Liquidity crunch occurs when short-term funding sources dry up, causing firms and financial institutions to struggle with meeting immediate cash demands. Financial contagion refers to the spread of economic shocks or crises across markets, institutions, or countries, amplifying the initial instability. Explore the mechanisms behind liquidity crises and contagion to understand their profound impact on the global economy.

Why it is important

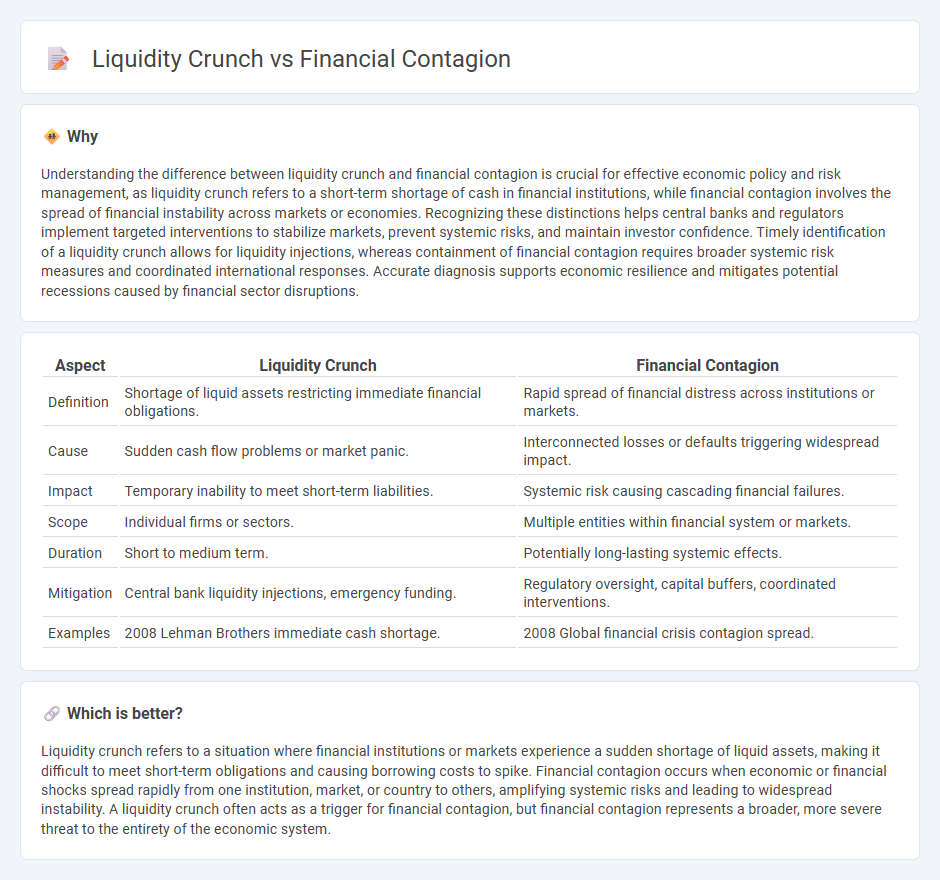

Understanding the difference between liquidity crunch and financial contagion is crucial for effective economic policy and risk management, as liquidity crunch refers to a short-term shortage of cash in financial institutions, while financial contagion involves the spread of financial instability across markets or economies. Recognizing these distinctions helps central banks and regulators implement targeted interventions to stabilize markets, prevent systemic risks, and maintain investor confidence. Timely identification of a liquidity crunch allows for liquidity injections, whereas containment of financial contagion requires broader systemic risk measures and coordinated international responses. Accurate diagnosis supports economic resilience and mitigates potential recessions caused by financial sector disruptions.

Comparison Table

| Aspect | Liquidity Crunch | Financial Contagion |

|---|---|---|

| Definition | Shortage of liquid assets restricting immediate financial obligations. | Rapid spread of financial distress across institutions or markets. |

| Cause | Sudden cash flow problems or market panic. | Interconnected losses or defaults triggering widespread impact. |

| Impact | Temporary inability to meet short-term liabilities. | Systemic risk causing cascading financial failures. |

| Scope | Individual firms or sectors. | Multiple entities within financial system or markets. |

| Duration | Short to medium term. | Potentially long-lasting systemic effects. |

| Mitigation | Central bank liquidity injections, emergency funding. | Regulatory oversight, capital buffers, coordinated interventions. |

| Examples | 2008 Lehman Brothers immediate cash shortage. | 2008 Global financial crisis contagion spread. |

Which is better?

Liquidity crunch refers to a situation where financial institutions or markets experience a sudden shortage of liquid assets, making it difficult to meet short-term obligations and causing borrowing costs to spike. Financial contagion occurs when economic or financial shocks spread rapidly from one institution, market, or country to others, amplifying systemic risks and leading to widespread instability. A liquidity crunch often acts as a trigger for financial contagion, but financial contagion represents a broader, more severe threat to the entirety of the economic system.

Connection

A liquidity crunch occurs when financial institutions face a sudden shortage of liquid assets, impairing their ability to meet short-term obligations. This scarcity can trigger financial contagion by eroding market confidence, causing panic selling and a rapid spread of distress across interconnected banks and markets. The resulting chain reaction intensifies systemic risk, leading to widespread economic instability.

Key Terms

Interconnectedness

Financial contagion arises when distress in one institution spreads through the interconnected financial network, amplifying systemic risk. A liquidity crunch occurs when the rapid withdrawal or shortage of liquid assets disrupts market functioning, exposing vulnerabilities in funding interdependencies. Explore deeper to understand how these interconnected dynamics shape financial stability.

Credit availability

Financial contagion refers to the rapid spread of market disturbances across institutions or countries, significantly reducing credit availability as investors withdraw funds and tighten lending standards. A liquidity crunch occurs when financial institutions face sudden cash shortages, limiting their ability to extend credit despite demand, directly impacting loan approvals and business funding. Explore deeper insights into how these phenomena impact credit availability and financial stability.

Market confidence

Financial contagion occurs when losses in one institution or market spread rapidly to others, eroding overall market confidence and triggering widespread asset sell-offs. A liquidity crunch specifically refers to a situation where financial institutions face a sudden shortage of liquid assets, impeding their ability to meet short-term obligations and deepening market mistrust. Understanding the interplay between market confidence, contagion, and liquidity crunch is crucial for grasping financial stability; explore more insights here.

Source and External Links

Financial contagion - Wikipedia - Financial contagion refers to the spread of market disturbances, often negative, from one country to another, characterized by co-movements in exchange rates, asset prices, and capital flows, and can occur both domestically and internationally when crises in one market trigger turmoil in others.

A wake-up call theory of contagion - ECB Working Paper - Financial contagion is a significant systemic risk evidenced in crises like the 2007-09 global financial crisis, spreading through channels such as trade, banks, portfolio investors, and investor reassessments known as "wake-up calls."

Financial Market Contagion - European Central Bank - Financial contagion can be identified by extreme negative returns and increased market interdependence beyond normal times, with contagion mostly limited to specific countries or regions and less common across different asset classes.

dowidth.com

dowidth.com