Shadow inflation represents hidden price increases not captured by official statistics, often due to changes in product quality or package size, while structural inflation stems from fundamental shifts in the economy such as wage growth or supply chain adjustments. Understanding these distinctions is crucial for accurate economic analysis and policy-making, as conventional metrics may underestimate the true cost pressures faced by consumers. Explore more to grasp how these inflation types impact economic stability and decision-making.

Why it is important

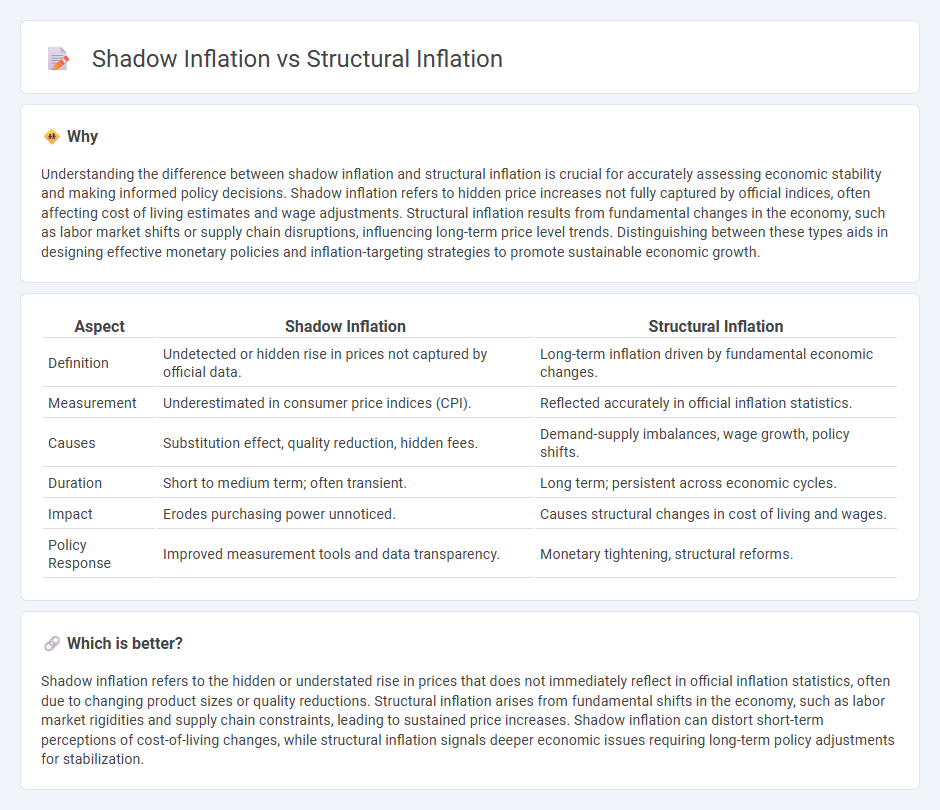

Understanding the difference between shadow inflation and structural inflation is crucial for accurately assessing economic stability and making informed policy decisions. Shadow inflation refers to hidden price increases not fully captured by official indices, often affecting cost of living estimates and wage adjustments. Structural inflation results from fundamental changes in the economy, such as labor market shifts or supply chain disruptions, influencing long-term price level trends. Distinguishing between these types aids in designing effective monetary policies and inflation-targeting strategies to promote sustainable economic growth.

Comparison Table

| Aspect | Shadow Inflation | Structural Inflation |

|---|---|---|

| Definition | Undetected or hidden rise in prices not captured by official data. | Long-term inflation driven by fundamental economic changes. |

| Measurement | Underestimated in consumer price indices (CPI). | Reflected accurately in official inflation statistics. |

| Causes | Substitution effect, quality reduction, hidden fees. | Demand-supply imbalances, wage growth, policy shifts. |

| Duration | Short to medium term; often transient. | Long term; persistent across economic cycles. |

| Impact | Erodes purchasing power unnoticed. | Causes structural changes in cost of living and wages. |

| Policy Response | Improved measurement tools and data transparency. | Monetary tightening, structural reforms. |

Which is better?

Shadow inflation refers to the hidden or understated rise in prices that does not immediately reflect in official inflation statistics, often due to changing product sizes or quality reductions. Structural inflation arises from fundamental shifts in the economy, such as labor market rigidities and supply chain constraints, leading to sustained price increases. Shadow inflation can distort short-term perceptions of cost-of-living changes, while structural inflation signals deeper economic issues requiring long-term policy adjustments for stabilization.

Connection

Shadow inflation and structural inflation are interconnected through their impact on the economy's real purchasing power and price stability. Shadow inflation occurs when rising costs and prices are not immediately reflected in official inflation statistics, often caused by hidden price increases or quality reductions. Structural inflation represents persistent inflation driven by fundamental factors such as wage-price spirals, rigid labor markets, and supply chain constraints, where shadow inflation can exacerbate these underlying pressures by masking true inflationary trends.

Key Terms

Market Distortions

Structural inflation results from fundamental shifts in economic factors such as labor markets, production costs, and persistent supply chain inefficiencies, leading to sustained price increases and altered market dynamics. Shadow inflation, often manifested through hidden or indirect price pressures like quality reductions and unrecorded cost hikes, distorts official inflation measures and obscures true market conditions. Explore how these inflation types uniquely impact market distortions and influence economic policy decisions.

Hidden Price Increases

Structural inflation arises from deep-rooted economic factors like labor costs, supply chain inefficiencies, and persistent demand-supply mismatches, leading to sustained price rises across industries. Shadow inflation refers to hidden price increases where products shrink in size or quality without an obvious change in price, subtly eroding consumer value while official inflation metrics may remain lower. Explore how these two inflation types impact purchasing power and economic stability to better understand hidden cost dynamics.

Supply Chain Rigidities

Structural inflation stems from persistent supply chain rigidities such as labor shortages, production bottlenecks, and inflexible logistics that prevent market adjustments and maintain elevated price levels over time. Shadow inflation reflects market distortions caused by temporary supply disruptions or hidden costs that are not immediately visible in official inflation metrics but influence consumer prices. Explore the nuances between structural and shadow inflation to better understand their distinct impacts on supply chain dynamics and inflationary pressures.

Source and External Links

Trend inflation and structural shocks - Structural inflation is primarily driven by four types of shocks: price mark-up and government policy shocks increase inflation, while finance and productivity shocks have a deflationary effect.

The "five Ds" of structurally higher inflation - Structural inflation in the long term is shaped by decarbonization, demographics, digitalization, deglobalization, and debt, with the net effect likely to be inflationary due to tightening labor markets, rising costs, and increased corporate pricing power.

STRUCTURAL INFLATION definition - Structural inflation refers to inflation caused by factors inherent to the economy's structure or government policy, rather than temporary fluctuations in supply and demand.

dowidth.com

dowidth.com