Greedflation occurs when businesses raise prices excessively beyond cost increases, driven by profit motives rather than actual demand, distorting market equilibrium. Demand-pull inflation arises from increased consumer demand outstripping supply, leading to a natural rise in prices across the economy. Explore the differences between greedflation and demand-pull inflation to understand their distinct impacts on economic stability.

Why it is important

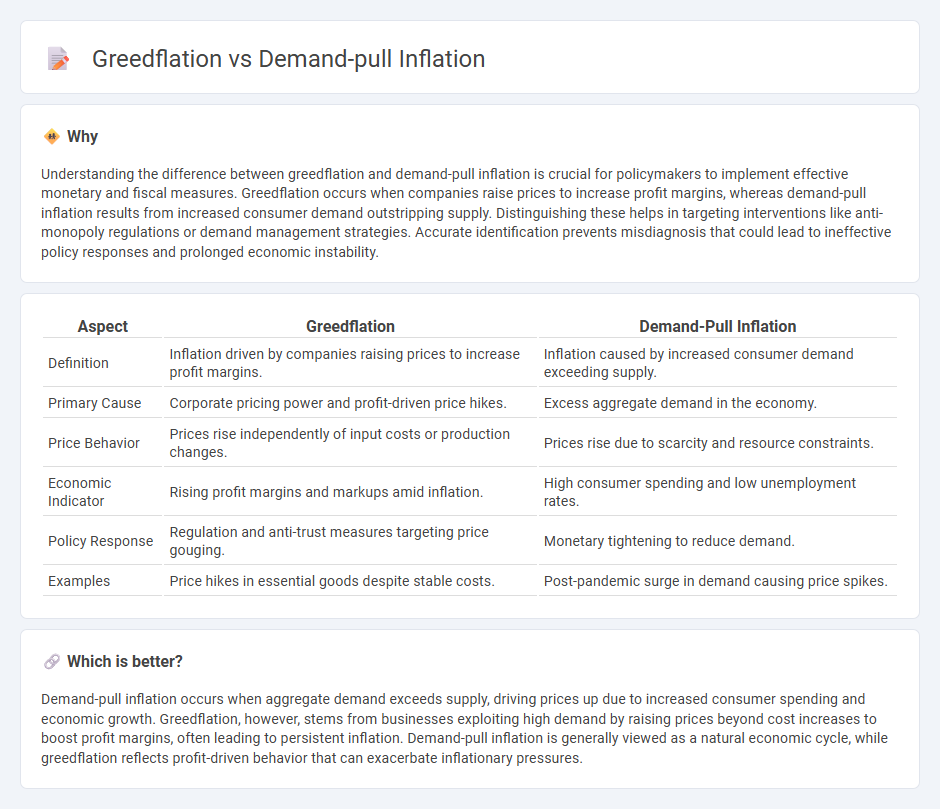

Understanding the difference between greedflation and demand-pull inflation is crucial for policymakers to implement effective monetary and fiscal measures. Greedflation occurs when companies raise prices to increase profit margins, whereas demand-pull inflation results from increased consumer demand outstripping supply. Distinguishing these helps in targeting interventions like anti-monopoly regulations or demand management strategies. Accurate identification prevents misdiagnosis that could lead to ineffective policy responses and prolonged economic instability.

Comparison Table

| Aspect | Greedflation | Demand-Pull Inflation |

|---|---|---|

| Definition | Inflation driven by companies raising prices to increase profit margins. | Inflation caused by increased consumer demand exceeding supply. |

| Primary Cause | Corporate pricing power and profit-driven price hikes. | Excess aggregate demand in the economy. |

| Price Behavior | Prices rise independently of input costs or production changes. | Prices rise due to scarcity and resource constraints. |

| Economic Indicator | Rising profit margins and markups amid inflation. | High consumer spending and low unemployment rates. |

| Policy Response | Regulation and anti-trust measures targeting price gouging. | Monetary tightening to reduce demand. |

| Examples | Price hikes in essential goods despite stable costs. | Post-pandemic surge in demand causing price spikes. |

Which is better?

Demand-pull inflation occurs when aggregate demand exceeds supply, driving prices up due to increased consumer spending and economic growth. Greedflation, however, stems from businesses exploiting high demand by raising prices beyond cost increases to boost profit margins, often leading to persistent inflation. Demand-pull inflation is generally viewed as a natural economic cycle, while greedflation reflects profit-driven behavior that can exacerbate inflationary pressures.

Connection

Greedflation and demand-pull inflation are interconnected as both contribute to rising price levels driven by different sources of economic pressure. Greedflation occurs when companies increase prices beyond cost needs to boost profit margins, while demand-pull inflation happens when aggregate demand surpasses aggregate supply, pushing prices up. The overlap emerges when excessive demand incentivizes businesses to exploit the market through greedflation, amplifying overall inflationary trends.

Key Terms

Aggregate Demand

Demand-pull inflation occurs when aggregate demand in an economy outpaces aggregate supply, leading to generalized price increases as consumers compete for limited goods. Greedflation arises when companies exploit rising demand by excessively raising prices beyond cost increases, driven by profit motives rather than supply-demand imbalances. Explore deeper insights into how aggregate demand influences these inflationary pressures and the broader economic implications.

Profit Margins

Demand-pull inflation occurs when increased consumer demand drives prices up, often leading to moderate profit margin growth as businesses respond to market conditions. Greedflation, in contrast, involves companies deliberately raising prices beyond cost increases to expand profit margins, exploiting market imbalances regardless of demand fluctuations. Explore the nuanced impacts of profit margin strategies in inflation dynamics to understand their economic consequences.

Pricing Power

Demand-pull inflation occurs when increased consumer demand drives prices up due to supply constraints, while greedflation stems from companies exercising strong pricing power to raise prices beyond cost increases, often to boost profit margins. Pricing power is central to greedflation, as firms with significant market control can set higher prices despite stable or low input costs, contrasting with demand-pull inflation's broader economic causes. Explore the nuances between these inflation types to understand how pricing strategies influence market dynamics.

Source and External Links

Causes of Inflation | Explainer | Education | RBA - Demand-pull inflation happens when aggregate demand exceeds sustainable aggregate supply, leading to widespread upward pressure on prices as businesses raise prices and wages to meet increased demand.

Demand-Pull Inflation: How Does It Work? - SmartAsset - Demand-pull inflation occurs when the demand for goods and services outpaces their supply, causing a general rise in prices, often during periods of strong economic growth and increased spending.

Demand-pull inflation - Wikipedia - Demand-pull inflation is characterized by aggregate demand exceeding aggregate supply, leading to higher prices as more money is spent chasing fewer goods, typically in a near-full-employment economy.

dowidth.com

dowidth.com