Biodiversity credits serve as tradable assets that quantify and monetize conservation efforts, promoting ecosystem protection and restoration. Environmental impact bonds function as performance-based financial instruments where investors fund environmental projects and receive returns based on achieved ecological outcomes. Explore how these innovative financial tools address ecological challenges and drive sustainable economic growth.

Why it is important

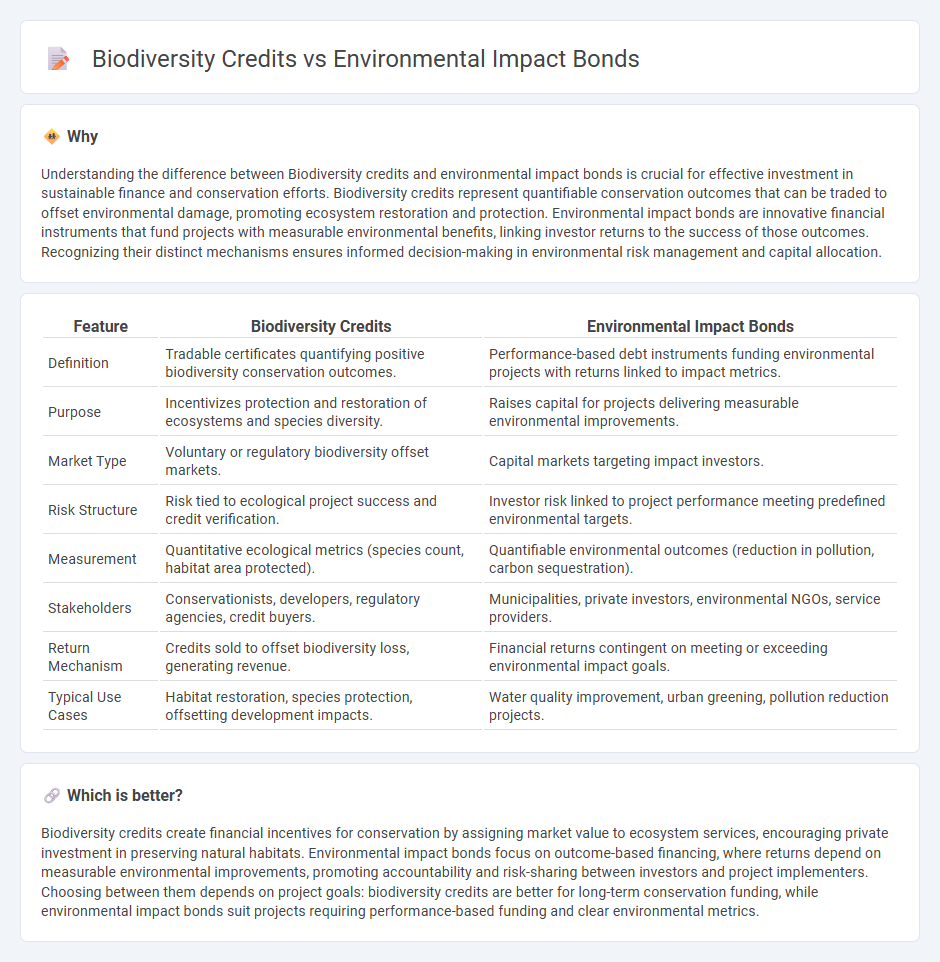

Understanding the difference between Biodiversity credits and environmental impact bonds is crucial for effective investment in sustainable finance and conservation efforts. Biodiversity credits represent quantifiable conservation outcomes that can be traded to offset environmental damage, promoting ecosystem restoration and protection. Environmental impact bonds are innovative financial instruments that fund projects with measurable environmental benefits, linking investor returns to the success of those outcomes. Recognizing their distinct mechanisms ensures informed decision-making in environmental risk management and capital allocation.

