Doom spending refers to the tendency of consumers to increase spending dramatically in response to anticipated economic hardship, driven by fear of future scarcity or inflation. Precautionary saving, on the other hand, involves setting aside funds to buffer against potential financial shocks, emphasizing financial security over immediate consumption. Explore the impacts of these contrasting behaviors on economic stability and growth.

Why it is important

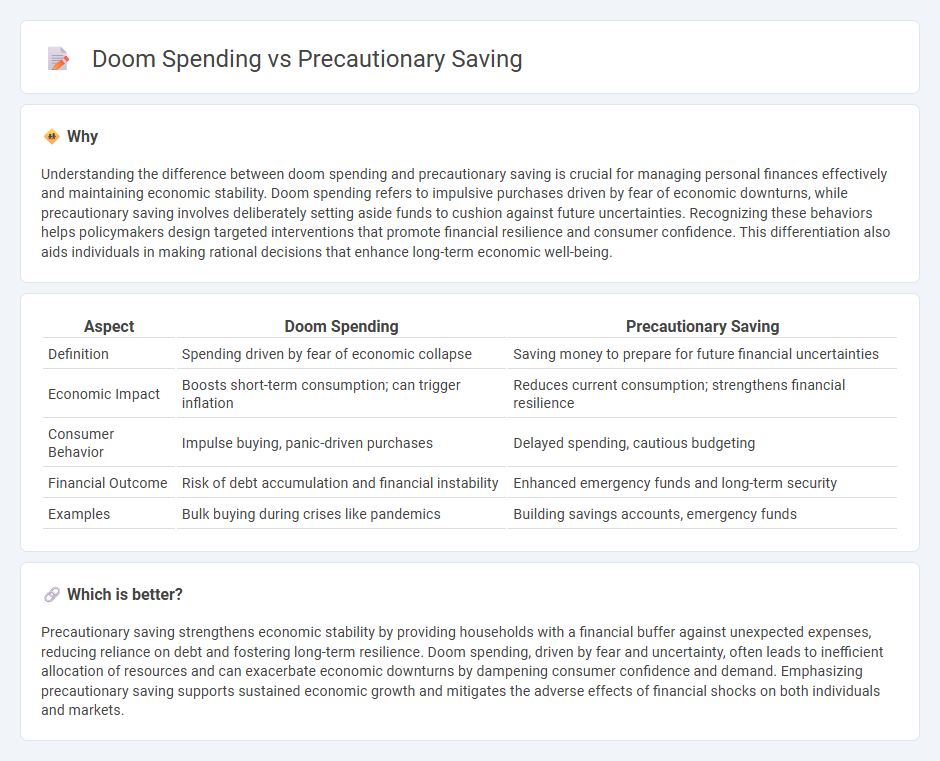

Understanding the difference between doom spending and precautionary saving is crucial for managing personal finances effectively and maintaining economic stability. Doom spending refers to impulsive purchases driven by fear of economic downturns, while precautionary saving involves deliberately setting aside funds to cushion against future uncertainties. Recognizing these behaviors helps policymakers design targeted interventions that promote financial resilience and consumer confidence. This differentiation also aids individuals in making rational decisions that enhance long-term economic well-being.

Comparison Table

| Aspect | Doom Spending | Precautionary Saving |

|---|---|---|

| Definition | Spending driven by fear of economic collapse | Saving money to prepare for future financial uncertainties |

| Economic Impact | Boosts short-term consumption; can trigger inflation | Reduces current consumption; strengthens financial resilience |

| Consumer Behavior | Impulse buying, panic-driven purchases | Delayed spending, cautious budgeting |

| Financial Outcome | Risk of debt accumulation and financial instability | Enhanced emergency funds and long-term security |

| Examples | Bulk buying during crises like pandemics | Building savings accounts, emergency funds |

Which is better?

Precautionary saving strengthens economic stability by providing households with a financial buffer against unexpected expenses, reducing reliance on debt and fostering long-term resilience. Doom spending, driven by fear and uncertainty, often leads to inefficient allocation of resources and can exacerbate economic downturns by dampening consumer confidence and demand. Emphasizing precautionary saving supports sustained economic growth and mitigates the adverse effects of financial shocks on both individuals and markets.

Connection

Doom spending and precautionary saving represent opposite economic behaviors driven by uncertainty about future financial conditions. Doom spending involves increased consumption in anticipation of potential hardships, depleting savings, while precautionary saving emphasizes setting aside funds to buffer against economic shocks. These contrasting strategies reflect individuals' efforts to manage financial risk and uncertainty within the broader economic environment.

Key Terms

Uncertainty

Precautionary saving arises from uncertainty about future income, prompting individuals to increase savings as a buffer against potential financial shocks. In contrast, doom spending reflects a psychological response to uncertainty, where people spend excessively to cope with stress or a perceived limited future. Explore the complex dynamics between uncertainty, precautionary saving, and doom spending for deeper financial insights.

Consumption smoothing

Precautionary saving involves setting aside funds to maintain stable consumption during income uncertainty, aligning with the concept of consumption smoothing that aims to balance spending over time. Doom spending, by contrast, refers to increased immediate consumption prompted by pessimistic outlooks on the future, disrupting consumption smoothing. Explore the dynamics between these behaviors to better understand their impacts on personal finance and economic stability.

Risk aversion

Precautionary saving arises from risk aversion, where individuals increase savings to buffer against future uncertainties such as job loss or medical emergencies. Doom spending, on the other hand, reflects a contrasting behavioral response where some risk-averse individuals indulge in immediate consumption, driven by fear of future economic downturns or personal hardship. Explore more about how varying degrees of risk aversion influence these opposing financial behaviors.

Source and External Links

Disentangling the Importance of the Precautionary Saving Motive - This study shows that precautionary saving motives are widespread among households, accounting for about 8% of total wealth and 20% of financial wealth, and are especially important for older households and business owners.

Precautionary savings - Precautionary saving occurs when individuals reduce current consumption and increase savings in response to uncertainty about future income, often as a hedge against potential income fluctuations.

Lecture 4 Precautionary Savings and Liquidity Constraints - Precautionary saving is formally defined as the reduction in current consumption due to uncertainty about future income, and it reflects how individuals adjust their savings behavior in the face of income risk.

dowidth.com

dowidth.com