Shrinkflation occurs when companies reduce product sizes or quantities while maintaining prices, effectively increasing the cost per unit and impacting consumer purchasing power. Hyperinflation is an extreme and rapid rise in prices, often exceeding 50% per month, leading to a severe erosion of currency value and economic stability. Explore how these inflationary phenomena differently affect markets and households worldwide.

Why it is important

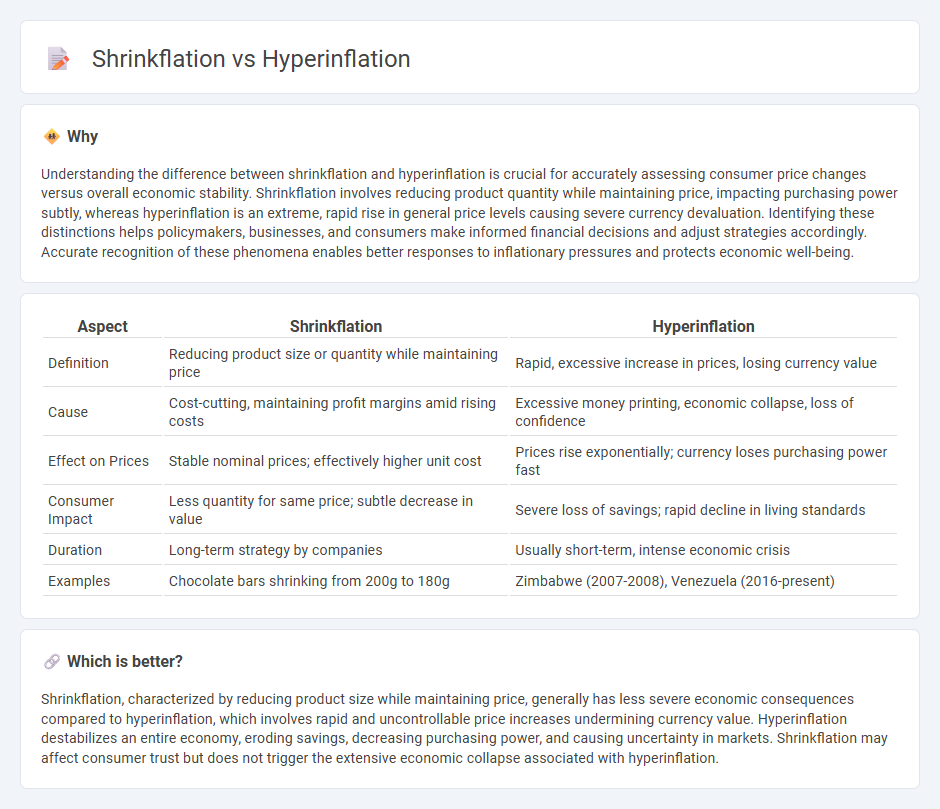

Understanding the difference between shrinkflation and hyperinflation is crucial for accurately assessing consumer price changes versus overall economic stability. Shrinkflation involves reducing product quantity while maintaining price, impacting purchasing power subtly, whereas hyperinflation is an extreme, rapid rise in general price levels causing severe currency devaluation. Identifying these distinctions helps policymakers, businesses, and consumers make informed financial decisions and adjust strategies accordingly. Accurate recognition of these phenomena enables better responses to inflationary pressures and protects economic well-being.

Comparison Table

| Aspect | Shrinkflation | Hyperinflation |

|---|---|---|

| Definition | Reducing product size or quantity while maintaining price | Rapid, excessive increase in prices, losing currency value |

| Cause | Cost-cutting, maintaining profit margins amid rising costs | Excessive money printing, economic collapse, loss of confidence |

| Effect on Prices | Stable nominal prices; effectively higher unit cost | Prices rise exponentially; currency loses purchasing power fast |

| Consumer Impact | Less quantity for same price; subtle decrease in value | Severe loss of savings; rapid decline in living standards |

| Duration | Long-term strategy by companies | Usually short-term, intense economic crisis |

| Examples | Chocolate bars shrinking from 200g to 180g | Zimbabwe (2007-2008), Venezuela (2016-present) |

Which is better?

Shrinkflation, characterized by reducing product size while maintaining price, generally has less severe economic consequences compared to hyperinflation, which involves rapid and uncontrollable price increases undermining currency value. Hyperinflation destabilizes an entire economy, eroding savings, decreasing purchasing power, and causing uncertainty in markets. Shrinkflation may affect consumer trust but does not trigger the extensive economic collapse associated with hyperinflation.

Connection

Shrinkflation and hyperinflation are connected through their shared impact on the purchasing power of consumers, with shrinkflation reducing product quantities while maintaining prices, effectively masking inflation, and hyperinflation causing rapid, excessive price increases that drastically erode currency value. Both phenomena reflect underlying inflationary pressures but manifest differently, with shrinkflation often used by producers as a stealth tactic during moderate inflation, and hyperinflation representing a severe economic crisis usually triggered by fiscal imbalances and loss of confidence in currency. Understanding their relationship helps in analyzing how inflation affects market dynamics, consumer behavior, and overall economic stability.

Key Terms

Money Supply

Hyperinflation occurs when the money supply rapidly expands, causing prices to surge dramatically as too much currency chases too few goods. Shrinkflation, in contrast, involves reducing product size or quantity while keeping prices steady, effectively eroding value without altering the money supply. Explore how these monetary dynamics impact consumer purchasing power and economic stability.

Price Index

Hyperinflation skyrockets the price index exponentially as currency value plummets, causing daily essentials to become unaffordable rapidly. Shrinkflation subtly distorts the price index by reducing product sizes while maintaining prices, misleading consumers about the real cost increase. Discover how these phenomena uniquely impact economic measurements and consumer perception.

Product Size

Hyperinflation causes a rapid increase in prices across the economy, leading to decreased purchasing power and forcing manufacturers to constantly adjust prices. Shrinkflation involves reducing the product size or quantity while maintaining the same price, effectively increasing the price per unit without overtly raising prices. Explore the detailed effects of these inflationary pressures on consumer products and market dynamics to understand their implications better.

Source and External Links

Hyperinflation | EBSCO Research Starters - Hyperinflation is a severe economic condition where prices increase extraordinarily rapidly, usually exceeding 50% per month, caused by excessive money printing without economic growth, leading to currency devaluation and financial crises as seen historically in Germany, Hungary, Zimbabwe, and Venezuela.

Hyperinflation - Wikipedia - Hyperinflation is very high and accelerating inflation that erodes currency value quickly, often triggered by government budget stresses like wars or political crises, and can lead to people abandoning the national currency in favor of more stable alternatives.

Hyperinflation: Definition, Causes, Effects and Examples - NetSuite - Hyperinflation, defined as price increases of 50% or more per month, occurs when there is a fundamental loss of trust in government, often following political upheaval, and results in the destruction of the national currency requiring its replacement with a stable one to restore control.

dowidth.com

dowidth.com