Soft saving emphasizes gradual, flexible reductions in expenses to improve financial stability without drastically impacting current operations. Soft budgeting refers to continuing financial support despite inefficiencies, often leading to resource misallocation and reduced economic discipline. Explore more to understand their consequences on fiscal policy and organizational efficiency.

Why it is important

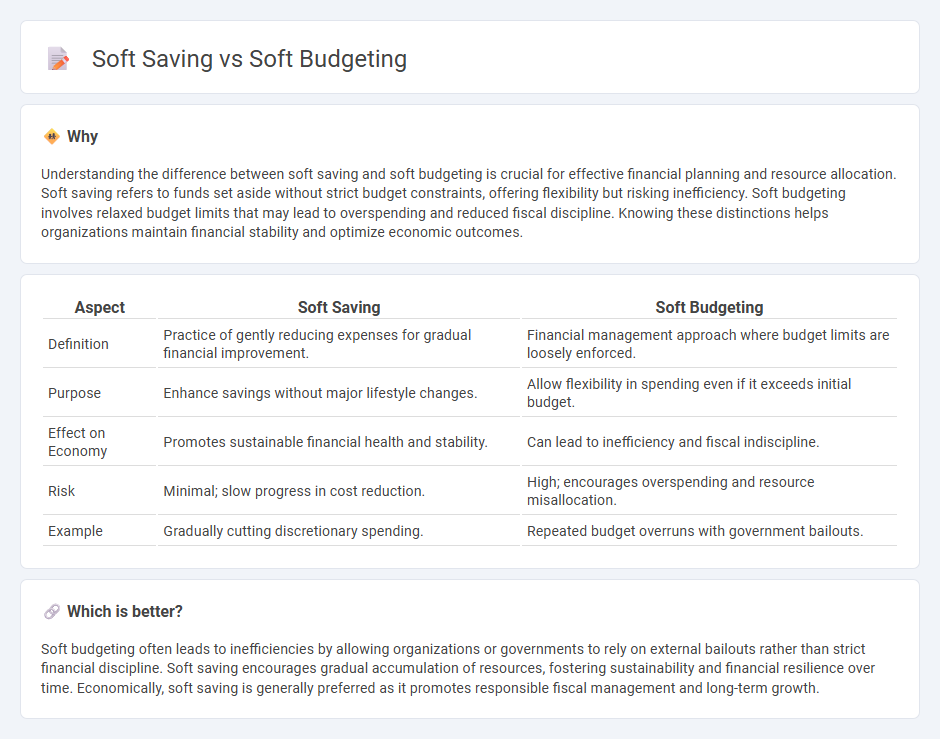

Understanding the difference between soft saving and soft budgeting is crucial for effective financial planning and resource allocation. Soft saving refers to funds set aside without strict budget constraints, offering flexibility but risking inefficiency. Soft budgeting involves relaxed budget limits that may lead to overspending and reduced fiscal discipline. Knowing these distinctions helps organizations maintain financial stability and optimize economic outcomes.

Comparison Table

| Aspect | Soft Saving | Soft Budgeting |

|---|---|---|

| Definition | Practice of gently reducing expenses for gradual financial improvement. | Financial management approach where budget limits are loosely enforced. |

| Purpose | Enhance savings without major lifestyle changes. | Allow flexibility in spending even if it exceeds initial budget. |

| Effect on Economy | Promotes sustainable financial health and stability. | Can lead to inefficiency and fiscal indiscipline. |

| Risk | Minimal; slow progress in cost reduction. | High; encourages overspending and resource misallocation. |

| Example | Gradually cutting discretionary spending. | Repeated budget overruns with government bailouts. |

Which is better?

Soft budgeting often leads to inefficiencies by allowing organizations or governments to rely on external bailouts rather than strict financial discipline. Soft saving encourages gradual accumulation of resources, fostering sustainability and financial resilience over time. Economically, soft saving is generally preferred as it promotes responsible fiscal management and long-term growth.

Connection

Soft saving refers to the practice of accumulating funds in non-liquid or less productive forms, often leading to inefficient capital allocation. Soft budgeting occurs when enterprises receive financial support or bailouts despite poor performance, fostering a dependency that discourages cost-conscious behavior and efficient saving. Both concepts are interconnected through their impact on economic inefficiency, where soft saving limits capital availability, and soft budgeting reduces incentives for fiscal discipline.

Key Terms

Fiscal Discipline

Soft budgeting often leads to inefficient allocation of resources as entities anticipate financial bailouts, undermining fiscal discipline and long-term sustainability. In contrast, soft saving encourages prudent financial management by promoting flexible yet consistent efforts to accumulate reserves without rigid constraints. Explore more about how maintaining fiscal discipline through balanced budgeting and saving strategies can drive economic resilience.

Bailout

Soft budgeting refers to the practice where organizations or governments provide financial bailouts to entities facing budget shortfalls, reducing the incentive for efficient management. Soft saving involves setting aside funds in a less rigid manner, often lacking strict budgetary discipline, which can lead to insufficient reserves during financial distress. Explore further to understand the implications of bailouts on fiscal responsibility and economic sustainability.

Incentive Structure

Soft budgeting often leads to diminished incentives for efficient resource allocation as organizations anticipate external financial support despite poor performance, reducing accountability. In contrast, soft saving encourages gradual accumulation of funds with flexible withdrawal options, fostering a balanced approach to spending while maintaining motivation for prudent financial management. Explore the detailed impact of these incentive structures on organizational behavior to understand their strategic implications.

Source and External Links

Soft Budget Constraint Definition & Examples - Quickonomics - A soft budget constraint refers to a situation where an entity, such as a government or state-owned enterprise, expects to receive financial support to cover its deficits and losses, rather than being forced to balance its budget.

Theories of the soft budget-constraint - Harvard University - In this context, a soft budget constraint arises when a funding source cannot commit to keeping an enterprise to a fixed budget, allowing the enterprise to extract additional funding from the government even if it operates inefficiently or unprofitably.

Understanding the Soft Budget Constraint - Journal of Economic Literature - The concept of a soft budget constraint is broadly used to classify and analyze the causes and consequences of situations where organizations are repeatedly bailed out, often leading to moral hazard and inefficiency in socialist, transitional, and even some market economies.

dowidth.com

dowidth.com