De-dollarization involves reducing reliance on the U.S. dollar in international trade and finance to enhance national monetary sovereignty and mitigate external economic shocks. Capital controls refer to regulatory measures that restrict or manage cross-border capital flows to protect domestic financial stability and prevent capital flight. Explore further to understand how these strategies impact global economic dynamics and national fiscal policies.

Why it is important

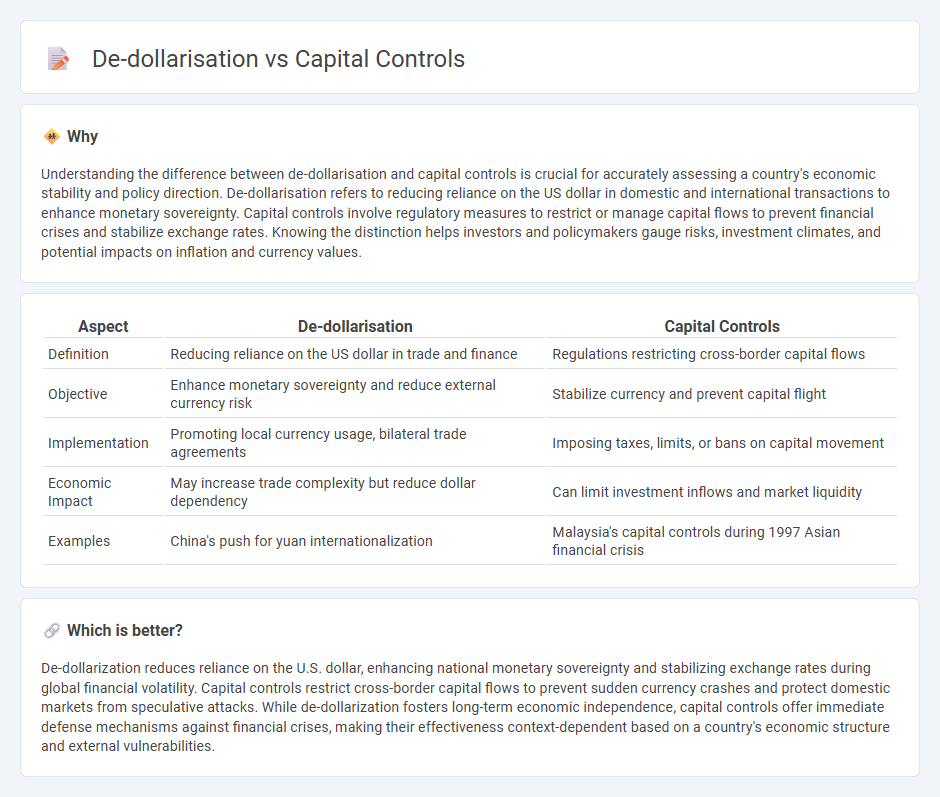

Understanding the difference between de-dollarisation and capital controls is crucial for accurately assessing a country's economic stability and policy direction. De-dollarisation refers to reducing reliance on the US dollar in domestic and international transactions to enhance monetary sovereignty. Capital controls involve regulatory measures to restrict or manage capital flows to prevent financial crises and stabilize exchange rates. Knowing the distinction helps investors and policymakers gauge risks, investment climates, and potential impacts on inflation and currency values.

Comparison Table

| Aspect | De-dollarisation | Capital Controls |

|---|---|---|

| Definition | Reducing reliance on the US dollar in trade and finance | Regulations restricting cross-border capital flows |

| Objective | Enhance monetary sovereignty and reduce external currency risk | Stabilize currency and prevent capital flight |

| Implementation | Promoting local currency usage, bilateral trade agreements | Imposing taxes, limits, or bans on capital movement |

| Economic Impact | May increase trade complexity but reduce dollar dependency | Can limit investment inflows and market liquidity |

| Examples | China's push for yuan internationalization | Malaysia's capital controls during 1997 Asian financial crisis |

Which is better?

De-dollarization reduces reliance on the U.S. dollar, enhancing national monetary sovereignty and stabilizing exchange rates during global financial volatility. Capital controls restrict cross-border capital flows to prevent sudden currency crashes and protect domestic markets from speculative attacks. While de-dollarization fosters long-term economic independence, capital controls offer immediate defense mechanisms against financial crises, making their effectiveness context-dependent based on a country's economic structure and external vulnerabilities.

Connection

De-dollarisation aims to reduce an economy's reliance on the US dollar, often prompting governments to implement capital controls to manage currency stability and limit capital flight. Capital controls restrict the flow of foreign currency and investments, supporting the shift towards domestic currencies in trade and finance. These measures collectively help stabilize national economies by reinforcing monetary sovereignty and curbing vulnerabilities associated with external dollar dependence.

Key Terms

Foreign Exchange Reserves

Capital controls are regulatory measures that restrict the flow of foreign currency to stabilize foreign exchange reserves and prevent excessive volatility in emerging markets. De-dollarisation involves reducing reliance on the US dollar in international trade and reserve holdings to diversify currency risk and enhance monetary sovereignty. Explore the implications of these strategies on foreign exchange reserve management and global economic stability.

Currency Convertibility

Capital controls limit currency convertibility by restricting the flow of foreign exchange and capital transactions to stabilize financial markets and protect domestic currencies. De-dollarisation reduces dependence on the US dollar in international trade and reserves, promoting local currency usage and enhancing monetary sovereignty. Explore more about how these strategies impact currency convertibility and global economic stability.

Balance of Payments

Capital controls regulate cross-border capital flows to stabilize a country's Balance of Payments (BoP) by preventing excessive capital flight or sudden inflows that could disrupt financial stability. De-dollarisation reduces reliance on the US dollar in trade and reserves, aiming to minimize external currency risks and improve BoP resilience by promoting the use of local or alternative currencies. Explore how these strategies influence international trade balances and currency stability to better understand their impact on national economic sovereignty.

Source and External Links

Capital control - Wikipedia - Capital controls are residency-based measures used by governments to regulate capital flows in and out of a country, including transaction taxes, limits, or prohibitions, aiming to manage foreign exchange and financial stability.

Capital Controls - Definition, Real-world Examples - Capital controls are government or central bank measures regulating foreign capital inflows and outflows to reduce currency volatility and support economic stability, especially in developing countries.

An Introduction to Capital Controls - CiteSeerX - Capital controls can limit destabilizing capital flow fluctuations by discouraging outflows during crises or altering inflow composition to enhance financial stability and aid economic reforms.

dowidth.com

dowidth.com