Unretirement refers to returning to work full-time or part-time after having previously retired, often driven by financial needs or desire for engagement, while semi-retirement involves reducing working hours or shifting to less demanding roles to maintain income with greater work-life balance. Economic factors such as pension adequacy, inflation rates, and healthcare costs significantly influence decisions between unretirement and semi-retirement. Explore more to understand how these trends impact workforce dynamics and retirement planning strategies.

Why it is important

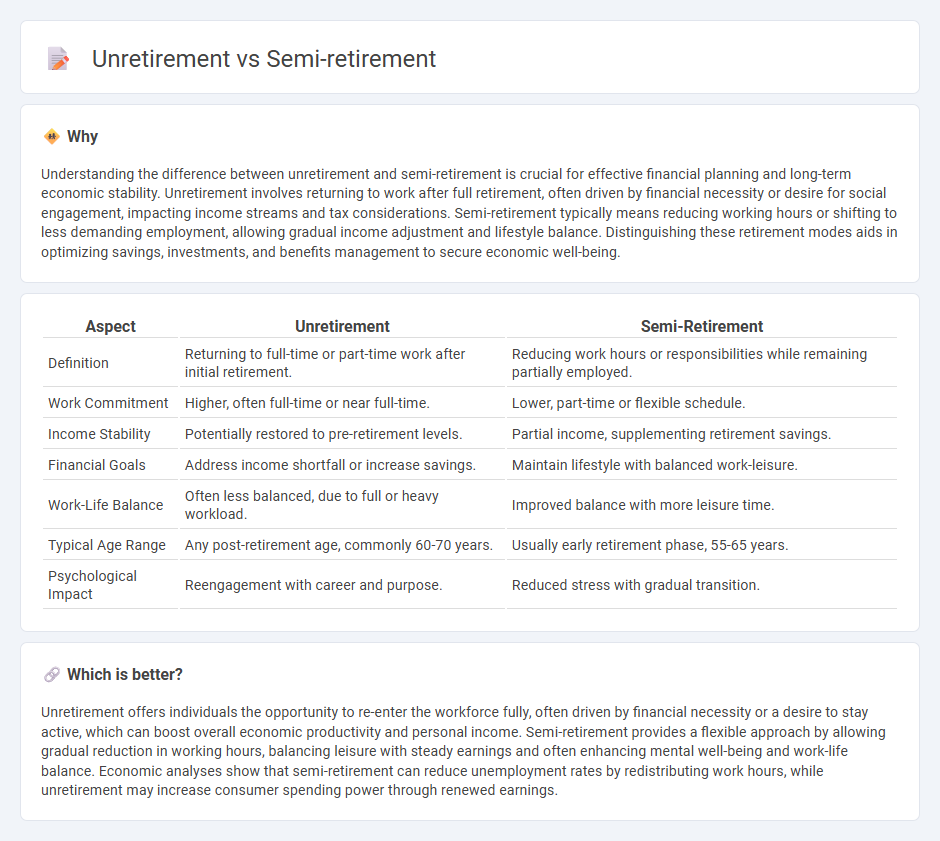

Understanding the difference between unretirement and semi-retirement is crucial for effective financial planning and long-term economic stability. Unretirement involves returning to work after full retirement, often driven by financial necessity or desire for social engagement, impacting income streams and tax considerations. Semi-retirement typically means reducing working hours or shifting to less demanding employment, allowing gradual income adjustment and lifestyle balance. Distinguishing these retirement modes aids in optimizing savings, investments, and benefits management to secure economic well-being.

Comparison Table

| Aspect | Unretirement | Semi-Retirement |

|---|---|---|

| Definition | Returning to full-time or part-time work after initial retirement. | Reducing work hours or responsibilities while remaining partially employed. |

| Work Commitment | Higher, often full-time or near full-time. | Lower, part-time or flexible schedule. |

| Income Stability | Potentially restored to pre-retirement levels. | Partial income, supplementing retirement savings. |

| Financial Goals | Address income shortfall or increase savings. | Maintain lifestyle with balanced work-leisure. |

| Work-Life Balance | Often less balanced, due to full or heavy workload. | Improved balance with more leisure time. |

| Typical Age Range | Any post-retirement age, commonly 60-70 years. | Usually early retirement phase, 55-65 years. |

| Psychological Impact | Reengagement with career and purpose. | Reduced stress with gradual transition. |

Which is better?

Unretirement offers individuals the opportunity to re-enter the workforce fully, often driven by financial necessity or a desire to stay active, which can boost overall economic productivity and personal income. Semi-retirement provides a flexible approach by allowing gradual reduction in working hours, balancing leisure with steady earnings and often enhancing mental well-being and work-life balance. Economic analyses show that semi-retirement can reduce unemployment rates by redistributing work hours, while unretirement may increase consumer spending power through renewed earnings.

Connection

Unretirement and semi-retirement represent evolving trends in workforce participation where individuals partially or fully return to work after an initial retirement, driven by factors like financial necessity or desire for engagement. These shifts impact economic patterns by extending labor force participation, influencing consumer spending, and altering retirement savings dynamics. Understanding this connection helps policymakers and businesses adapt to changing demographic and economic landscapes.

Key Terms

Labor Force Participation

Semi-retirement often involves reduced labor force participation, allowing individuals to balance work with leisure while maintaining some income and social engagement. Unretirement refers to re-entering the workforce after a period of full retirement, typically driven by financial necessity or desire for purpose, leading to increased labor force participation among older adults. Explore the dynamics influencing labor force trends in semi-retirement and unretirement to understand evolving retirement patterns.

Income Security

Semi-retirement offers a flexible transition with partial income from continued work, blending earnings and savings to maintain financial stability. Unretirement involves re-entering the workforce after full retirement, often driven by financial necessity or desire for additional income security across unexpected expenses. Explore strategies to optimize income security through both semi-retirement and unretirement options.

Pension Flexibility

Semi-retirement offers gradual pension access, allowing individuals to draw partial benefits while continuing work and increasing income flexibility. Unretirement often involves resuming full-time employment after pension commencement, impacting benefit calculations and tax liabilities differently. Explore how these strategies optimize pension flexibility and retirement planning choices.

Source and External Links

What Is Semi-Retirement and How Do You Do It? - Semi-retirement involves transitioning from full-time work to fewer hours, often in more enjoyable roles, offering extra income and a sense of purpose.

The Art of Semi-Retirement - Semi-retirement can provide flexibility and financial benefits by working fewer hours or in less demanding jobs, allowing for a boost to retirement plans.

How to plan for semi-retirement - Semi-retirement allows individuals to gain flexibility while still earning income, often by working part-time and enjoying more personal freedom.

dowidth.com

dowidth.com