Polycrisis describes the simultaneous occurrence of multiple, interconnected economic crises that amplify overall systemic risk, while sovereign default occurs when a country fails to meet its debt obligations, triggering severe financial instability. Understanding the dynamics between polycrisis and sovereign default is crucial for assessing global economic resilience and predicting potential market disruptions. Explore further to learn how these phenomena impact international economies and investment strategies.

Why it is important

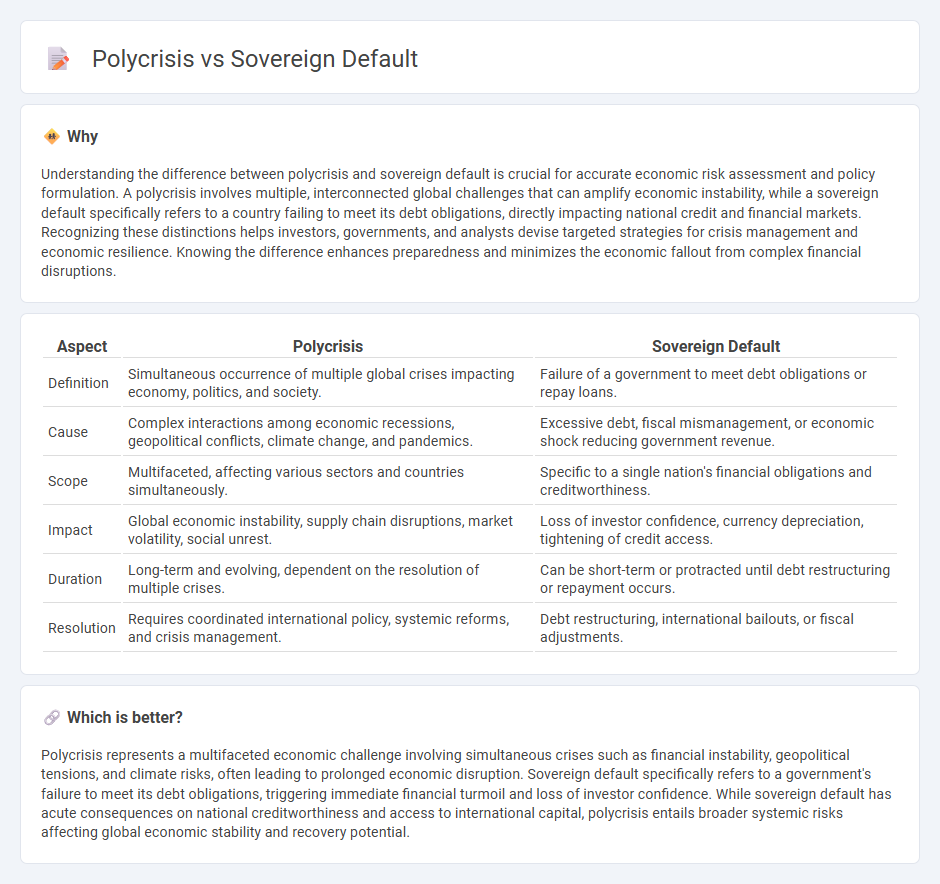

Understanding the difference between polycrisis and sovereign default is crucial for accurate economic risk assessment and policy formulation. A polycrisis involves multiple, interconnected global challenges that can amplify economic instability, while a sovereign default specifically refers to a country failing to meet its debt obligations, directly impacting national credit and financial markets. Recognizing these distinctions helps investors, governments, and analysts devise targeted strategies for crisis management and economic resilience. Knowing the difference enhances preparedness and minimizes the economic fallout from complex financial disruptions.

Comparison Table

| Aspect | Polycrisis | Sovereign Default |

|---|---|---|

| Definition | Simultaneous occurrence of multiple global crises impacting economy, politics, and society. | Failure of a government to meet debt obligations or repay loans. |

| Cause | Complex interactions among economic recessions, geopolitical conflicts, climate change, and pandemics. | Excessive debt, fiscal mismanagement, or economic shock reducing government revenue. |

| Scope | Multifaceted, affecting various sectors and countries simultaneously. | Specific to a single nation's financial obligations and creditworthiness. |

| Impact | Global economic instability, supply chain disruptions, market volatility, social unrest. | Loss of investor confidence, currency depreciation, tightening of credit access. |

| Duration | Long-term and evolving, dependent on the resolution of multiple crises. | Can be short-term or protracted until debt restructuring or repayment occurs. |

| Resolution | Requires coordinated international policy, systemic reforms, and crisis management. | Debt restructuring, international bailouts, or fiscal adjustments. |

Which is better?

Polycrisis represents a multifaceted economic challenge involving simultaneous crises such as financial instability, geopolitical tensions, and climate risks, often leading to prolonged economic disruption. Sovereign default specifically refers to a government's failure to meet its debt obligations, triggering immediate financial turmoil and loss of investor confidence. While sovereign default has acute consequences on national creditworthiness and access to international capital, polycrisis entails broader systemic risks affecting global economic stability and recovery potential.

Connection

Polycrisis, characterized by the simultaneous occurrence of multiple interconnected global challenges, exacerbates fiscal pressures on governments, increasing the risk of sovereign default. When compounded crises such as inflation, supply chain disruptions, and geopolitical tensions converge, they strain national budgets, reducing the capacity to meet debt obligations. Sovereign default becomes more likely as these economic shocks impair revenue streams and escalate borrowing costs, undermining financial stability.

Key Terms

Debt Restructuring

Sovereign default occurs when a country fails to meet its debt repayment obligations, often leading to complex debt restructuring negotiations involving creditors and international institutions. Polycrisis refers to the simultaneous occurrence of multiple crises, such as economic, financial, and political disruptions, which intensify challenges in managing sovereign debt and complicate restructuring efforts. Explore further to understand how these dynamics shape global financial stability and debt sustainability strategies.

Systemic Risk

Sovereign default significantly heightens systemic risk by triggering cascading financial failures across interconnected banks, markets, and economies due to the abrupt loss of government debt value. Polycrisis, characterized by the simultaneous occurrence of multiple crises such as economic instability, geopolitical conflict, and climate disasters, exponentially multiplies systemic vulnerabilities across global systems. Explore how these complex risk dynamics influence global financial stability and strategies for mitigation.

Contagion

Sovereign default contagion occurs when the failure of one country's debt payments spreads financial distress to other nations through interconnected banking systems and investor portfolios. Polycrisis contagion involves simultaneous or compounding crises--economic, social, and environmental--that amplify systemic risks and destabilize multiple sectors globally. Explore how these contagion dynamics interact to affect global stability and economic resilience.

Source and External Links

Sovereign default - Wikipedia - Sovereign default occurs when a government fails or refuses to fully repay its debts when due, often due to factors like excessive foreign debt, poor credit history, or economic insolvency from overspending and declining revenues.

Sovereign Default - Overview, Causes, Consequences - Sovereign default is the failure of a country to repay principal or interest on its debt leading to potential partial debt cancellation or debt restructuring with creditors.

Chapter 7. Sovereign Default - International Monetary Fund (IMF) - Sovereign default is a breach of debt contract by a state, involving missed payments or subordination, shaped by economic and legal factors and often analyzed through case studies of countries.

dowidth.com

dowidth.com