Scrap metal arbitrage involves capitalizing on price discrepancies in the global metals market by buying undervalued scrap metal and selling it where prices are higher, leveraging physical commodity flows. Risk arbitrage, also known as merger arbitrage, entails profiting from the price differentials before and after corporate mergers or acquisitions, focusing on securities rather than physical goods. Explore deeper insights into these distinct arbitrage strategies and their impact on economic landscapes.

Why it is important

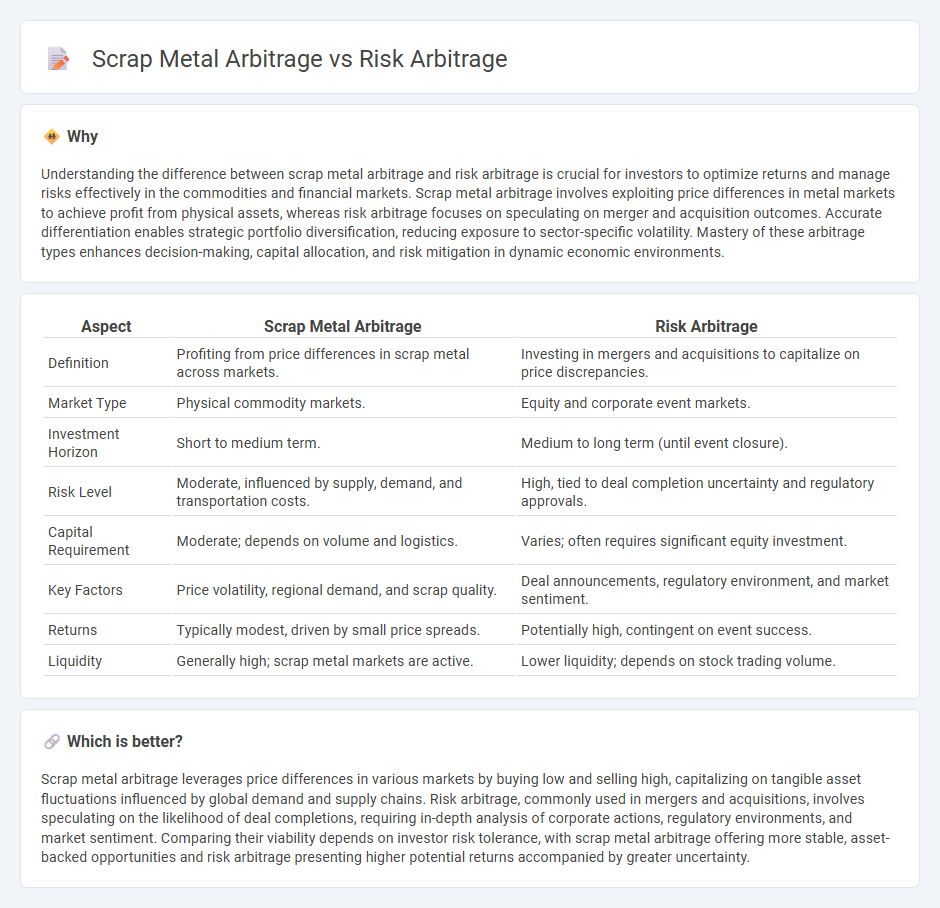

Understanding the difference between scrap metal arbitrage and risk arbitrage is crucial for investors to optimize returns and manage risks effectively in the commodities and financial markets. Scrap metal arbitrage involves exploiting price differences in metal markets to achieve profit from physical assets, whereas risk arbitrage focuses on speculating on merger and acquisition outcomes. Accurate differentiation enables strategic portfolio diversification, reducing exposure to sector-specific volatility. Mastery of these arbitrage types enhances decision-making, capital allocation, and risk mitigation in dynamic economic environments.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Risk Arbitrage |

|---|---|---|

| Definition | Profiting from price differences in scrap metal across markets. | Investing in mergers and acquisitions to capitalize on price discrepancies. |

| Market Type | Physical commodity markets. | Equity and corporate event markets. |

| Investment Horizon | Short to medium term. | Medium to long term (until event closure). |

| Risk Level | Moderate, influenced by supply, demand, and transportation costs. | High, tied to deal completion uncertainty and regulatory approvals. |

| Capital Requirement | Moderate; depends on volume and logistics. | Varies; often requires significant equity investment. |

| Key Factors | Price volatility, regional demand, and scrap quality. | Deal announcements, regulatory environment, and market sentiment. |

| Returns | Typically modest, driven by small price spreads. | Potentially high, contingent on event success. |

| Liquidity | Generally high; scrap metal markets are active. | Lower liquidity; depends on stock trading volume. |

Which is better?

Scrap metal arbitrage leverages price differences in various markets by buying low and selling high, capitalizing on tangible asset fluctuations influenced by global demand and supply chains. Risk arbitrage, commonly used in mergers and acquisitions, involves speculating on the likelihood of deal completions, requiring in-depth analysis of corporate actions, regulatory environments, and market sentiment. Comparing their viability depends on investor risk tolerance, with scrap metal arbitrage offering more stable, asset-backed opportunities and risk arbitrage presenting higher potential returns accompanied by greater uncertainty.

Connection

Scrap metal arbitrage involves exploiting price differences of scrap metals across markets, while risk arbitrage focuses on profiting from price changes during corporate events like mergers or acquisitions. Both strategies rely on identifying and capitalizing on market inefficiencies to generate returns. The connection lies in their shared principle of leveraging price discrepancies and anticipated market reactions to reduce risk and maximize profits.

Key Terms

Merger arbitrage

Merger arbitrage, a subset of risk arbitrage, involves capitalizing on price discrepancies between the current market price and the eventual takeover price in announced corporate mergers or acquisitions. Unlike scrap metal arbitrage, which exploits price differentials in physical commodity markets, merger arbitrage leverages detailed analysis of deal terms, regulatory approvals, and market sentiment. Explore how merger arbitrage strategies can maximize returns by navigating complex transaction dynamics and market reactions.

Price discrepancy

Risk arbitrage exploits price discrepancies during corporate events such as mergers and acquisitions, targeting spread differences between bid and market prices. Scrap metal arbitrage capitalizes on regional price variations in raw metal commodities like copper, aluminum, or steel, optimizing procurement and resale margins. Explore the unique strategies behind these arbitrage opportunities to enhance your trading approach.

Commodity markets

Risk arbitrage in commodity markets involves exploiting price discrepancies from potential mergers or acquisitions affecting commodity producers, while scrap metal arbitrage capitalizes on price differences between raw scrap material and processed metals. Both strategies require deep market analysis and timely execution to profit from inefficiencies in commodity pricing. Explore further to understand how these arbitrage methods impact commodity trading dynamics.

Source and External Links

Characteristics of Risk and Return in Risk Arbitrage - Risk arbitrage, also known as merger arbitrage, is an investment strategy that aims to profit from the spread between a target company's stock price and the offer price after a merger announcement, generating excess returns around four percent per year after accounting for transaction costs, but with potential losses if deals fail.

Risk arbitrage - Wikipedia - Risk arbitrage is a strategy that speculates on the successful completion of mergers and acquisitions, typically yielding positive long-run returns, though returns are asymmetric--less correlated with markets in flat or rising environments but vulnerable during downturns, and individual deal failures can lead to significant losses.

Merger (Risk) Arbitrage Strategy - The main risks in merger arbitrage include deal risk (failure or delay of the merger) and portfolio risk (management of multiple positions), with factors like market shifts, interest rate changes, financing availability, and regulatory actions potentially impacting outcomes.

dowidth.com

dowidth.com