De-dollarization involves reducing reliance on the US dollar in international trade and finance, aiming to stabilize economies against dollar fluctuations and geopolitical risks. Bimetallism advocates for a monetary system based on two metals, typically gold and silver, to enhance currency stability and diversify reserves. Explore the impacts and potential benefits of these approaches in reshaping global economic dynamics.

Why it is important

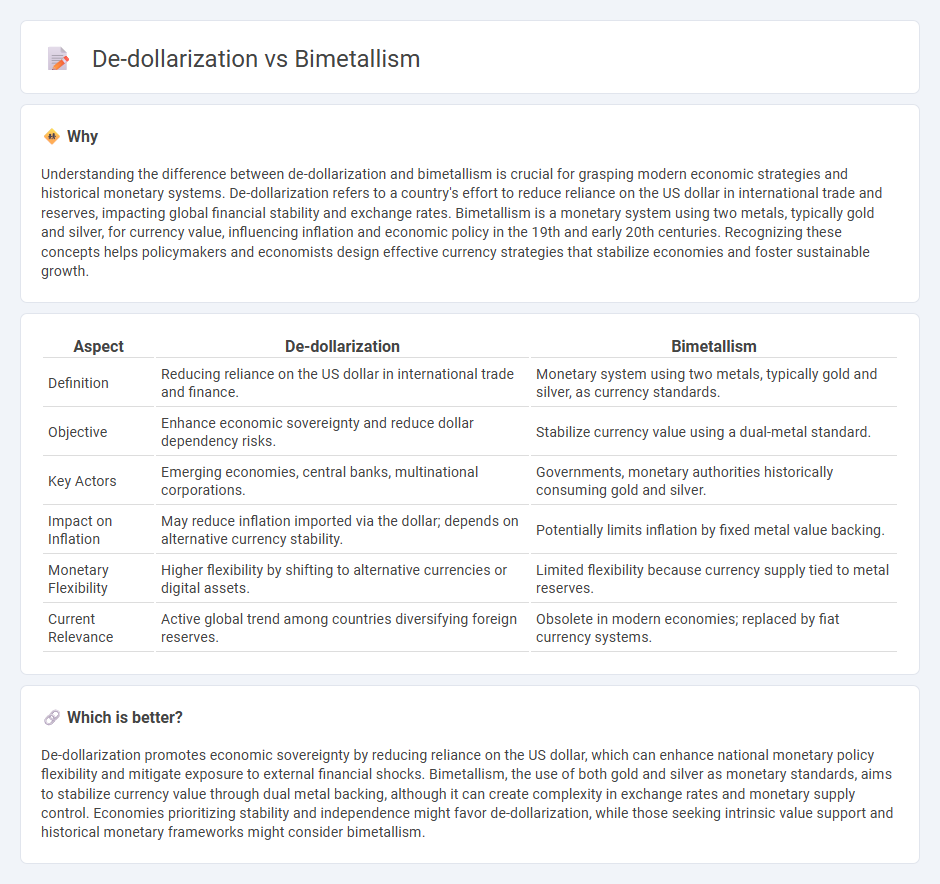

Understanding the difference between de-dollarization and bimetallism is crucial for grasping modern economic strategies and historical monetary systems. De-dollarization refers to a country's effort to reduce reliance on the US dollar in international trade and reserves, impacting global financial stability and exchange rates. Bimetallism is a monetary system using two metals, typically gold and silver, for currency value, influencing inflation and economic policy in the 19th and early 20th centuries. Recognizing these concepts helps policymakers and economists design effective currency strategies that stabilize economies and foster sustainable growth.

Comparison Table

| Aspect | De-dollarization | Bimetallism |

|---|---|---|

| Definition | Reducing reliance on the US dollar in international trade and finance. | Monetary system using two metals, typically gold and silver, as currency standards. |

| Objective | Enhance economic sovereignty and reduce dollar dependency risks. | Stabilize currency value using a dual-metal standard. |

| Key Actors | Emerging economies, central banks, multinational corporations. | Governments, monetary authorities historically consuming gold and silver. |

| Impact on Inflation | May reduce inflation imported via the dollar; depends on alternative currency stability. | Potentially limits inflation by fixed metal value backing. |

| Monetary Flexibility | Higher flexibility by shifting to alternative currencies or digital assets. | Limited flexibility because currency supply tied to metal reserves. |

| Current Relevance | Active global trend among countries diversifying foreign reserves. | Obsolete in modern economies; replaced by fiat currency systems. |

Which is better?

De-dollarization promotes economic sovereignty by reducing reliance on the US dollar, which can enhance national monetary policy flexibility and mitigate exposure to external financial shocks. Bimetallism, the use of both gold and silver as monetary standards, aims to stabilize currency value through dual metal backing, although it can create complexity in exchange rates and monetary supply control. Economies prioritizing stability and independence might favor de-dollarization, while those seeking intrinsic value support and historical monetary frameworks might consider bimetallism.

Connection

De-dollarization reduces reliance on the US dollar in international trade, encouraging countries to explore alternative monetary systems like bimetallism, which uses both gold and silver as legal tender. Bimetallism aims to stabilize currency values by balancing the supply and demand of two metals, providing a hedge against dollar volatility and inflation. This shift supports economic diversification and enhances monetary sovereignty, mitigating risks associated with dollar dominance.

Key Terms

Gold-Silver Standard

The Gold-Silver Standard under bimetallism establishes fixed exchange rates between gold and silver, influencing currency stability and trade balances. De-dollarization involves reducing reliance on the U.S. dollar in international trade and finance, often prompting countries to explore alternative standards like bimetallism for monetary sovereignty. Explore further insights into how these monetary strategies impact global economic dynamics.

Reserve Currency

Bimetallism involves a monetary system using two metals, typically gold and silver, as legal tender to stabilize currency value, while de-dollarization refers to reducing reliance on the US dollar in international trade and reserves. Central banks adopt bimetallism to hedge against currency volatility, whereas de-dollarization strategies diversify foreign exchange reserves through alternatives like the euro, yuan, or gold. Explore deeper insights into how these financial mechanisms impact global reserve currency dynamics and economic sovereignty.

Exchange Rate System

Bimetallism is a monetary system where two metals, typically gold and silver, are used as legal tender at a fixed ratio, influencing exchange rates through metal valuation. De-dollarization entails reducing reliance on the U.S. dollar in international trade and reserves, often causing shifts in exchange rate dynamics as countries adopt alternative currencies or basket approaches. Explore how these exchange rate systems shape global economic stability and monetary policy.

Source and External Links

Bimetallism Definition & History - This webpage provides an overview of bimetallism as a monetary system based on two metals, typically gold and silver, allowing for the exchange of paper money for either metal.

Bimetallic Standard and Bimetallism - This webpage introduces the concept of a bimetallic standard, where the monetary unit is defined as consisting of either gold or silver, with examples from the United States in the 19th century.

Bimetallism, Free Silver Movement, Facts - This webpage discusses bimetallism as a monetary policy allowing the use of gold and silver as currency, highlighting its role in the United States during the Gilded Age.

dowidth.com

dowidth.com