Biodiversity credits create financial incentives for preserving ecosystems by monetizing conservation efforts, while green bonds raise capital specifically for projects with environmental benefits, including renewable energy and pollution reduction. Both tools aim to drive sustainable investment but differ in structure and market mechanisms. Explore how these innovative financial solutions impact economic growth and environmental protection.

Why it is important

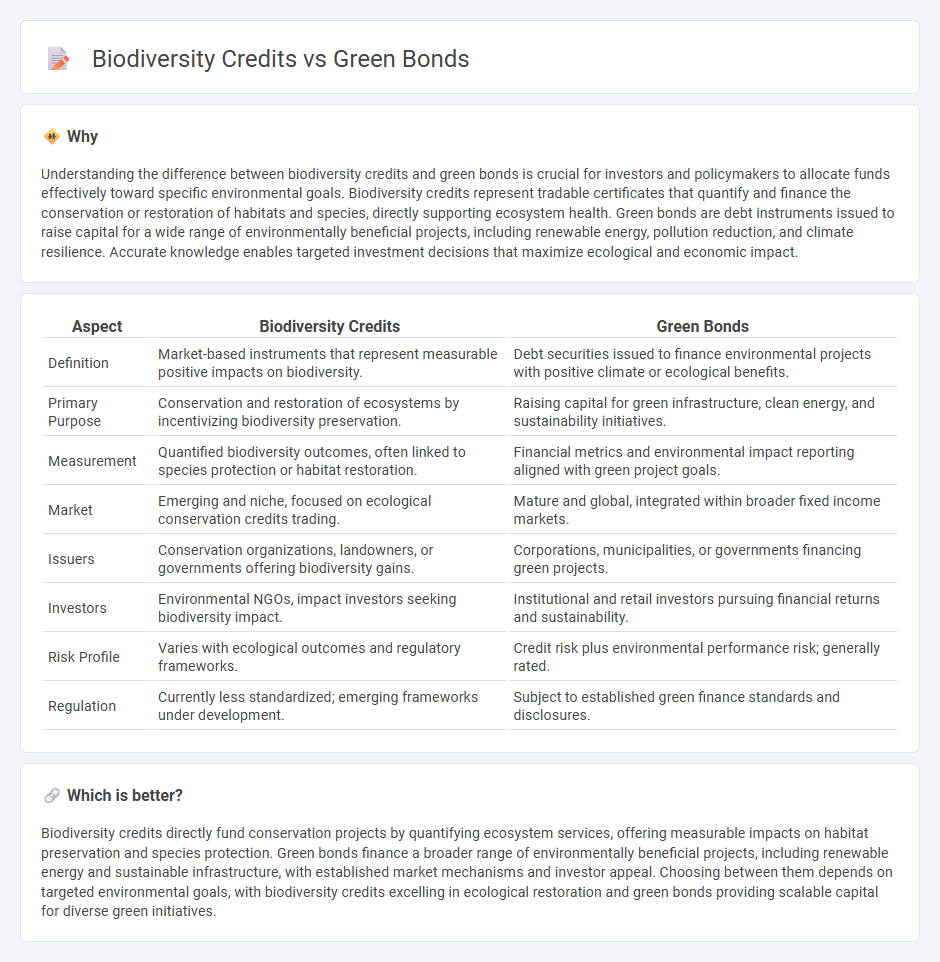

Understanding the difference between biodiversity credits and green bonds is crucial for investors and policymakers to allocate funds effectively toward specific environmental goals. Biodiversity credits represent tradable certificates that quantify and finance the conservation or restoration of habitats and species, directly supporting ecosystem health. Green bonds are debt instruments issued to raise capital for a wide range of environmentally beneficial projects, including renewable energy, pollution reduction, and climate resilience. Accurate knowledge enables targeted investment decisions that maximize ecological and economic impact.

Comparison Table

| Aspect | Biodiversity Credits | Green Bonds |

|---|---|---|

| Definition | Market-based instruments that represent measurable positive impacts on biodiversity. | Debt securities issued to finance environmental projects with positive climate or ecological benefits. |

| Primary Purpose | Conservation and restoration of ecosystems by incentivizing biodiversity preservation. | Raising capital for green infrastructure, clean energy, and sustainability initiatives. |

| Measurement | Quantified biodiversity outcomes, often linked to species protection or habitat restoration. | Financial metrics and environmental impact reporting aligned with green project goals. |

| Market | Emerging and niche, focused on ecological conservation credits trading. | Mature and global, integrated within broader fixed income markets. |

| Issuers | Conservation organizations, landowners, or governments offering biodiversity gains. | Corporations, municipalities, or governments financing green projects. |

| Investors | Environmental NGOs, impact investors seeking biodiversity impact. | Institutional and retail investors pursuing financial returns and sustainability. |

| Risk Profile | Varies with ecological outcomes and regulatory frameworks. | Credit risk plus environmental performance risk; generally rated. |

| Regulation | Currently less standardized; emerging frameworks under development. | Subject to established green finance standards and disclosures. |

Which is better?

Biodiversity credits directly fund conservation projects by quantifying ecosystem services, offering measurable impacts on habitat preservation and species protection. Green bonds finance a broader range of environmentally beneficial projects, including renewable energy and sustainable infrastructure, with established market mechanisms and investor appeal. Choosing between them depends on targeted environmental goals, with biodiversity credits excelling in ecological restoration and green bonds providing scalable capital for diverse green initiatives.

Connection

Biodiversity credits and green bonds are financial instruments designed to promote environmental sustainability by channeling investment into conservation and restoration projects. Biodiversity credits quantify the ecological value of preserving habitats or species, enabling businesses to offset their environmental impacts, while green bonds raise capital specifically for projects that deliver measurable environmental benefits. Together, they create a synergistic framework that incentivizes private sector participation and funds large-scale initiatives enhancing ecosystem resilience and biodiversity conservation.

Key Terms

Sustainable finance

Green bonds fund projects targeting environmental sustainability, such as renewable energy and pollution reduction, aligning with global climate goals. Biodiversity credits represent tradable permits focused on preserving ecosystems and species, incentivizing conservation efforts within sustainable finance frameworks. Explore the impact of these financial tools in driving ecological and climate resilience.

Ecosystem services

Green bonds finance projects that address climate change and promote environmental sustainability, often targeting renewable energy and pollution reduction. Biodiversity credits specifically support the preservation and restoration of ecosystems, directly enhancing ecosystem services such as habitat provision, water purification, and carbon sequestration. Explore how these financial instruments contribute differently to ecosystem service conservation and sustainable development.

Carbon offset

Green bonds finance projects targeting environmental sustainability, including carbon offset initiatives like renewable energy and reforestation. Biodiversity credits specifically fund conservation efforts that preserve ecosystems and enhance carbon sequestration while supporting biodiversity. Explore more to understand how these financial instruments uniquely contribute to carbon offset strategies.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income financial instrument used exclusively to fund projects with positive environmental benefits, such as renewable energy, clean transportation, and climate change adaptation, allowing investors to meet environmental and sustainability goals.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles provide voluntary guidelines promoting transparency and integrity in green bond issuance to finance projects fostering a net-zero emissions economy and environmental protection.

Climate Bonds | Homepage - The Climate Bonds Initiative sets a science-based standard to certify green bonds, ensuring alignment with climate goals and enhancing market integrity as the green bond market grows to hundreds of billions of dollars annually.

dowidth.com

dowidth.com