Comparison Table

| Feature | Biodiversity Credits | Environmental Impact Bonds |

|---|---|---|

| Definition | Tradable certificates quantifying positive biodiversity conservation outcomes. | Performance-based debt instruments funding environmental projects with returns linked to impact metrics. |

| Purpose | Incentivizes protection and restoration of ecosystems and species diversity. | Raises capital for projects delivering measurable environmental improvements. |

| Market Type | Voluntary or regulatory biodiversity offset markets. | Capital markets targeting impact investors. |

| Risk Structure | Risk tied to ecological project success and credit verification. | Investor risk linked to project performance meeting predefined environmental targets. |

| Measurement | Quantitative ecological metrics (species count, habitat area protected). | Quantifiable environmental outcomes (reduction in pollution, carbon sequestration). |

| Stakeholders | Conservationists, developers, regulatory agencies, credit buyers. | Municipalities, private investors, environmental NGOs, service providers. |

| Return Mechanism | Credits sold to offset biodiversity loss, generating revenue. | Financial returns contingent on meeting or exceeding environmental impact goals. |

| Typical Use Cases | Habitat restoration, species protection, offsetting development impacts. | Water quality improvement, urban greening, pollution reduction projects. |

Which is better?

Biodiversity credits create financial incentives for conservation by assigning market value to ecosystem services, encouraging private investment in preserving natural habitats. Environmental impact bonds focus on outcome-based financing, where returns depend on measurable environmental improvements, promoting accountability and risk-sharing between investors and project implementers. Choosing between them depends on project goals: biodiversity credits are better for long-term conservation funding, while environmental impact bonds suit projects requiring performance-based funding and clear environmental metrics.

Connection

Biodiversity credits and environmental impact bonds both serve as innovative financial instruments aimed at funding conservation and sustainability projects. Biodiversity credits monetize ecosystem services by allowing companies to offset their environmental impacts, while environmental impact bonds provide upfront capital to projects with measurable ecological outcomes, repaid based on their success. Together, they create a market-driven approach to align economic incentives with biodiversity preservation and environmental restoration.

Key Terms

Performance-based returns

Environmental impact bonds (EIBs) offer performance-based returns by tying investor payouts to measurable environmental outcomes such as reduced pollution or enhanced ecosystem services, which are independently verified to ensure accountability. Biodiversity credits, meanwhile, generate returns based on the conservation and restoration of specific habitats or species populations, with performance metrics linked to biodiversity gains and compliance with regulatory standards. Explore more about how these innovative financial instruments drive sustainability through measurable environmental impact and return on investment.

Ecosystem services

Environmental impact bonds (EIBs) are financial instruments that fund conservation projects by linking returns to measurable ecosystem service outcomes, such as water purification and carbon sequestration. Biodiversity credits represent quantifiable units of biodiversity conservation generated by projects, often traded to offset environmental impacts while supporting habitat preservation and species protection. Explore how these innovative mechanisms drive investment in natural capital and promote sustainable ecosystem services.

Measurable biodiversity outcomes

Environmental impact bonds primarily focus on quantifiable environmental improvements, utilizing investor capital to fund projects with measurable outcomes such as habitat restoration or pollution reduction. Biodiversity credits create a market-driven approach to biodiversity conservation by assigning value to specific species or ecosystem services, enabling tradable credits reflective of tangible conservation gains. Explore detailed comparisons and case studies to understand how both tools deliver measurable biodiversity outcomes and drive sustainable investment.

Source and External Links

What is an Environmental Impact Bond - Environmental Impact Bonds (EIBs) are municipal bonds that provide ESG transparency and commit to predicting, evaluating, and reporting on environmental outcomes, helping fund nature-based solutions while expanding investor bases and enabling smarter capital spending decisions.

Environmental Impact Bonds: a common framework and ... - EIBs are structured financial instruments with repayment tied to environmental benefits realized through pay-for-performance models, linking environmental outcomes to financial returns with variable, fixed, or mixed repayment schemes.

ENVIRONMENTAL IMPACT BONDS (EIB). WHAT ARE ... - EIBs promote innovation by contracting for outcomes rather than outputs, reducing risk for public funders by linking repayment to performance and enabling municipalities to plan repayments over time while delivering verified environmental impacts.

dowidth.com

dowidth.com