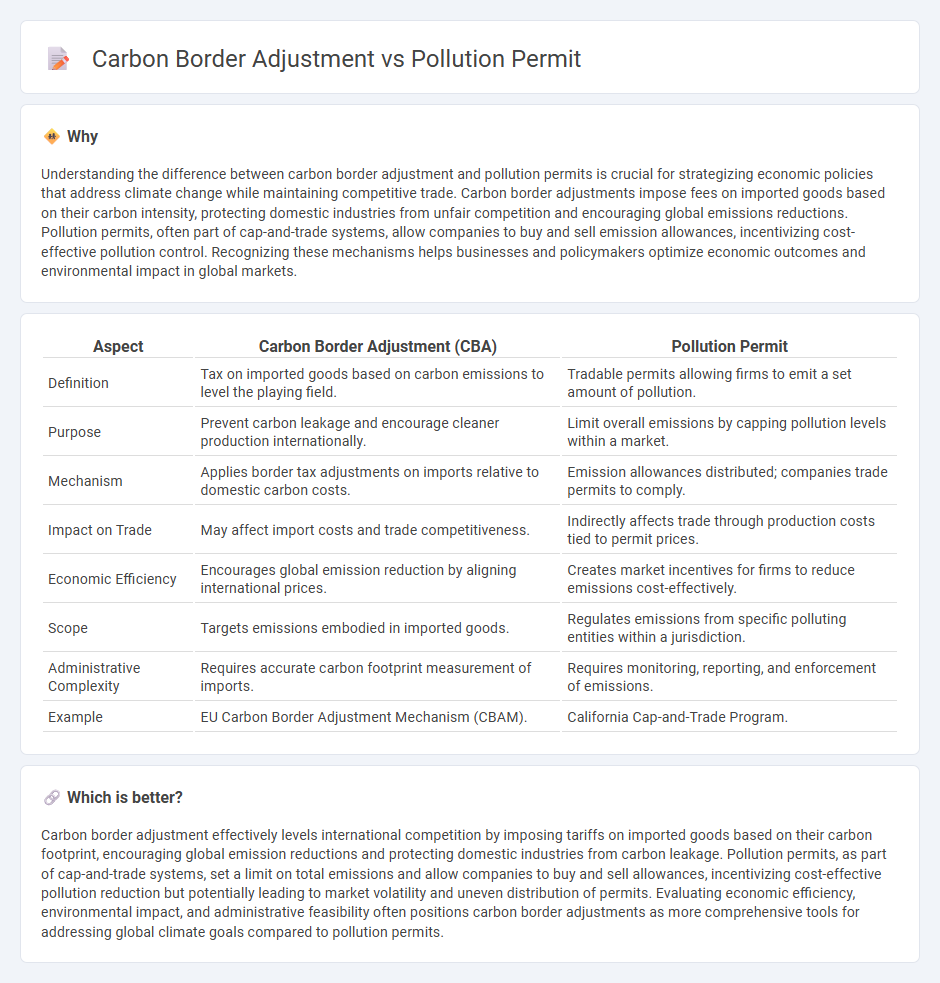

Understanding the difference between carbon border adjustment and pollution permits is crucial for strategizing economic policies that address climate change while maintaining competitive trade. Carbon border adjustments impose fees on imported goods based on their carbon intensity, protecting domestic industries from unfair competition and encouraging global emissions reductions. Pollution permits, often part of cap-and-trade systems, allow companies to buy and sell emission allowances, incentivizing cost-effective pollution control. Recognizing these mechanisms helps businesses and policymakers optimize economic outcomes and environmental impact in global markets.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Pollution Permit |

|---|---|---|

| Definition | Tax on imported goods based on carbon emissions to level the playing field. | Tradable permits allowing firms to emit a set amount of pollution. |

| Purpose | Prevent carbon leakage and encourage cleaner production internationally. | Limit overall emissions by capping pollution levels within a market. |

