Carbon farming enhances soil carbon sequestration by promoting sustainable agricultural practices, directly reducing greenhouse gas emissions at the source. In contrast, carbon tax imposes a financial charge on carbon emissions, incentivizing businesses and consumers to lower their carbon footprint through economic means. Explore the economic impacts and effectiveness of carbon farming versus carbon tax to understand their roles in climate policy.

Why it is important

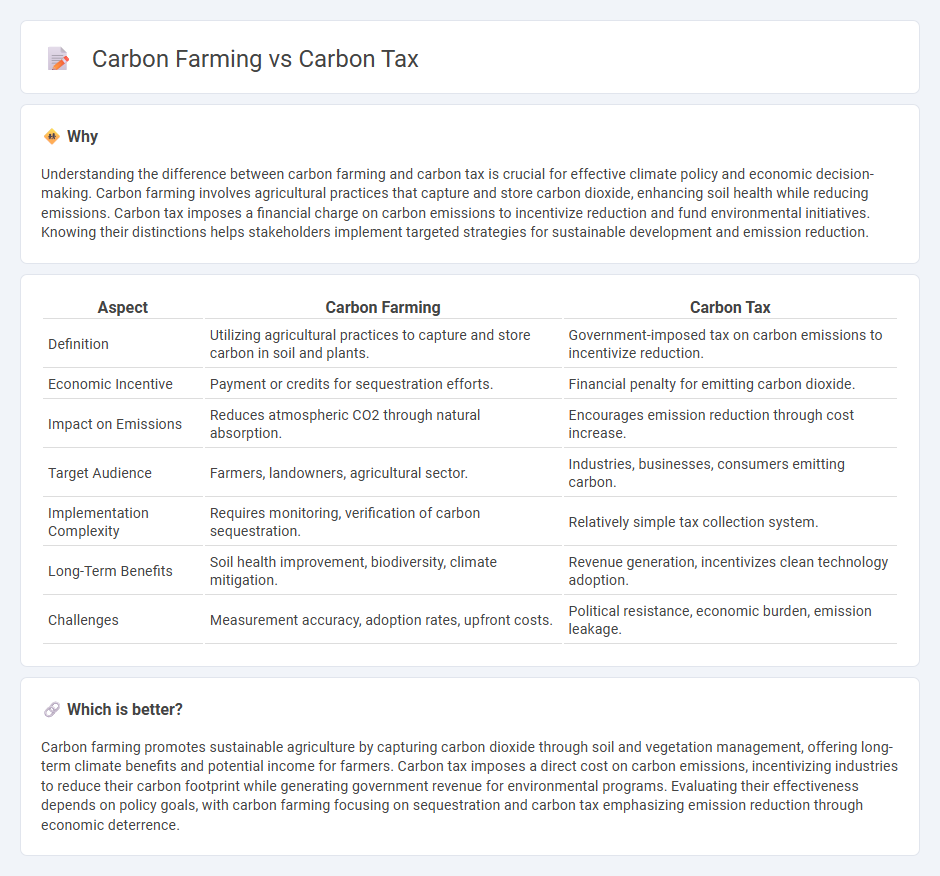

Understanding the difference between carbon farming and carbon tax is crucial for effective climate policy and economic decision-making. Carbon farming involves agricultural practices that capture and store carbon dioxide, enhancing soil health while reducing emissions. Carbon tax imposes a financial charge on carbon emissions to incentivize reduction and fund environmental initiatives. Knowing their distinctions helps stakeholders implement targeted strategies for sustainable development and emission reduction.

Comparison Table

| Aspect | Carbon Farming | Carbon Tax |

|---|---|---|

| Definition | Utilizing agricultural practices to capture and store carbon in soil and plants. | Government-imposed tax on carbon emissions to incentivize reduction. |

| Economic Incentive | Payment or credits for sequestration efforts. | Financial penalty for emitting carbon dioxide. |

| Impact on Emissions | Reduces atmospheric CO2 through natural absorption. | Encourages emission reduction through cost increase. |

| Target Audience | Farmers, landowners, agricultural sector. | Industries, businesses, consumers emitting carbon. |

| Implementation Complexity | Requires monitoring, verification of carbon sequestration. | Relatively simple tax collection system. |

| Long-Term Benefits | Soil health improvement, biodiversity, climate mitigation. | Revenue generation, incentivizes clean technology adoption. |

| Challenges | Measurement accuracy, adoption rates, upfront costs. | Political resistance, economic burden, emission leakage. |

Which is better?

Carbon farming promotes sustainable agriculture by capturing carbon dioxide through soil and vegetation management, offering long-term climate benefits and potential income for farmers. Carbon tax imposes a direct cost on carbon emissions, incentivizing industries to reduce their carbon footprint while generating government revenue for environmental programs. Evaluating their effectiveness depends on policy goals, with carbon farming focusing on sequestration and carbon tax emphasizing emission reduction through economic deterrence.

Connection

Carbon farming enhances soil carbon sequestration, directly reducing atmospheric CO2 levels, which can generate carbon credits that offset tax liabilities under carbon tax regimes. Carbon tax incentivizes businesses and farmers to adopt carbon farming practices by imposing fees on emissions, making sustainable land management financially viable. Integrating carbon farming with carbon tax policies drives economic shifts toward low-carbon agriculture and supports national carbon reduction targets.

Key Terms

Emissions pricing

Carbon tax directly sets a price per ton of CO2 emitted, creating a financial incentive for companies and individuals to reduce emissions. Carbon farming involves agricultural practices that capture carbon dioxide from the atmosphere, effectively generating carbon credits that can be sold or traded. Explore the detailed mechanisms and impacts of emissions pricing in carbon tax and carbon farming to understand their roles in climate policy.

Carbon sequestration

Carbon tax imposes a direct fee on carbon emissions to incentivize reduction, while carbon farming promotes carbon sequestration by enhancing soil carbon storage through agricultural practices. Carbon farming techniques such as cover cropping, agroforestry, and biochar application effectively capture atmospheric CO2, contributing to climate change mitigation. Explore the benefits and implementation strategies of carbon farming to maximize environmental and economic outcomes.

Market incentives

Carbon tax imposes a direct cost on carbon emissions, incentivizing businesses and consumers to reduce their carbon footprint by making polluting activities more expensive. Carbon farming provides market incentives through financial rewards for landowners who implement practices that capture and store carbon, such as reforestation and soil management. Explore how these market-based approaches drive sustainable environmental practices by learning more about carbon tax and carbon farming strategies.

Source and External Links

Carbon Tax: Definition, Pros and Cons, and Implementation - A carbon tax directly prices emissions from burning fossil fuels, incentivizing reductions by making polluters pay and allowing revenue to be used for rebates, tax offsets, or green investments.

What is a carbon tax? | Tax Policy Center - A carbon tax encourages lower emissions by putting a price on greenhouse gases, with the burden falling heaviest on energy-intensive industries and lower-income households, while revenue use can offset impacts or fund other priorities.

What You Need to Know About a Federal Carbon Tax in the United States - A carbon tax provides a financial incentive to reduce emissions by encouraging shifts to cleaner alternatives and accelerating innovation in low-carbon technologies, with the tax rate determining the scale of emission reductions.

dowidth.com

dowidth.com