Shadow bailouts refer to undisclosed financial support provided by governments or central banks to prevent the collapse of failing institutions without formal announcements, which can obscure risks in the economy. Open market operations involve the buying or selling of government securities by central banks to regulate liquidity and control interest rates, directly impacting economic stability. Explore the mechanisms and implications of these interventions to understand their roles in modern economic policy.

Why it is important

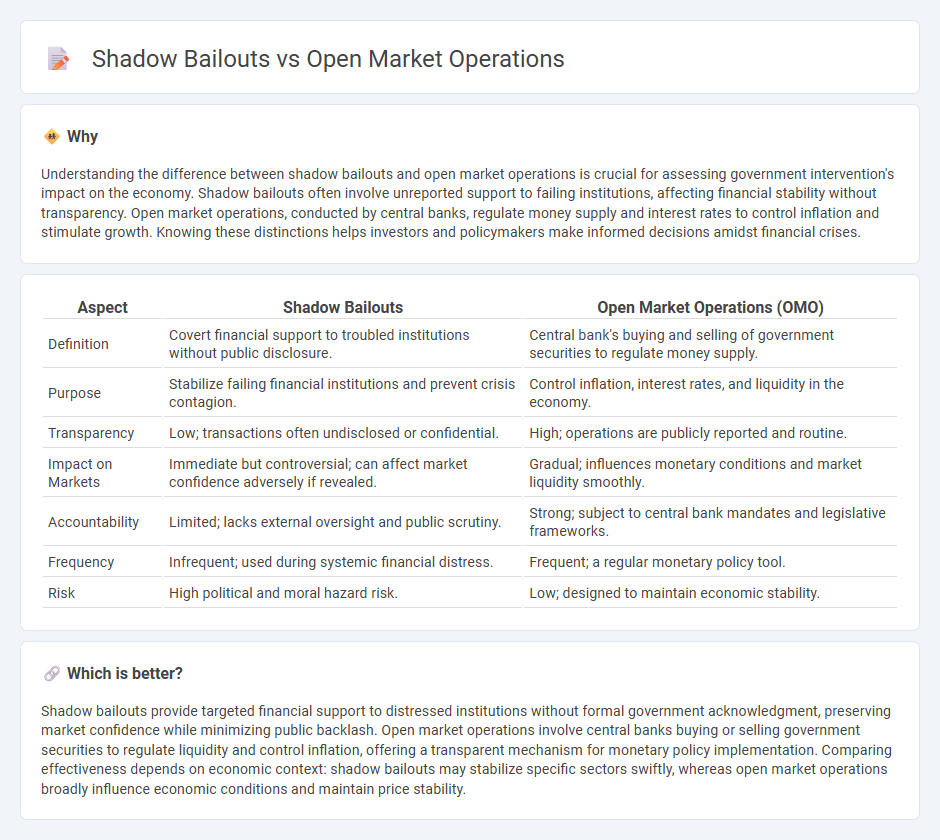

Understanding the difference between shadow bailouts and open market operations is crucial for assessing government intervention's impact on the economy. Shadow bailouts often involve unreported support to failing institutions, affecting financial stability without transparency. Open market operations, conducted by central banks, regulate money supply and interest rates to control inflation and stimulate growth. Knowing these distinctions helps investors and policymakers make informed decisions amidst financial crises.

Comparison Table

| Aspect | Shadow Bailouts | Open Market Operations (OMO) |

|---|---|---|

| Definition | Covert financial support to troubled institutions without public disclosure. | Central bank's buying and selling of government securities to regulate money supply. |

| Purpose | Stabilize failing financial institutions and prevent crisis contagion. | Control inflation, interest rates, and liquidity in the economy. |

| Transparency | Low; transactions often undisclosed or confidential. | High; operations are publicly reported and routine. |

| Impact on Markets | Immediate but controversial; can affect market confidence adversely if revealed. | Gradual; influences monetary conditions and market liquidity smoothly. |

| Accountability | Limited; lacks external oversight and public scrutiny. | Strong; subject to central bank mandates and legislative frameworks. |

| Frequency | Infrequent; used during systemic financial distress. | Frequent; a regular monetary policy tool. |

| Risk | High political and moral hazard risk. | Low; designed to maintain economic stability. |

Which is better?

Shadow bailouts provide targeted financial support to distressed institutions without formal government acknowledgment, preserving market confidence while minimizing public backlash. Open market operations involve central banks buying or selling government securities to regulate liquidity and control inflation, offering a transparent mechanism for monetary policy implementation. Comparing effectiveness depends on economic context: shadow bailouts may stabilize specific sectors swiftly, whereas open market operations broadly influence economic conditions and maintain price stability.

Connection

Shadow bailouts involve covert government support to failing financial institutions, mitigating systemic risk without public disclosure. Open market operations, conducted by central banks, regulate liquidity by buying or selling government securities, influencing interest rates and credit availability. Together, these mechanisms stabilize financial markets by managing liquidity and preventing institution collapses during economic crises.

Key Terms

Central Bank

Central banks use open market operations to regulate liquidity by buying or selling government securities, influencing interest rates and monetary policy without direct fiscal intervention. Shadow bailouts involve covert financial support to failing institutions, often through indirect channels or non-transparent measures, to stabilize markets without triggering public scrutiny or legal constraints. Explore the distinct roles and impacts of these tools in modern financial systems for deeper insights.

Liquidity

Open market operations involve the central bank buying or selling government securities to regulate liquidity in the banking system, directly influencing short-term interest rates and money supply. Shadow bailouts refer to unpublicized financial support to institutions, often through informal channels, aimed at preventing liquidity crises without official acknowledgment or market disruption. Explore more to understand the impact of these mechanisms on financial stability and market confidence.

Off-balance-sheet

Open market operations (OMO) involve central banks buying or selling government securities to regulate money supply directly on the balance sheet, while shadow bailouts operate off-balance-sheet through contingent liabilities and special purpose vehicles that stabilize financial institutions without immediate public disclosure. Off-balance-sheet mechanisms in shadow bailouts help mitigate fiscal risk by concealing substantial commitments, contrasting with the transparent, on-balance-sheet approach of OMOs. Explore the nuances of these financial strategies to understand their differential impact on market stability and government transparency.

Source and External Links

Open market operation - Wikipedia - An open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with banks to manage liquidity, influence short-term interest rates, and implement monetary policy, often involving buying or selling government bonds.

Open Market Operations (OMO) | Economics Definition + Examples - OMOs involve a central bank buying or selling securities in the open market to influence the money supply, typically increasing liquidity when purchasing securities to encourage lending and economic spending.

Open Market Operations - Federal Reserve Board - The Federal Reserve uses OMOs, buying and selling securities, as a key monetary policy tool to adjust reserve balances and control short-term interest rates, with evolved practices post-2008 incorporating longer-term asset purchases to support economic growth.

dowidth.com

dowidth.com