| Mechanism | Applies border tax adjustments on imports relative to domestic carbon costs. | Emission allowances distributed; companies trade permits to comply. |

| Impact on Trade | May affect import costs and trade competitiveness. | Indirectly affects trade through production costs tied to permit prices. |

| Economic Efficiency | Encourages global emission reduction by aligning international prices. | Creates market incentives for firms to reduce emissions cost-effectively. |

| Scope | Targets emissions embodied in imported goods. | Regulates emissions from specific polluting entities within a jurisdiction. |

| Administrative Complexity | Requires accurate carbon footprint measurement of imports. | Requires monitoring, reporting, and enforcement of emissions. |

| Example | EU Carbon Border Adjustment Mechanism (CBAM). | California Cap-and-Trade Program. |

Which is better?

Carbon border adjustment effectively levels international competition by imposing tariffs on imported goods based on their carbon footprint, encouraging global emission reductions and protecting domestic industries from carbon leakage. Pollution permits, as part of cap-and-trade systems, set a limit on total emissions and allow companies to buy and sell allowances, incentivizing cost-effective pollution reduction but potentially leading to market volatility and uneven distribution of permits. Evaluating economic efficiency, environmental impact, and administrative feasibility often positions carbon border adjustments as more comprehensive tools for addressing global climate goals compared to pollution permits.

Connection

Carbon border adjustment mechanisms and pollution permits are interconnected tools designed to reduce carbon emissions by incentivizing cleaner production practices. Carbon border adjustments impose tariffs on imported goods based on their carbon content, ensuring that foreign producers face similar regulatory costs as domestic firms under pollution permit schemes, such as cap-and-trade systems. This alignment helps prevent carbon leakage and promotes global emissions reduction by creating a level playing field for carbon pricing.

Key Terms

Cap-and-Trade

Pollution permits under Cap-and-Trade systems set a firm cap on emissions, allowing companies to buy and sell allowances to meet regulatory limits efficiently, thereby reducing overall pollution. Carbon Border Adjustment Mechanisms (CBAM) impose tariffs on imported goods based on their carbon footprint, preventing carbon leakage and ensuring fair competition between domestic and foreign producers. Explore the impact of Cap-and-Trade and CBAM on global carbon markets and climate policy for deeper insights.

Carbon Leakage

Pollution permits and carbon border adjustment mechanisms both target carbon leakage by regulating emissions, but pollution permits limit domestic emissions through tradable allowances, while carbon border adjustments impose tariffs on imported goods from countries with less stringent climate policies. The European Union's Emissions Trading System (EU ETS) exemplifies pollution permits, whereas the proposed Carbon Border Adjustment Mechanism (CBAM) aims to prevent carbon leakage by leveling the playing field for EU industries. Explore the implications of these tools on global trade and climate strategy.

Emissions Pricing

Pollution permits, often linked to cap-and-trade systems, establish a market-driven price for emissions, allowing companies to buy and sell allowances to meet regulatory limits. Carbon Border Adjustment Mechanisms (CBAM) impose tariffs on imported goods based on their carbon footprint to prevent carbon leakage and ensure fair competition. Explore how emissions pricing strategies like pollution permits and CBAM can drive global carbon reduction efforts.

Source and External Links

Pollution Permits - Economics Help - Pollution permits legally allow firms to emit a certain amount of pollutants, and firms can trade these permits, creating market incentives to reduce pollution over time by setting a cap and gradually reducing permits.

Pollution permit trading | EBSCO Research Starters - Pollution permit trading (cap-and-trade) is a market-based system where companies buy and sell emission rights under a total emissions cap to achieve cost-effective pollution management and encourage innovation.

The Pros and Cons of Pollution Permit Trading - Seaside Sustainability - Pollution permit trading offers cost-effective pollution reductions, market-driven incentives, and regulatory flexibility, enabling firms to reduce emissions or purchase permits, though it also faces some limitations.

dowidth.com

dowidth.com